{{item.title}}

{{item.text}}

{{item.text}}

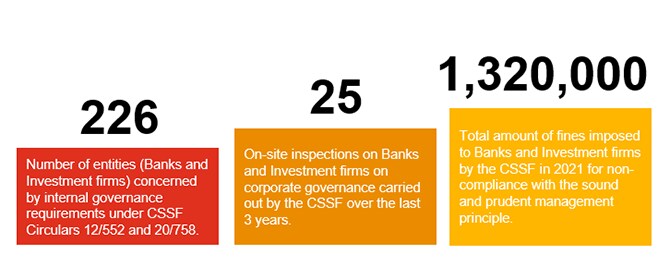

As a Bank or an Investment Firm, you are subject to corporate governance rules detailed in various regulations and CSSF Circulars.

In particular, Banks are subject to the CSSF Circular 12/552 on central administration, corporate governance and risk management (as amended by the newly issued CSSF Circular 22/807).

Investment firms are, from their part, subject to the CSSF Circular 20/758.

Regardless of the service you provide to your clients, the aim of the regulatory framework is to define and implement:

The updated version of the CSSF Circular 12/552 and the CSSF Circular 20/758 strengthen the responsibilities and organization rules of both the Board of Directors and the authorised management, reinforce the tasks of the internal control functions and introduce additional requirements related to the suitability and diversity assessment of the members of the management body and key function holders.

At PwC, we assist our clients, both Banks and Investment Firms, in identifying and assessing the regulatory and operational impacts related to the successive revisions of the CSSF Circular 12/552 and the recent CSSF Circular 20/758:

EMIR applies to all financial counterparties such as credit institutions, investment firms or UCITS, and to non-financial counterparties such as corporates, professionals of the financial sector that do not qualify as financial counterparties or securitisation vehicles. Moreover, it applies indirectly to non-European counterparties trading with European counterparties.

EMIR introduces, among others, the following obligations:

The publication of the new Regulation on Sustainable Financial Disclosure (Regulation (EU) 2019/2088, “SFDR”) establishes a new regulatory framework for the sustainable finance.

SFDR applies to financial market participants, i.e. credit institutions and investment firm providing portfolio management services, AIFMs and UCITS Management Companies, as well as to Investment Advisers such as insurance intermediaries or credit institutions providing investment advices.

The objective of SFDR is to increase overall transparency on ESG products (Environmental, Social and Governance) by reducing the asymmetry of information between end-investors and financial entities with the purpose to enhance transparency with regard to sustainability risks and impacts.

The new Sustainable Finance regulatory framework introduces new transparency requirements for financial institutions regarding the environmental impact of their investment advices and decisions, mainly at two levels:

SFDR will entry into force on 10 March 2020 and will have significant impacts on the Banks’ investment processes and product design, as well as on the ESG information to be disclosed to their clients.

