IFRS 18 stands as an additional important aspect to consider in an entity’s transformation journey.

The level of operational change required by the new standard should not be underestimated, entailing possible system and process revisions, so entities should start thinking about the challenges as soon as possible to be ready for the adoption. Details below will bring light on why it is so.

Issued by the International Accounting Standard Board (IASB) on 9 April 2024, IFRS 18 “Presentation and Disclosure in Financial Statements” will replace the existing IAS 1 “Presentation of Financial Statements” for annual periods beginning on or after 1 January 2027. The application of the new standard is required to be retrospective, early application being permitted. In the year of adoption, IFRS 18 requires a reconciliation for the comparative period for each line item in the statement of profit or loss between the restated amounts presented applying the new standard and the amounts previously presented applying IAS 1. Same requirement applies for the interim financial statements.

The reason for developing IFRS 18 is to respond to the strong demand from stakeholders, particularly from users of financial statements, for improvements to financial performance reporting. The key new concepts introduced by IFRS 18 relate to:

- subtotals in the statement of profit or loss – as IAS 1 required no specific subtotals, this led to diversity in the presentation and calculation of subtotals even among entities in the same industry. In a sample of 100 companies, it was found that 63% reported operating profit in the financial statements using at least nine different definitions.[1]

- aggregation and disaggregation — the requirements in IAS 1 for the aggregation and disaggregation of information in the primary financial statements and the notes were sometimes not understood or applied well in practice, leading to diversity. Entities sometimes disclose large expenses in the notes as ‘other expenses’, with no information provided to help understand their composition.[2]

- management-defined performance measures — referred also as ‘alternative performance measures’ or ‘non-GAAP measures’ are provided by entities as own management-defined measures of performance. As IASB notes2, it can be difficult to find and understand such measures, including why the measures are used and how they are calculated. Typically, entities report such measures outside the financial statements, where they are often not subject to assurance.

[1] Source: Emerging Economies Group, Oct 2023, AP1: Introduction to IFRS 18 Presentation and Disclosure in Financial Statements

[2] IFRS 18 paragraph BC3

Subtotals in the statement of profit or loss

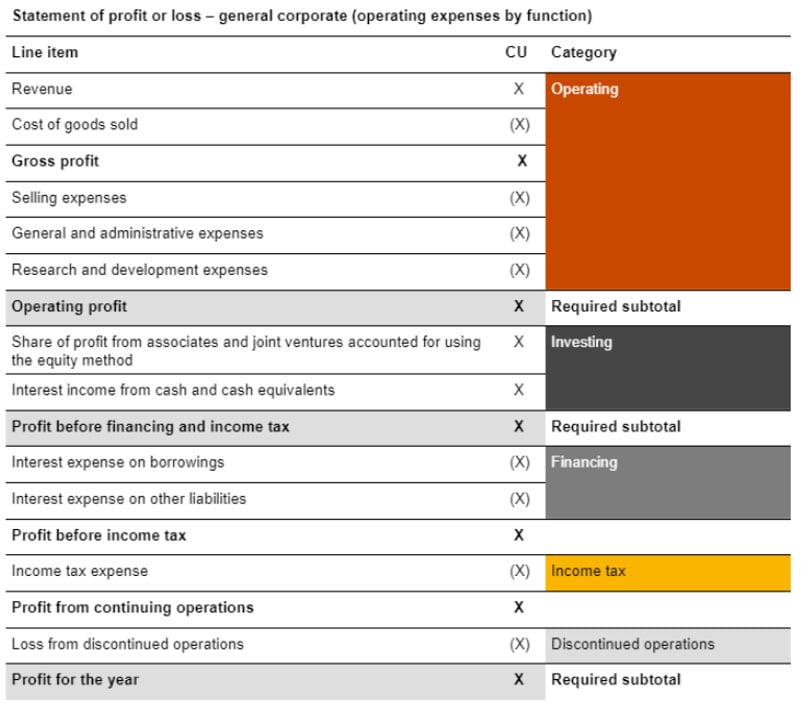

IFRS 18 introduces a defined structure for the statement of profit or loss. The structure is composed of categories and required subtotals.

Items in the statement of profit or loss will need to be classified into one of the following five categories: operating, investing, financing, income taxes and discontinued operations. IFRS 18 provides general guidance for entities to classify the items among these categories, the three main categories being:

- Investing comprises income and expenses from investments in associates, joint ventures and unconsolidated subsidiaries accounted for using the equity method. Otherwise, if such investments represent the main business activity (not at equity method) are presented as operating.

Investing also includes income and expenses from cash and cash equivalents and other assets that generate a return individually and largely independently of the entity’s other resources (such as debt or equity investments and investment properties).

