In this guide, we present the basics of securitisation in general and in Luxembourg. In this year’s edition, we have primarily updated Chapter 5 on taxation. Notably, we have included commentary on the impact of certain amendments to the Pillar 2 Law and the introduction of the “single entity group” concept for applying interest limitation rules. This new concept has significantly reduced the uncertainty around the interest limitation rules under the Anti-Tax Avoidance Directive 1 (ATAD 1).

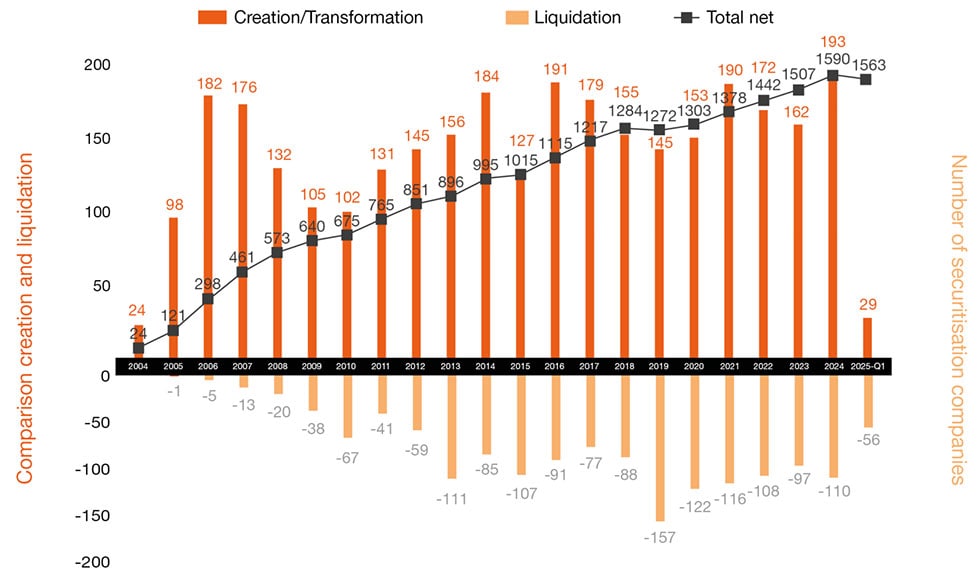

As a result, Luxembourg continues to be one of the two leading jurisdictions for establishing issuing vehicles. In 2024, 190 securitisation vehicles were created in Luxembourg, bringing the total to around 1,590 by March 2025. We anticipate continued growth, driven by the updated Securitisation Law enabling 100% loan financing, partnerships, and clarity on ATAD I.

All these topics - and many more - are covered in the 14th edition of our reference guide for securitisation in Luxembourg.

Key figures

Yearly evolution of Luxembourg securitisation vehicles

Source: PwC Analysis based on Luxembourg trade register, ECB statistics and CSSF figures

Euro area countries for securitisation

Source: PwC Analysis based on Luxembourg trade register, ECB statistics and CSSF figures

Download the guide

Securitisation in Luxembourg: A comprehensive guide

Order your printed copy

Discover the new edition of our guide

Contact us

Luc Petit

Tax Partner, Clients & Markets Hedge Funds Leader, PwC Luxembourg

Tel: +352 62133 31 48