The sixth edition of our EU ESG UCITS poster aims at helping stakeholders in the Asset and Wealth Management (AWM) industry keep track of the latest ESG developments in the European AWM landscape.

EU ESG AuM and Number of Funds (AuM in EUR bn)

Sources: PwC Global AWM & ESG Research Centre, LSEG Lipper

Note 1: Other includes Article 6 funds, funds that have not reported their SFDR status to LSEG Lipper and funds for which no data is available.

Note 2: Some figures might not add up due to rounding.

Note 3: Funds of funds are excluded from our analysis.

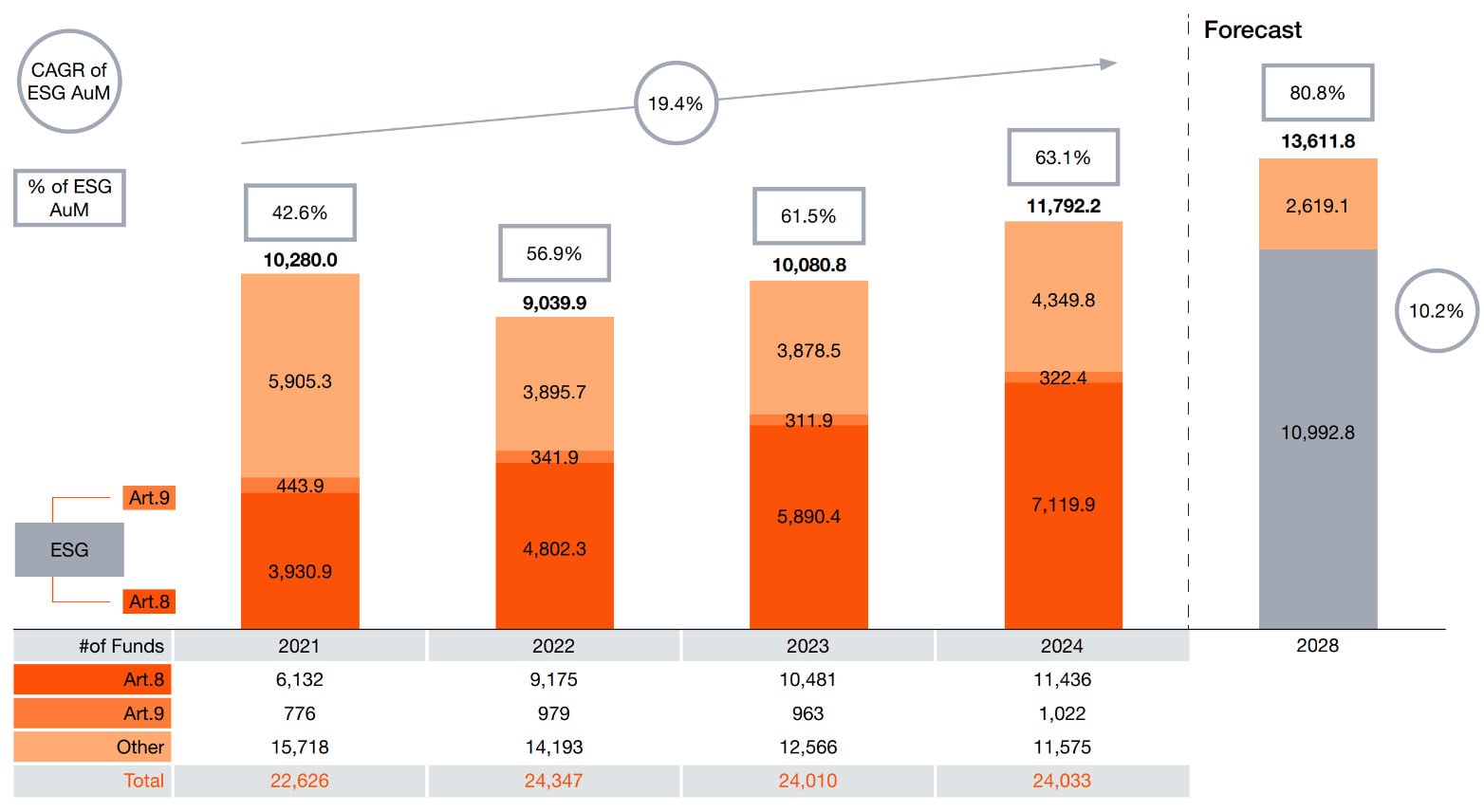

As of the end of 2024, ESG UCITS AuM in the EU stood at EUR 7.4tn, reflecting a CAGR of 19.4% since the introduction of the SFDR in 2021 – this growth trajectory is consistent with the forecasts we have published in previous years. These funds represented 63.1% of total UCITS AuM in 2024, a notable increase from 42.6% in 2021.

This expansion has been supported by a steady increase in the number of ESG UCITS, reflecting growing engagement from asset managers. By the end of 2024, the total number of Art.8 and Art.9 UCITS reached 12,458, accounting for 51.8% of all UCITS funds.

Looking ahead, ESG UCITS AuM in the EU is projected to reach EUR 11tn by 2028, representing a CAGR of 10.2% and accounting for an estimated 80.8% of total UCITS AuM.

EU ETFs AuM as of end-2024

Sources: PwC Global AWM & ESG Research Centre, LSEG Lipper

Despite still representing a smaller share of the EU ETF market, ESG ETFs (Art. 8 and Art. 9) continued their strong growth trajectory in 2024. The combined AuM of ESG ETFs rose to EUR 468bn by the end of 2024, up from EUR 367bn in 2023 — a 27.5% year-on-year increase. ESG ETFs now account for 23.3% of total EU ETF AuM, with Article 8 ETFs growing from EUR 353bn to EUR 451.1bn, and Article 9 ETFs from EUR 14.2bn to EUR 16.9bn. This steady rise highlights increasing investor demand for sustainable and transparent investment strategies within the ETF space.

EU ESG UCITS Poster - Full year 2024

Contact us

Michael Horvath

Advisory Partner, Sustainability Leader, PwC Luxembourg

Tel: +352 49 48 48 3612

Michael Delano

Audit Partner, Asset & Wealth Management Leader, PwC Luxembourg

Tel: +352 49 48 48 2109

Geoffroy Marcassoli

Audit Partner, EMEA AWM ESG Leader, PwC Luxembourg

Tel: +352 49 48 48 5410

Partner, Global AWM Market Research Centre Leader, PwC Luxembourg

Tel: +352 49 48 48 2191