Do you still remember 2004? That was the year when Facebook and Gmail were launched. Like 2024, it also had Olympic Games (in Athens instead of Paris) and a US Presidential Election (George W. Bush re-elected). Luxembourg re-elected Jean-Claude Juncker, acting as Prime and Finance minister at the time. And at the beginning of that year, the Luxembourg parliament passed a law on a promising financing technique called securitisation, where assets are pooled and backing securities issued to the capital market.

Two decades have now passed since the Luxembourg Law of 22 March 2004 on securitisation (the “Securitisation Law”) came into effect. Enacted in 2004, the Securitisation Law aimed to boost Luxembourg's position as a financial hub by introducing another appealing mechanism for international financial transactions.

Securitisation, a form of structured financing, involves the transfer of a pool of similar assets, such as loans or receivables, from an "originator" to a securitisation entity. This entity issues securities or other financial instruments to finance the purchase of these assets. The repayment and the interest payments of the issued (asset-backed) securities are then secured exclusively by the transferred assets and the cash flows resulting from these assets. Let's look back in history and discover what impacted (Luxembourg) securitisation during this period.

The early years (2004 - 2010)

From the launch of the Securitisation Law in 2004 until the start of the financial crisis in 2008, Luxembourg's securitisation market experienced significant expansion. With the implementation of the Securitisation Law in 2004, Luxembourg emerged as an attractive hub for global financial activities, fostering a favourable regulatory environment for securitisation transactions.

During this period, there was a notable growth in the establishment of securitisation vehicles and the diversification of securitised asset classes. Market participants capitalised on Luxembourg's reliable legal and tax frameworks, attracting both investors and originators seeking efficient financing solutions.

In the years following the enactment of the Securitisation Law, the market was looking for further clarification of some of the concepts of the Securitisation Law. As an answer to this, the Luxembourg supervisor, Commission de Surveillance du Secteur Financier (CSSF) has published (and regularly updated) its “Frequently Asked Questions Securitisation”. Even though formally only applying to supervised securitisation vehicles, this document provides market players with clarity and legal certainty, allowing them to harmonise their understanding and practice of securitisation in Luxembourg.

