The European Union’s Corporate Sustainability Reporting Directive (CSRD) is a cornerstone of the “European Green Deal” which seeks to transform the Union into a modern, resource-efficient and competitive economy with no net emissions of greenhouse gases by 2050.

By elevating sustainability reporting to the importance and rigour of financial reporting, and by requiring external assurance to ensure that sustainability information disclosed is accurate, reliable, and consistent, CSRD will likely be a gamechanger when it comes to understanding how entities’ business models impact environmental, social, and governance (ESG) topics and what impact sustainability matters have on their financial performance and outlook.

Based on a survey of 215 financial market participants and operating companies, this report offers numerous insights on the state of CSRD preparedness.

For instance, almost 50% of entities required to report for FY2024 are approaching CSRD as a strategic project, while 51% fully expect CSRD reporting to be materially relevant to their value creation. Moreover, 47% of companies required to report for FY2024 and 56% of those required to report for FY2025 expect CSRD reporting to have a material impact on their financing conditions.

As for the anticipated challenges when it comes to processing and managing the increased volume of sustainability data, over half (55%) of entities required to report for FY2024 believe they will encounter challenges pertaining to the quality and consistency of the data, while 45% anticipate resource constraints as a hurdle.

Within your entity, how would you classify CSRD reporting?

Note: Numbers may not add up due to rounding.

Source: PwC Global AWM & ESG Research Centre; survey conducted in Q1 and Q2 2024

Do you expect that CSRD reporting will be materially relevant to create value for your company?

Do you expect CSRD reporting to have a material impact on the following matters?

Note: Multiple choice question.

Source: PwC Global AWM & ESG Research Centre; survey conducted in Q1 and Q2 2024

What challenges do you anticipate for processing and managing the increased volume of sustainability information?

Note: Multiple choice question.

