{{item.title}}

{{item.text}}

{{item.text}}

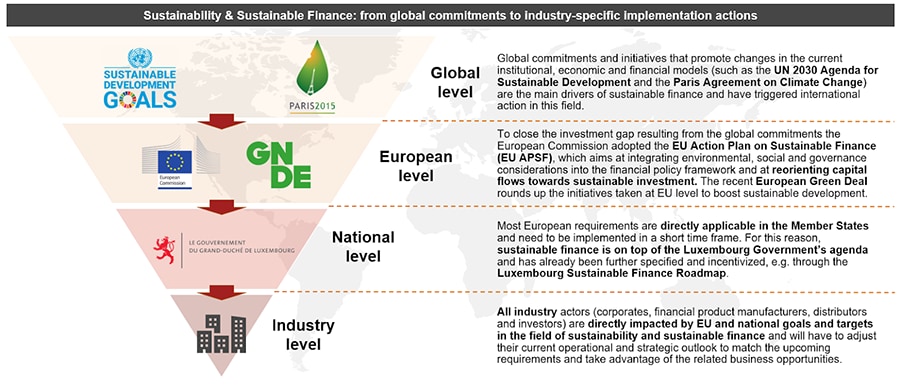

The debate on environmental issues and sustainable development dates back to the 70’s and the attention given to the topic has increased exponentially over the last decade, leading to a series of global commitments and initiatives that promote changes in the current institutional, economic and financial models.

On the global level, the year 2015 marks an important milestone in this regard as the 21st UN Climate Change Conference - better known as the Paris Agreement - took place and furthermore, during its 69th General Assembly, the UN presented its 2030 Agenda which sets out 17 sustainable development goals (SDGs) in order to tackle social, economic and environmental issues with the aim to promote prosperity while protecting the planet.

Today, the aforementioned two events are perceived as the main drivers for the EU Action Plan on Sustainable Finance (EU APSF). At the latest with the EU APSF, sustainability has found its place in the Financial Services industry.

a Corporate looking to develop your sustainability strategy or to finance your next project;

a Product Manufacturer of financial products / - instruments trying to minimize the downside risk by incorporating sustainability risks in your due diligence;

a Distributor of financial products having to take into consideration clients’ preferences in terms of sustainable investing in order to cater their needs;

or an Investor looking to optimize the financial performance and the impact orientation of your portfolio.

In one way or the other, you will be affected and PwC can help you navigate through the “Sustainable Finance maze” and most importantly to turn the challenge into a business opportunity.

(source: EU Action Plan on Financing Sustainable Growth, 2018)

6. Better integrating sustainability in ratings and market researches

7. Clarifying institutional investors' and asset managers' duties

8. Incorporating sustainability in prudential requirements

9. Strengthening sustainability disclosure and accounting rule-making

10. Fostering sustainable corporate governance and attenuating short-termism in capital markets

“Sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs.”

Our Common Future (“Brundtland Report”), 1987This initiative is part of the broader efforts to connect finance with the specific needs of the European and global economy for the benefit of the planet and our society. The EU defines “Sustainable Finance” as the process of taking due account of environmental and social considerations in investment decision-making, leading to increased investments in longer-term and sustainable activities – whilst the plan recognises the key role of “Governance”, there is a clear focus on “Environmental” and “Social” considerations. The ten actions of the EU APSF do have major impacts on all participants of the financial market.

The EU has also defined further actions through the European Green Deal, which aims to make Europe climate neutral by 2050. In order to achieve this objective, regulators, corporates and financial players alike will be required to take further steps that will certainly impact their strategic and operational needs in the medium and long term.

