Banking & PSF Set-up/Licensing

Banking

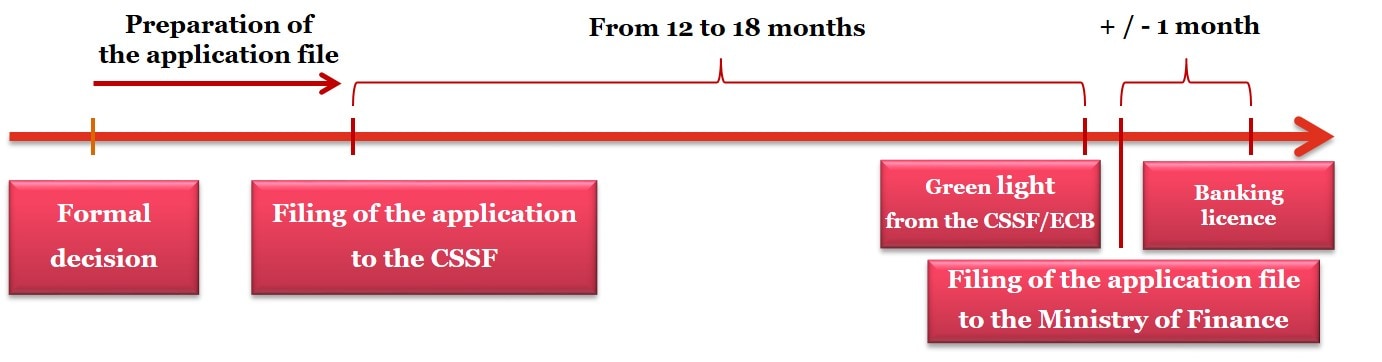

Set-up process - Focus on the licensing procedure

Applicants that wish to incorporate a Luxembourg banking legal entity or to set up a branch of a non-EU head office have to obtain prior authorisation from the Luxembourg authorities and have to follow a licence application procedure described hereafter.

PwC service offering

Should you intend to set-up a bank in Luxembourg, you would need to apply to the Ministry of Finance. The authorisation will be granted after seeking advice from the Luxembourg regulator of the financial sector, the Commission de Surveillance du Secteur Financier ("the CSSF") and the European Central Bank (ECB).

In that context, PwC Luxembourg is able to provide you with the following services:

- Preparation of the application file

- Defining a business plan*

- Description of the IT infrastructure*

- Drafting of the anti-money laundering and counter-financing procedure*

- Drafting of frameworks and policies*

- Drafting of the recovery plan*

- Incorporation of private company in Luxembourg

- Recruitment services

- Project Management

Preparation of the application file

- Define and assess your project from a regulatory perspective;

- Introduce you/your project to the Commission de Surveillance du Secteur Financier ("CSSF");

- Assisting you in the preparation of an application file and its formal filing to the CSSF until its approval and the one from the ECB* and the Ministry of Finance;

- Passporting services and cross-border development plans;

* For subsidiary set-up only

Defining a business plan*

Defining a business plan for at least the first three business years, including calculations for own funds, liquidity and leverage requirements

Description of the IT infrastructure*

Description of the IT infrastructure: systems, hosting arrangements, structure, strategy, governance, business continuity, security and controls in place.

Drafting of the anti-money laundering and counter-financing procedure*

Drafting or reviewing of the anti-money laundering and counter-financing procedure to ensure compliance with Luxembourg laws and regulations.

Drafting of frameworks and policies*

Drafting or reviewing of frameworks and policies including risk management, credit and lending, concentration, trading book, conflicts of interest, complaints handling, remuneration, etc. to ensure compliance with Luxembourg regulations.

Drafting of the recovery plan*

Drafting or reviewing of the recovery plan

Incorporation of private company in Luxembourg

- Drafting of the required documentation, including the review of KYC/Identification requirements, drafting of standard articles of incorporation;

- Coordination with the notary for the enactment of the incorporation deed;

- Follow-up of the registration, filing and publication formalities etc.

Recruitment services

Selection of key positions as CEO, Deputy CEO, Chief Compliance Officer, Chief Risk Officer, Chief Internal Auditor.., through a combination of the following channels:

- PwC database research;

- Activation of PwC’s network;

- Advertisement on PwC’s website: www.pwc.lu as well as on web job boards.

PwC disposes of a permanently updated database of profiles in varied areas such as Finance, Risk Management, HR, Accounting, Compliance, including Independent Administrators.

Project Management

Managing the project (coordinate the project with you and all PwC teams): establishing timeline with milestones, organising meetings, etc.

* Mandatory item to be included in the application file

Timeline

PSF

A Professional of the Financial Sector ("PSF") is a legal person that has been granted authorisation to perform, as a regular occupation, an activity of the financial sector (whether direct, connected or complementary) in accordance with article 13 of the law of 5 April 1993 on the financial sector, as amended ("the Law").

