In the last few decades, the world of finance has navigated waves of disruption—be it online banking, the rise of FinTechs, or the introduction of open banking which allowed third parties to access once-guarded bank data. Now, we are entering the next paradigm of disruption. The age of open finance is here, and it is set to rewrite the rules of the financial services sector.

Open Finance

Genesis of a Revolution

Key findings

The evolution of open banking, open finance and open data

Source: PwC Global AWM & ESG Research Centre

Standardised APIs will drive the implementation of open finance

Source: PwC Global AWM & ESG Research Centre

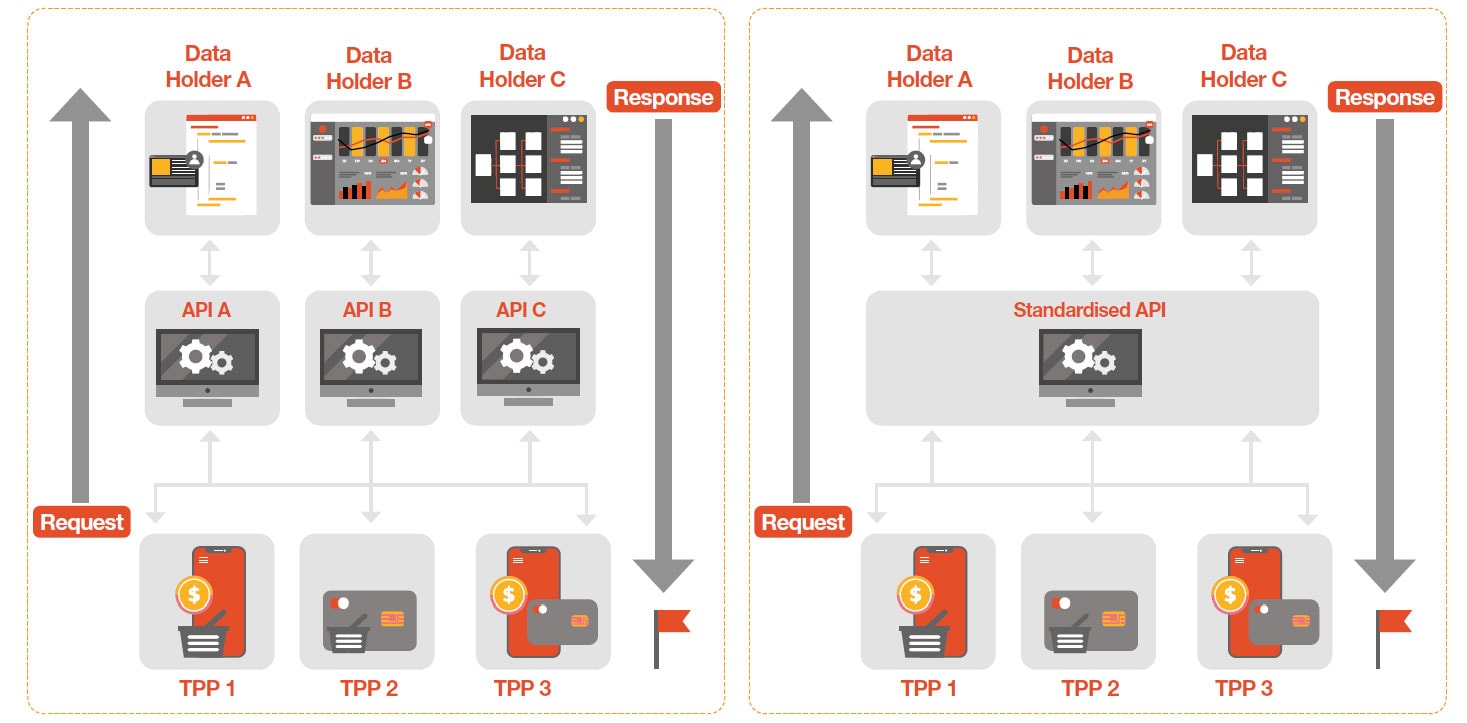

As open finance evolves, regulatory frameworks will continue to adapt to ensure data security, privacy, and interoperability between different financial services. We expect global efforts to standardise data formats and Application Programming Interface (APIs) to gain momentum.

This harmonisation will reduce friction in cross-border transactions and enhance the global financial ecosystem’s overall user experience. With standardised APIs and data formats, new entrants can more easily connect with existing financial networks and offer their services to a broader audience. This openness will foster competition, leading to more innovative financial products and services.

Such standardisation is crucial for achieving seamless interoperability, making it easier for various financial institutions—such as payment providers, banks, insurers, and wealth managers—to integrate and collaborate with third-party providers (TPPs).

Our recommendations

Open finance will herald a revolution so profound that industry players will be compelled to reshape their business models. We are truly at the genesis of a revolution, and open finance will unlock significant opportunities for innovation, enhanced customer experiences and competitive advantages. For this reason, we outline some key considerations that will position the European financial sector to navigate the evolving landscape:

Open Finance

Genesis of a Revolution

Contact us

Björn Ebert

Financial Services and Managed Services Leader, PwC Luxembourg

Tel: +325 621 332 256

Partner, Global AWM Market Research Centre Leader, PwC Luxembourg

Tel: +352 49 48 48 2191