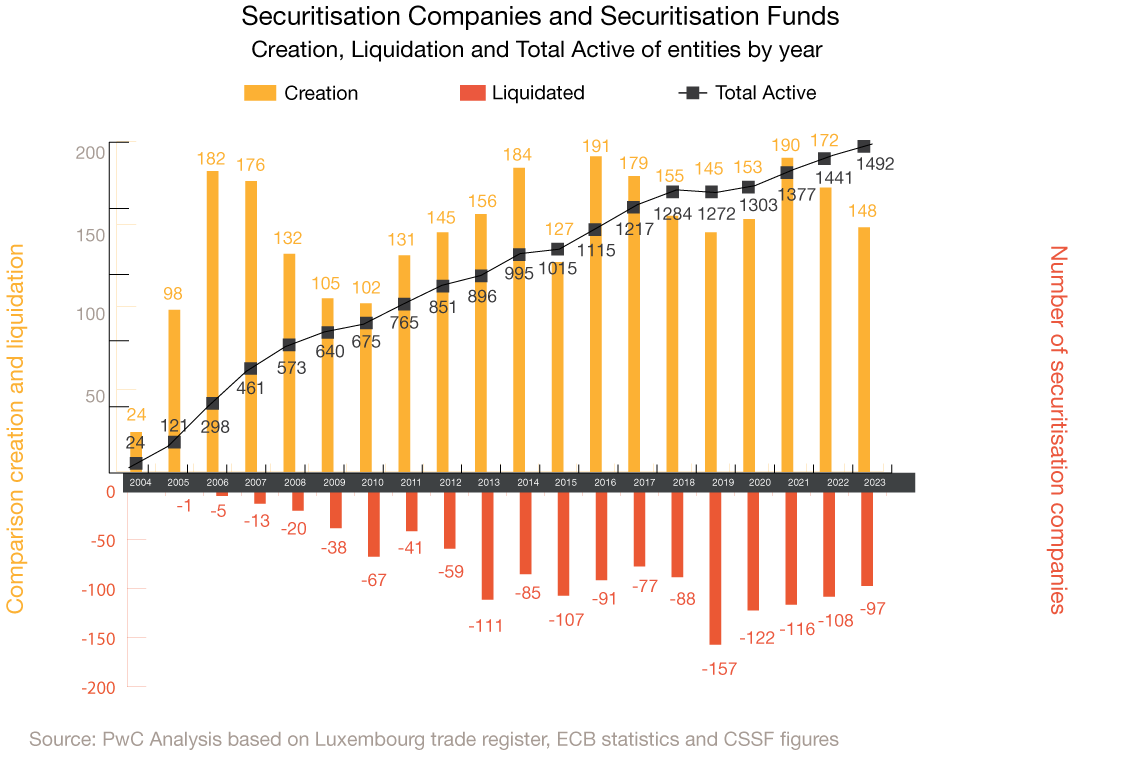

Nevertheless, due to the securitisation of "bad" assets, to which the return of the issued securities is linked, and the misuse and lack of transparency of some structuring techniques in the run-up to the 2008 so called “sub-prime”-crisis in the USA, the reputation of "securitisation" was highly affected worldwide. Subprime loans, i.e. non-first-lien high-yield mortgage loans, were securitised, re-securitised and acquired by numerous investors all around the world attracted by the high interest rates. Ultimately, the issued securities could not be fully repaid due to the payment difficulties of the borrowers and the US real estate bubble. This had a worldwide impact on the securitisation market as well as the entire financial market. Luxembourg was not unaffected by this; however, the Luxembourg securitisation market showed a higher robustness and was less impacted than the US or European market. Examining the annual creation of securitisation vehicles in Luxembourg, a noticeable slowdown is evident during the financial crisis period. In 2009, only 105 vehicles were created, followed by 102 in 2010, contrasting sharply with the figures of 176 in 2007 and 132 in 2008. At the end of 2010, 675 vehicles were active on the Luxembourg market and a steep drop like in other jurisdictions was avoided. This shows that the Luxembourg securitisation market, even though of course affected by the global crisis, was more resilient since overall hosting less risky asset classes (like trade and lease receivables or structured products).

Surviving the crisis (2010 up to 2018)

During the aftermath of the financial crisis up to 2018, Luxembourg's securitisation market demonstrated remarkable resilience and adaptability in the face of evolving global financial landscapes. Emerging from the crisis, market participants navigated through regulatory reforms and heightened risk awareness, fostering a renewed focus on transparency and risk management practices.

Luxembourg's robust legal and regulatory framework, coupled with its reputation as a stable financial centre, positioned the country as an attractive destination for securitisation activities. This period witnessed a gradual recovery in securitisation volumes and a resurgence of investor confidence, driven by innovative structuring solutions and a diversified range of securitised asset classes. Furthermore, Luxembourg's proactive approach to aligning with international regulatory standards, combined with its expertise in facilitating cross-border transactions, solidified its position as a preferred jurisdiction for securitisation transactions. As the market continued to evolve, Luxembourg remained at the forefront of innovation, leveraging its strengths to sustain growth and uphold its status as a leading player in the global securitisation arena.

By the end of 2018, 1,284 vehicles were active on the Luxembourg market, exhibiting a consistent upward trajectory throughout the period spanning from 2010 to 2018. This made Luxembourg to the leading European location hosting 29% of the European securitisation vehicles and with around 6,600 series issued by these vehicles, representing 40% of the European securitisation series.

Adapting to tax and regulatory evolvements (2019 – 2021)

Following the financial crisis, the European legislator brought forward initiatives to better regulate securitisation transactions and at the same time promote a European Capital Markets Union with securitisation as one means to improving the financing of the EU economy. Since 1 January 2019, Regulation (EU) 2017/2402 (the “EU Securitisation Regulation”) is applicable to EU securitisation transactions whose securities (or other securitisation positions) are issued on or after that date. With a securitisation definition partly different from the Luxembourg one, several responsibilities were implemented for originators, original lenders, sponsors, and investors to increase quality and transparency of the transactions.