Source: PwC Global AWM & ESG Research Centre; survey conducted in Q1 and Q2 2024

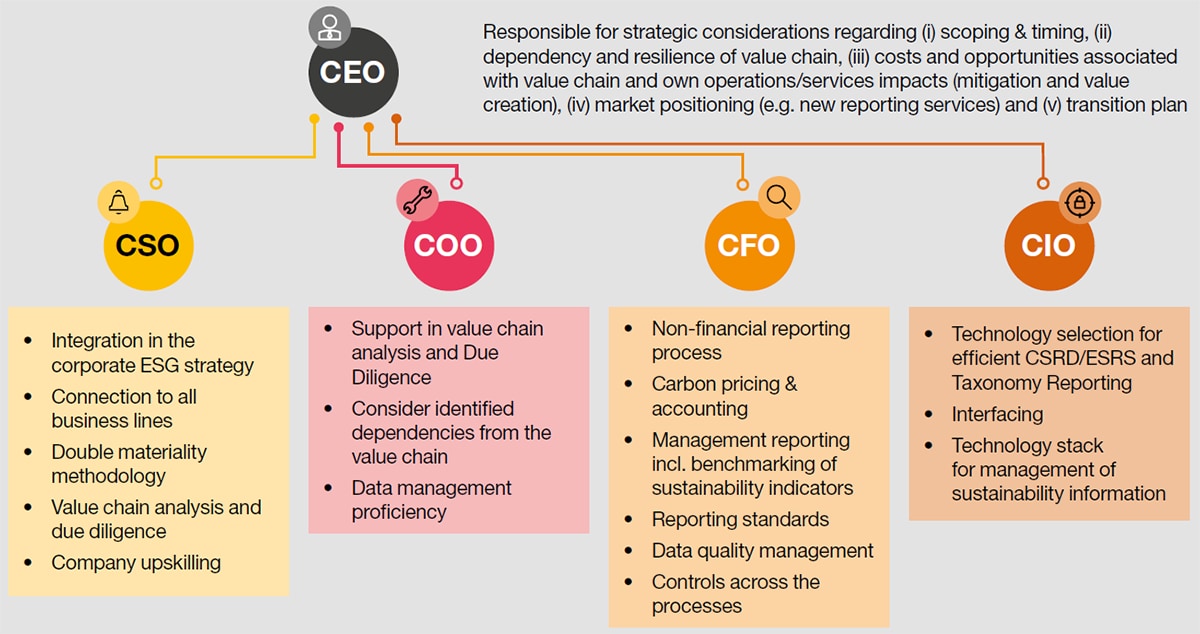

Beyond the survey data, this report offers a high-level CSRD implementation roadmap for the first year of reporting to all concerned entities, with a focus on the roles assumed by different members of the C-Suite: Chief Executive Officer (CEO), Chief Financial Officer (CFO), Chief Operating Officer (COO), Chief Information Officer (CIO), and Chief Sustainability Officer (CSO).

