This means our clients have had to navigate through this inflationary context that continued over the year, amid rising cost pressures and a drop in pricing power. And all this during a time of critical transformation for businesses - regulatory demands, artificial intelligence (AI), the Cloud, product diversification, climate risk, sustainability and diversity - to name a few of the key trends.

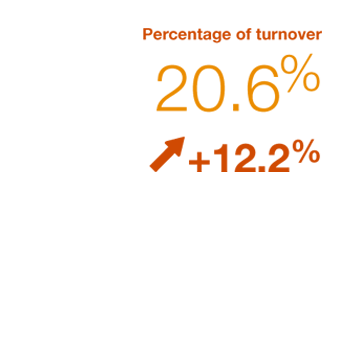

Yet, despite these adverse impacts, we are pleased to report a +16.8% increase in our net revenue (based on turnover), taking us to year ended 30 June, 2023.

As a professional services firm in Luxembourg, we believe this was an exceptional year despite the disruption. We were—and continue to be—able to adjust our services to respond to our clients’ needs. We also continue to invest for tomorrow's needs, for example, on our Environmental, Social, and Governance (ESG) services offer.

According to our 24th Annual Global CEO Survey - Luxembourg Findings - “Embracing Tomorrow with Optimism”, Luxembourg CEOs seem optimistic regarding their operations in the Grand Duchy in the medium term (five years). However, the search for talent, rising costs and the need to diversify products/services are seen as key challenges.

This is why it is even more important for us to listen closely to our clients to get their real-time insights. We are convinced this is how we will best drive actions and bring the right value to them. Asking them about their experience with us is an important part of our culture. This is reflected in our latest results, showing that what our clients appreciate most is our ability to create trustful and long-term relationships, which enable our teams to have the right impact while delivering high-quality service.

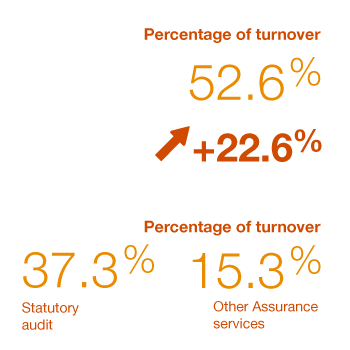

Indeed, providing our clients quality services and solutions in both financial and non-financial areas, with trust, is what is behind the growth in all our lines of services in FY23, with an exceptional increase in Assurance.

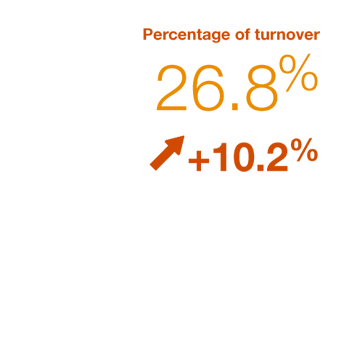

Higher growth is with Alternatives, where we observe huge interest from both private markets players and traditional funds players. We have also been able to contribute to the transformation journey of other industries, such as Banking or Industries and Services, and adapt to the often-complex regulatory agenda driven (amongst other factors) by climate change and the digital era.

Our clients have started their transformation journeys. We want to help them with their navigation to tomorrow by being the most impactful, dynamic and trusted partnership for our clients and all our stakeholders, in Luxembourg and beyond its borders.