Also in 2019, Luxembourg implemented the first Anti-Tax Avoidance Directive (ATAD 1), a significant legislative measure aimed at combating tax avoidance practices within the European Union based on recommendations of the OECD. ATAD 1 introduced several requirements to enhance tax transparency and fairness across member states. One key requirement is the interest limitation rule, which aims to restrict the deduction of borrowing costs (approximately interest expenses) that exceed 30% of a company's earnings before interest, tax, depreciation, and amortization (EBITDA). This rule affected some securitisation companies even if securitisation companies, especially orphan structures, are not used for tax avoidance purposes.

The implementation of ATAD 1 and the uncertainty about certain interpretations presented an important challenge to Luxembourg's securitisation market, as some securitisation companies could eventually face the prospect of unexpectedly high tax liabilities that were not accounted for in their initial structures. As a consequence, the market witnessed a downturn, marking the first instance where the number of active securitisation vehicles declined slightly from one year to the next, with 1,272 active vehicles end of 2019. At that time, Luxembourg was still leading the European securitisation market with 29% of the European securitisation vehicles and 41% of the series issued. This changed end of 2021, when Luxembourg lost its leading position to Ireland and hosted 29% of the European securitisation vehicles (Ireland: 32%) issuing 32% of the European series (Ireland: 45%).

Despite this challenge, the securitisation market in Luxembourg has again demonstrated resilience and adaptability in the face of evolving regulatory landscapes and market dynamics. Besides the use of the flexibility of the so-called Luxembourg toolbox (e.g. increased use of securitisation funds in addition to securitisation companies or fiduciary structures (both being tax transparent)), the jurisdiction embarked on a path of regulatory modernisation to address these obstacles and enhance the competitiveness of its securitisation framework. Since 2019, the market is also speaking with one voice, the Luxembourg Capital Markets Association (LuxCMA). LuxCMA’s objective is to promote the capital markets industry (incl. securitisation) and Luxembourg.

Continuing the growth path (2022 – today)

The modernisation was materialised with the enaction of the amended Securitisation Law in March 2022. The modernised Securitisation Law built upon the success of the former Securitisation Law and continued to incorporate legal certainty and flexibility. As such, the modernised Securitisation Law was not a revolution of the understanding of Luxembourg securitisation vehicles but rather an evolution towards changed demands in the use of such vehicles and increased flexibility when compared to other jurisdictions. The two main changes were the possibility of the issuance of all types of financial instruments and no longer only securities and the active management of debt portfolios. Beside this and some other items, new legal forms of securitisation vehicles, like partnerships, were introduced, and a legal subordination for issued financial debt instruments was defined. Even if the effect of the modernised Securitisation Law was not the one expected, with the Collateral Loan Obligation structures not (yet) being that present on the Luxembourg market after the enaction of the modernised law, the Luxembourg securitisation market continued its steady growth, reaching a total of 1,492 active vehicles at the end of 2023 and still representing 29% of the European securitisation vehicles.

Looking at the future – challenges and opportunities

Looking ahead, the securitisation market in Luxembourg faces challenges with navigating through evolving regulatory landscapes, particularly tax initiatives like ATAD, while also facing some operational challenges, e.g. in the process of opening bank accounts. However, amongst these challenges, opportunities arise, including the potential for expansion into green financing to meet the growing demand for sustainable investment options. Additionally, embracing cryptocurrencies and blockchain technology presents avenues for innovation within securitisation structures, offering enhanced efficiency and the creation of novel financial products.

We are very confident, that securitisation in Luxembourg will continue to steadily reinvent itself based on its foundations of flexibility and legal certainty, as it did in the past. With the dynamics and commitment, we see in the market, and a new Luxembourg legislator providing a supportive environment, securitisation in Luxembourg will have a bright future for the next 20 years to come and support the European Capital Markets Union.