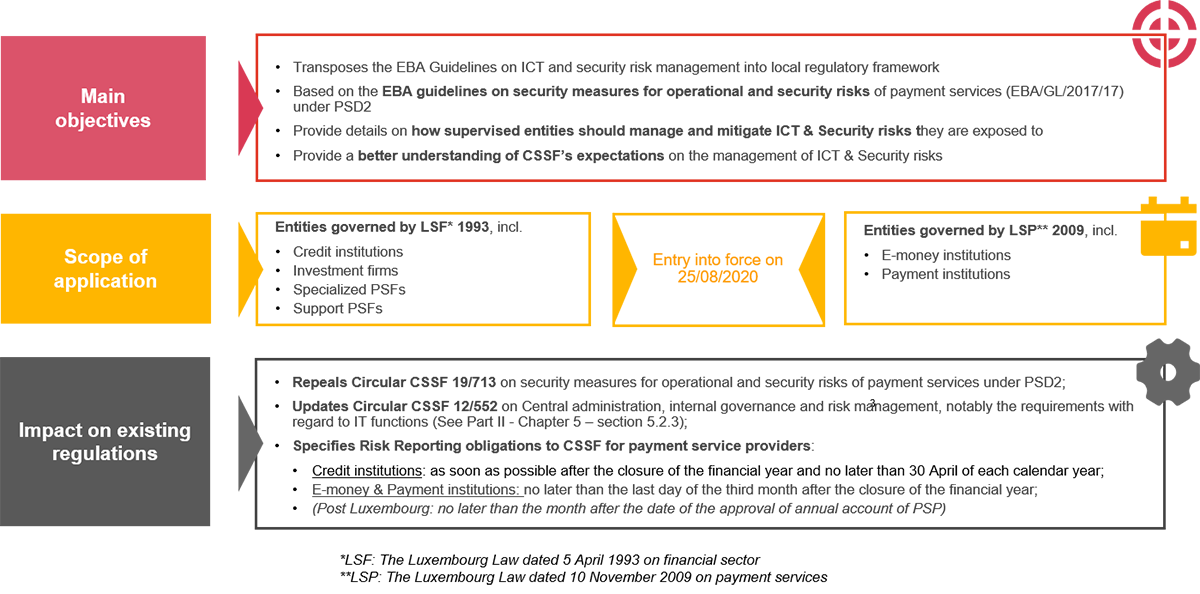

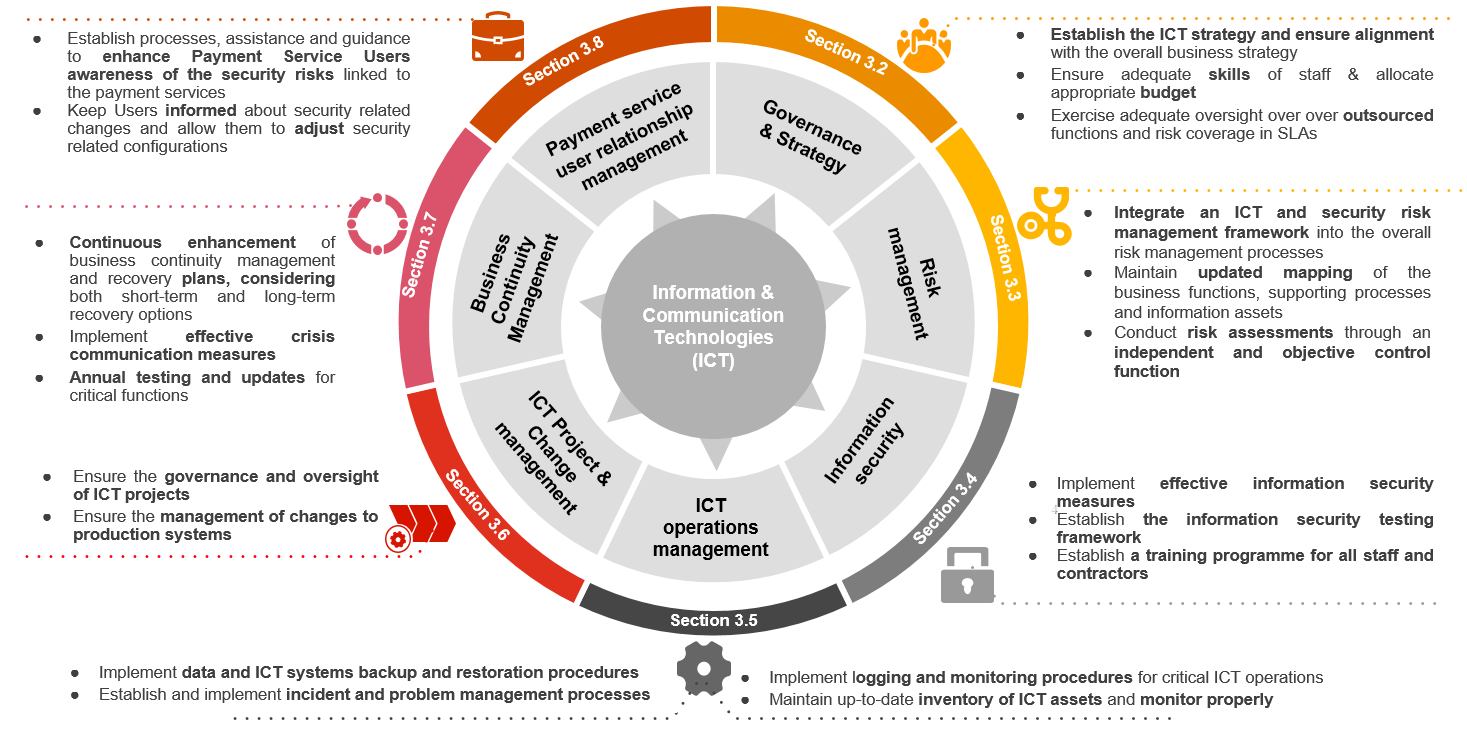

As a payment service provider located in the EEA, you are subject to PSD2 for all transactions performed within the EEA in any currency, including specific requirements when the other end of the transaction is located outside the EEA. Additional technology-related requirements apply if the payment service provider provides online access to payment accounts.

The aim of framework of PSD2 is to enhance the regulatory framework for payment services within the EEA by:

The CSSF has recently published three new Circulars introducing new reporting requirements for payment service providers:

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}

Olivier Carré

Deputy Managing Partner, Technology & Transformation Leader, PwC Luxembourg

Tel: +352 49 48 48 4174

Isabelle Melcion-Richard

Advisory Partner, Regulatory & Compliance, PwC Luxembourg

Tel: +352 49 48 48 2469