In practice, PSF is a generic label which embraces various and heterogeneous types of legal license (or “status”): from traditional actors of the financial sector (such as investment firms) to highly technical service providers (such as IT service providers, regulated as Support PSF). Depending on their activity and the risks they are likely to face, the intensity of the rules applicable to them will vary.

Should you intend to set-up a Professional of the Financial Sector in Luxembourg, you would need to apply to the Ministry of Finance. The authorisation will be granted after seeking advice from the Luxembourg regulator of the financial sector, the Commission de Surveillance du Secteur Financier ("the CSSF").

In that context, PwC Luxembourg is able to provide you with the following services:

- Preparation of the application file

- Defining a business plan*

- Description of the IT infrastructure*

- Drafting of the anti-money laundering and counter-financing procedure*

- Incorporation of private company in Luxembourg

- Recruitment services

- Project Management

Preparation of the application file

- Define and assess your project from a regulatory perspective;

- Introduce you/your project to the Commission de Surveillance du Secteur Financier ("CSSF");

- Assisting you in the preparation of an application file and its formal filing to the CSSF until its approval and the one from the Ministry of Finance

Defining a business plan*

Defining a business plan for at least the first three business years, including calculations for own funds, liquidity and leverage requirements.

Description of the IT infrastructure*

Description of the IT infrastructure: systems, hosting arrangements, structure, strategy, governance, business continuity, security and controls in place.

Drafting of the anti-money laundering and counter-financing procedure*

Drafting or reviewing of the anti-money laundering and counter-financing procedure to ensure compliance with Luxembourg laws and regulations.

Incorporation of private company in Luxembourg

- Drafting of the required documentation, including the review of KYC/Identification requirements, drafting of standard articles of incorporation;

- Coordination with the notary for the enactment of the incorporation deed;

- Follow-up of the registration, filing and publication formalities etc.

Recruitment services

Selection of key positions as CEO, Deputy CEO, Chief Compliance Officer, Chief Risk Officer, Chief Internal Auditor.., through a combination of the following channels:

- PwC database research;

- Activation of PwC’s network;

- Advertisement on PwC’s website: www.pwc.lu as well as on web job boards.

PwC disposes of a permanently updated database of profiles in varied areas such as Finance, Risk Management, HR, Accounting, Compliance, including Independent Administrators.

Project Management

Managing the project (coordinate the project with you and all PwC teams): establishing timeline with milestones, organising meetings, etc.

* Mandatory item to be included in the application file

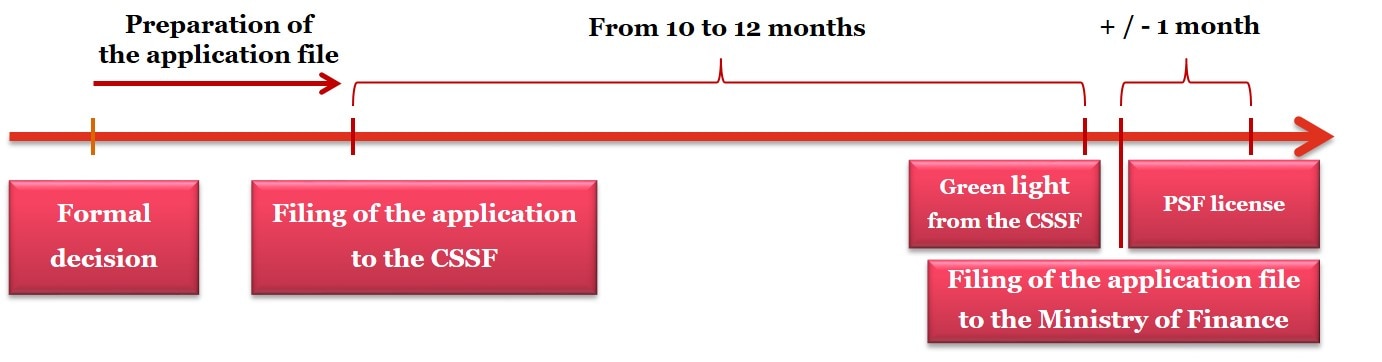

Timeline

- Applicants who wish to incorporate a Luxembourg PSF office have to obtain prior authorisation from the Luxembourg authorities and have to follow the licence application procedure described hereafter.

- The authorisation procedure is described in the amended Law of 5 April 1993.

- Before taking a formal decision to set up a PSF operation in Luxembourg, it is advisable that senior representatives of the applicant have an introductory meeting with the CSSF in order to give a general overview of the project to the authorities.

- The CSSF will examine the application file and may address additional queries to the applicant. The Ministry of Finance will seek advice from the CSSF before granting the PSF licence for an unlimited duration.