The income and expenses include the results from the initial and subsequent measurement, including on derecognition of the assets and the incremental expenses, e.g. transaction costs and costs to sell the assets.

Income and expenses from cash and cash equivalents are classified as operating in case the main business activity is investing in financial assets or providing financing to customers.

- Financing category includes income and expenses from the initial and subsequent measurement (including on derecognition) and incremental expenses (transaction costs) of liabilities arising from the raising of finance (e.g. bank borrowings). In case providing financing to customers is the main business activity, the income and expenses from such liabilities are classified as operating.

The financing category also includes interest income, expenses and effects of changes in interest rates for other liabilities that do not involve the raising of finance (e.g. lease liability, defined benefit pension liabilities, provisions). Any other income and expenses for such liabilities that do not involve the raising of finance is classified as operating for an entity providing financing to customers as main business activity.

For a hybrid contract, the income and expenses from the separated host liability are classified in line with the above requirements.

The gains and losses on a derivative that is not used to manage identified risks are classified in the financing category if the derivative relates to a transaction that involves the raising of finance. Otherwise, it is included in operating.

- Operating category will typically include the entity’s results from its main business activities and all income and expenses that are not classified in the other categories, including such income or expenses that are volatile or non-recurring.

An entity shall exclude from the financing category and classify in the operating category: income and expenses from issued investment contracts with participation features recognised applying IFRS 9 “Financial Instruments” and insurance finance income and expenses included in the statement of profit or loss applying IFRS 17 “Insurance Contracts”.

The main change brought by IFRS 18 relates to the mandatory inclusion of ‘Operating profit or loss’ subtotal.

Gains and losses on a hedging instrument are classified in the same category as the income and expenses affected by the risks the instrument is used to manage.

Aggregation and disaggregation

IFRS 18 provides enhanced guidance on the principles of aggregation and disaggregation which focus on grouping items based on their shared characteristics. Characteristics refer for example to nature, function or measurement basis. The result is the presentation in the primary financial statements of line items and disclosure in the notes of items that have at least one similar characteristic. For instance, financial assets with different measurement bases — some measured at fair value through profit or loss and others at amortised cost, it will be necessary to present line items that disaggregate the financial assets based on those measurement bases. An entity is required to disaggregate items that have dissimilar characteristics when the resulting information is material. These principles are applied across the financial statements, and they are used in defining which line items are presented in the primary financial statements and what information is disclosed in the notes.

Management-defined performance measures

IFRS 18 defines a management-defined performance measure (MPM) as a subtotal of income and expenses that an entity uses in public communications outside financial statements and that an entity uses to communicate management’s view of an aspect of the financial performance of the entity as a whole. For the purpose of defining MPMs, public communications exclude oral communications, written transcripts of oral communications and social media posts.

Information related to these measures should be disclosed in the financial statements in a single note, including a reconciliation between the MPM and the most similar specified subtotal in IFRS® Accounting Standards. This will effectively bring a portion of non-GAAP measures into the financial statements.

It excludes subtotal of income and expenses specifically required to be presented or disclosed by IFRS® Accounting Standards. For instance, an MPM is not represented by gross profit or loss, operating profit or loss before depreciation, amortisation and impairments or profit or loss before income taxes. Also subtotals of only income or only expenses, assets, liabilities, equity or combinations of these elements, financial ratios or measures of liquidity or cash flows, do not represent MPMs as they are not subtotals of income and expenses.

Other changes

Entities will present expenses in the operating category by nature, function or a mix of both. IFRS 18 includes guidance for entities to assess and determine which approach is most appropriate, based on the facts and circumstances. Where items are presented by function, an entity is required to disclose information by nature for specific expenses.

IFRS 18 will make some other limited changes to presentation and disclosure in the financial statements. For example, IAS 7 “Statement of cash flows” is amended to have ‘operating profit or loss’ as the starting point for reconciling cash flows from operating activities and remove the existing options for the presentation of interest and dividends paid and received.

IFRS 18 will not impact the recognition or measurement of items in the financial statements. The classification among categories for the statement of profit or loss is performed at the reporting entity level – there might therefore be differences in classification between an entity’s individual financial statements and the consolidated financial statements.

The guidance on aggregation and disaggregation will require entities to reconsider their chart of accounts and to evaluate whether their existing presentation is still appropriate. In addition, changes in the structure of the statement of profit or loss and additional disclosures might require an entity to make significant changes to its systems, charts of accounts, mappings etc.

Moreover, it might be difficult to identify MPMs and extensive procedures might be required by auditors to assess completeness.

So, would it come from the revised primary statement that will need to be fed by your system, the new mapping to implement or the impact and potential alignment between external stakeholder and management view on performance, IFRS 18 is definitely part of the agenda.