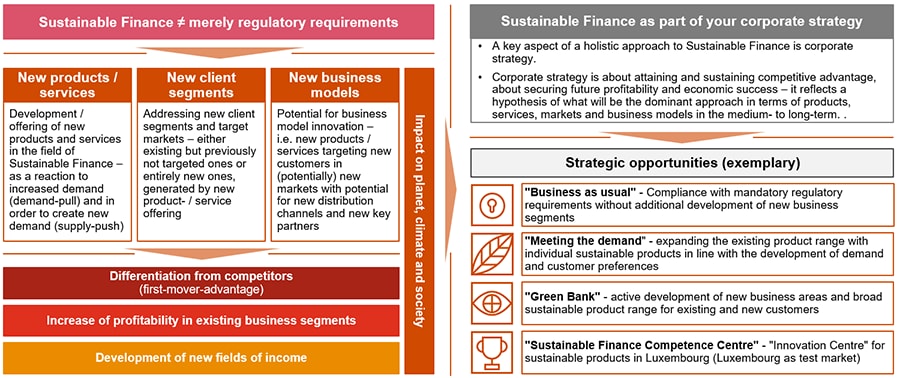

However, complying with existing and upcoming regulatory requirements is not what sustainable finance is all about. Together with all the duties, there comes a chance for strategic development that might reshape the current business models of all market participants. Driven by an increasing demand, sustainable finance offers a series of strategic opportunities that allow for a repositioning and the creation of new fields of income.

The points mentioned above, are only a small fraction of the countless practical challenges ahead of you. Here is how PwC can help you and your company to manage all the business needs and to find the proper fit for your company regarding your strategic positioning in the field of sustainability and sustainable finance.

Rationale - why is this relevant for you?

The EU Action Plan on Sustainable Finance leads to several new EU regulations and amendments of existing regulatory texts applicable to financial service providers

These will have far-reaching effects on the entire value chain of banks and asset managers and require significant implementation efforts

The new requirements add up to the existing ones, such as the Non-Financial Reporting Directive

Objectives - what are you looking to achieve?

Understand regulatory requirements on EU- and national level including their implications on products, services, processes and business segments

Identify concrete actions to be taken to achieve compliance (gap analysis)

Design a target operating model for processes and IT

Define implementation timeline and milestones

Implement solution

Solutions - how we can help you to meet your objectives

Overview of regulatory requirements

Impact assessment: evaluation of impacts on products, processes and business segments

Gap analysis, target operating model, implementation roadmap, policy review

Implementation support

Rationale - why is this relevant for you?

Sustainable finance offers very attractive opportunities for business development, competitive advantage and profitability and thus should be an integral part of corporate strategy

Identifying the best possible options for strategic positioning in the market as well as for sustainable product- and service portfolios will be essential for your future success

Objectives - what are you looking to achieve?

Understand demands of existing (and potential future) customers

Analyse positioning of (key) competitors and identify best practices

Identify opportunities to deliver added value to clients

Identify potential for development of new products, services or business models

Identify opportunities and risks in the market

Be positioned optimally and pursue the 'right' strategy to guarantee profitability and competitiveness in the long run

Solutions - how we can help you to meet your objectives

Individual strategy development

Market- and competitor analysis, benchmarking

Readiness and potential analysis

Rationale - why is this relevant for you?

The growing customer demand for sustainable products / services must be met in order to remain competitive and ensure alignment with current market needs

The framework defined by the EU Action Plan on Sustainable Finance offers a great opportunity for product development and innovation

Objectives - what are you looking to achieve?

Understand the unexploited potential of the current product / service offering

Identify new opportunities to meet the increasing customer demand for sustainable products / services

Generate new fields of income through new customer segments and define appropriate target market for products

Design new products in line with customer expectations and regulatory framework (EU Action Plan on Sustainable Finance)

Gain trust of customers and promote transparency through product ESG labelling / rating

Solutions - how we can help you to meet your objectives

Evaluation of existing products / services and business models and identification of new options

Business model adjustment, product development, product portfolio analysis

Support with ESG labelling / rating

Rationale - why is this relevant for you?

The implementation of the various measures of the EU Action Plan on Sustainable Finance will result in increasing disclosures and data demands on financial players

Obtaining / providing ESG data is essential to comply with the upcoming regulatory requirements and to ensure alignment with the own ESG strategy and the related targets

Financial players will need to identify one or more external data providers in order to fulfill their regulatory duties and to enable transparency, disclosure and goal measurement

Objectives - what are you looking to achieve?

Selection of one or more reliable ESG-data providers with adequate coverage and in line with the business needs

Leverage ESG-data to measure the achievement of ESG-targets

Leverage data to measure the market perception of own positioning with regards to sustainability factors

Solutions - how we can help you to meet your objectives

Evaluation of data requirements, support in decision on data providers (long list / short list)

ESG data control framework (design and implementation support)

PwC Digital Intelligence Services (market & consumer sentiment analysis)

Rationale - why is this relevant for you?