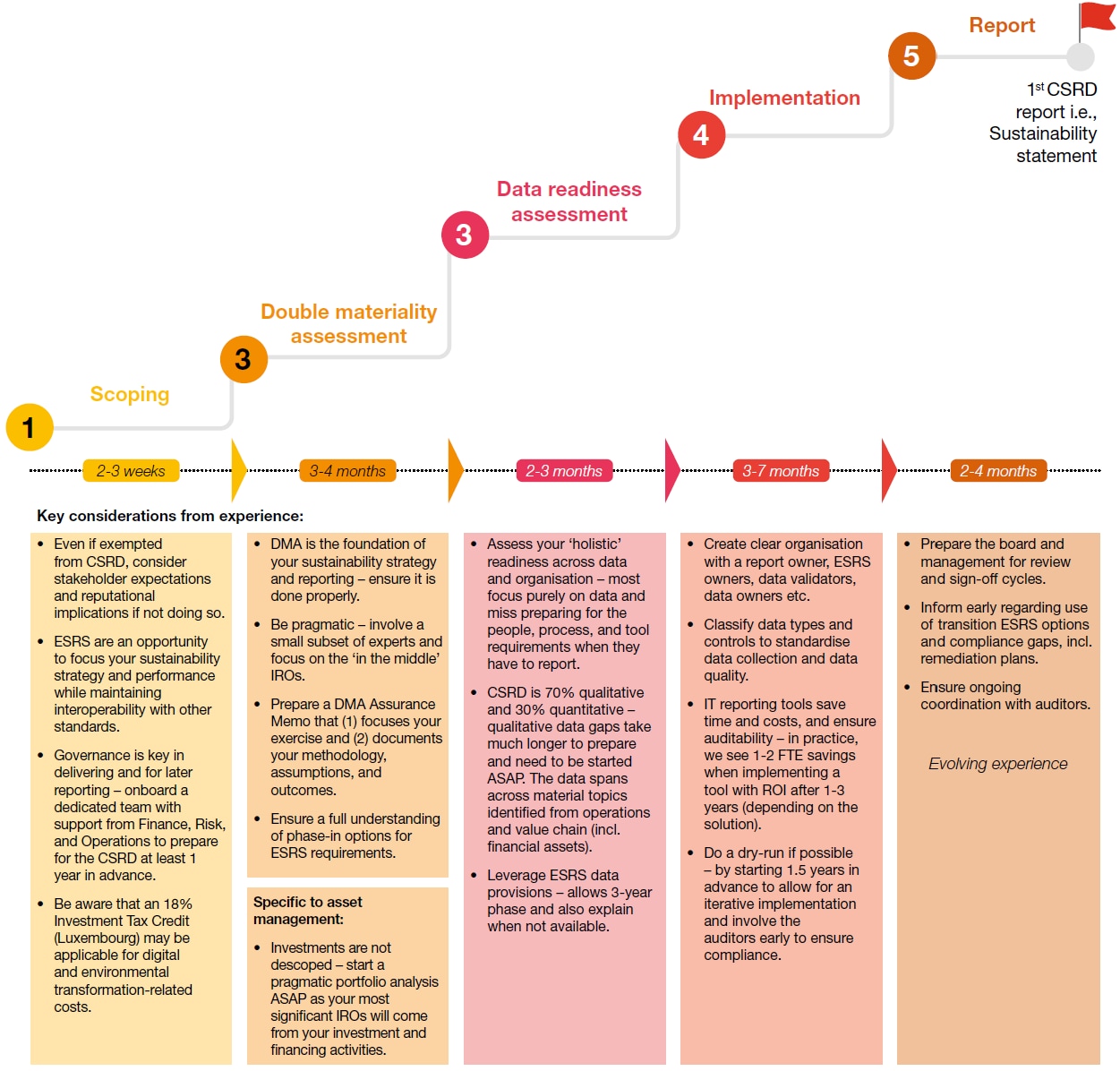

Members of the C-Suite are faced with a significant opportunity to reinvent their business and integrate sustainability across all operational facets. Based on our experience, they can use this CSRD implementation roadmap:

Note: Average duration per step is an indication only and is subject to change depending on the company’s size, complexity etc.

Members of the C-Suite should incorporate this roadmap in the entity’s overall strategy and decision-making, as the CSRD will likely shed light on previously unexplored areas of the business and the value chain, allowing them to better assess themselves compared to their peers within the same industry and to gain a sustainability-oriented strategic edge over competitors.

But this is far easier said than done, and CSRD implementation requires tight collaboration across the C-Suite throughout all stages of the roadmap. If implemented properly, it can bring about substantial long-term benefits and serve as a catalyst for meaningful business transformation in an era where sustainability considerations are paramount.

Rather than being yet another compliance requirement, the CSRD should be seen as a chance to take the lead in sustainability and reimagine business models and operations for the better, which is imperative to ensure prosperity and continued growth.

"The successful implementation of CSRD hinges on leveraging advanced technology solutions that can efficiently manage and integrate vast amounts of sustainability data. While challenges in maintaining data quality and consistency are anticipated, the demands for accurate, real-time ESG reporting present an opportunity for growth. Companies must invest in robust data management and reporting systems to overcome these hurdles. We are committed to guiding businesses through this technological transformation, ensuring that they not only meet compliance requirements but also gain actionable insights to drive sustainable growth."

"The CSRD is the cornerstone enabling Europe to deliver on the European Green Deal, elevating sustainability reporting over time to the same level of importance and rigour as financial reporting. It puts sustainability at the core of companies’ business models and operations, prompting them to integrate it into their strategic decision-making processes. At PwC Luxembourg, we see this as an opportunity for businesses to enhance their long-term resilience and competitiveness in an increasingly sustainability-conscious market."

"The assurance requirement mandated by the CSRD marks a pivotal turning point in Europe's sustainability journey, signaling a shift towards transparency, reliability and accountability in sustainability reporting. In-scope entities will gradually begin adopting and integrating more impactful and verifiable sustainability practices across all operational facets, which will in turn boost their resilience against all ESG-related risks while enhancing their sustainability credentials in the eyes of investors, regulators and the general public. Ultimately, the CSRD's assurance dimension will lead to a more resilient European corporate landscape, whereby ESG factors effectively drive long-term positive change and business reinvention."

Download our report below to find out how you can implement the CSRD and get a granular understanding of the different roles and responsibilities assumed by the members of the C-Suite.

All Hands on Deck

CSRD reporting as the accelerator for sustainable business transformation

Contact us

Olivier Carré

Deputy Managing Partner, Technology & Transformation Leader, PwC Luxembourg

Tel: +352 49 48 48 4174

Michael Horvath

Advisory Partner, Sustainability Leader, PwC Luxembourg

Tel: +352 49 48 48 3612

Julien Melotte

Audit Partner, Industry & Public Sector, Sustainability, PwC Luxembourg

Tel: +352 49 48 48 5287

Geoffroy Marcassoli

Audit Partner, EMEA AWM ESG Leader, PwC Luxembourg

Tel: +352 49 48 48 5410

Partner, Global AWM Market Research Centre Leader, PwC Luxembourg

Tel: +352 49 48 48 2191