Sustainability issues such as climate change can have huge impacts on the business of financial players, as for example they could cause major credit default risk, loss of value of collaterals and indirect social and ethical risks (e.g. associated with pollution, exploitative or unethical customers)

It is essential to be prepared to face those risks and to an have an adequate risk management framework in place

Objectives - what are you looking to achieve?

Systematic inclusion of ESG-criteria in internal risk management

Assess physical (e.g. hurricanes, storms, floods) as well as transitional risks (e.g. emerging regulations, new technologies, shifting supply and demand) related to climate change

Evaluation of portfolios with regard to their ESG-risk exposure

Assess resilience of own business

Solutions - how we can help you to meet your objectives

Risk management support, ESG-risk assessment and reporting

PwC ESG risk reporting tool

Due diligence support

Stress testing

Climate risk scenario analysis

Rationale - why is this relevant for you?

The Non-Financial Reporting Directive requires large public-interest companies with more than 500 employees (including parent undertakings) to disclose information on the way they operate and manage social and environmental challenges and to include non-financial statements in their annual reports

Several voluntary disclosure initiatives round up the mandatory requirements

It is essential to meet the demand for transparency and accountability from regulators, shareholders, customers and society at large in order to comply with regulatory duties and maintain a good reputation whilst ensuring visibility

Communicating effectively on the achievement of sustainability targets supports the strategic positioning with regards to sustainable finance

Objectives - what are you looking to achieve?

Disclose climate-change related risks

Reinforce positioning with regard to sustainable finance by implementing voluntary initiatives

Effectively communicate to the public how and to what extent the defined ESG-targets have been achieved

Leverage existing reporting frameworks to allow for more transparency and comparability

Solutions - how we can help you to meet your objectives

Analysis and evaluation of voluntary sustainable finance initiatives (e.g. UN PRI, UN GC etc.), implementation support

Design and implementation of CSR- / Non-Financial Reporting (e.g. TCFD, GRI)

Marketing support, design / amendment of marketing materials

Rationale - why is this relevant for you?

Complying with the upcoming regulatory duties in the field of sustainable finance as well as the development and implementation of new strategies requires the development of skills and expertise, both on a management and on staff level

It is essential to train all employees according to their needs (e.g. technical implementation of sustainability strategies, compliance with disclosure requirements, general awareness needs)

Objectives - what are you looking to achieve?

Provide adequate training to all employees depending on their role and the relevance of sustainability / sustainable finance for their day to day business and their operational needs

Make sure all employees have at least a basic understanding of sustainability / sustainable finance

Specifically train key staff to develop new expertise, skills and competences related to sustainability / sustainable finance

Create awareness on management level about the opportunities, the risks and the related potential strategic options in the field of sustainability / sustainable finance

Understand which new qualifications and job profiles are required based on the applicable regulatory requirements and business needs

Get an overview of the upcoming regulatory requirements in the field of sustainable finance and their main business impacts

Solutions - how we can help you to meet your objectives

Foundations and awareness training

Knowledge and competence training

Fit and proper training for senior management

Rationale - why is this relevant for you?

It is important to build trust in all stakeholders and society at large with regards to the correctness of the disclosed non-financial information

The reliability and accuracy of non-financial information lays the foundation for achieving any defined strategic targets

Objectives - what are you looking to achieve?

Ensure that the disclosed information with regards to non-financial targets is correct and accurate

Solutions - how we can help you to meet your objectives

Assurance over policies and procedures, processes, controls, data

Assurance over non-financial reports

{{item.text}}

{{item.text}}

Michael Horvath

Advisory Partner, Sustainability Leader, PwC Luxembourg

Tel: +352 49 48 48 3612

Olivier Carré

Deputy Managing Partner, Technology & Transformation Leader, PwC Luxembourg

Tel: +352 49 48 48 4174

Geoffroy Marcassoli

Audit Partner, EMEA AWM ESG Leader, PwC Luxembourg

Tel: +352 49 48 48 5410