Vote of the new Luxembourg investment tax credits regime to accelerate sustainability transformation

19/12/23

In brief

On 19 December 2023, the Luxembourg Parliament voted to approve bill n°8276 (hereafter “the Law”) revamping the investment tax credits available under article 152bis of the Luxembourg Income Tax Law (“LITL”). The aim of the Law is notably to support Luxembourg companies in their digital and ecological/energetic transformation.

The most significant change to the rules, in addition to the increase of applicable rates, consists of an inclusion of certain operating expenses connected with the digital/ecological transformation on which a 18% tax credit may apply. This change is expected to provide a strong incentive for companies to accelerate their digital and ecological/energetic transition.

In detail

The draft text as set out in bill n°8276 was released on 13 July 2023 and has been amended during the legislative process following comments notably from the State Council. You will find below an overview of the new regime as amended.

As a reminder, article 152bis LITL offered two forms of investment tax credits until now:

- a Tax Credit for Overall Investment (TCOI) determined based on the acquisition price or production costs of certain qualifying assets (e.g., tangible depreciable assets) acquired during a given accounting period. The tax credit amounts to 8% for the tranche up to EUR 150,000 and 2% for the tranche exceeding EUR 150,000.

- a Tax Credit for Additional Investment (TCAI) representing 13% of the additional investment in qualifying assets (e.g., tangible depreciable assets) determined under a specific formula.

The Law as voted results notably in the following changes:

1. Repeal of the tax credit for additional investment

The existing 13% TCAI is fully repealed.

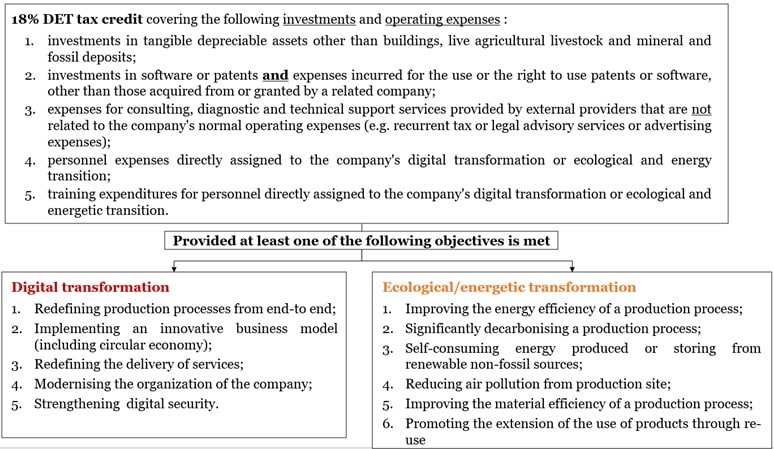

2. Introduction of a 18% tax credit for investments and operating expenses connected with digital and ecological transformation (the DET tax credit)

The new DET tax credit applies to certain investments and operating expenses connected with digital and ecological transformation, provided they comply with at least one of the objectives listed for each category respectively, as summarised in the table below;

For investments in tangible depreciable assets, the DET tax credit is limited to 6% considering that these assets are expected to benefit from the 12% tax credit for global investment (further described below), hence reaching the expected 18% tax credit overall.

Income derived from investments and expenses related to the acquisition or development of software/patents would not be eligible to the patent box regime provided by article 50ter LITL to the extent the company benefits from a DET tax credit on these investments and expenses.

Also, excluded from the DET tax credit, are:

- assets that are depreciable over a period of less than three years;

- automotive vehicles;

- investments and operating expenses to bring the company into compliance with obligations arising from environmental protection legislation and other legal and regulatory provisions applicable to the establishment and operation of industrial and commercial companies.

The benefit of the DET tax credit requires obtaining:

- (i) an eligibility certificate issued by the Minister of Economy, attesting the eligibility of the investments and operating expenses in relation to a project of digital/ecological transformation as defined under the new article 152bis LITL; and

- (ii) an annual certificate issued by the Minister of Economy proving the reality of the project and investments and operating expenses. Such certificate should be attached to the corporate tax return filed with the Luxembourg tax authorities every year. Following the request of the State Council, the Law now explicitly provides that this certificate is binding to the tax authorities.

The issuance of the eligibility certificate by the Minister of Economy will be subject to the consultation of an inter-ministerial commission whose missions, functioning and composition will be defined in a Grand Ducal regulation. All related provisions initially included in the draft Law as regard such commission have therefore been removed upon concerns raised by the State Council.

Further to the request of the State Council, the Law introduces a temporary tax assessment procedure which maintains, in case of a refusal of issuance of a certificate by the Minister of Economy, the taxpayer’s right to benefit from the tax credit in the event of a favourable decision by the administrative courts and the subsequent issuance of said certificate.

The draft Law provided initially that projects with cumulative investments and operating expenses remaining below EUR 20,000 (excluding VAT) over the three consecutive fiscal years of the realisation of the project would not be considered in obtaining the eligibility certificate. This restriction has however been removed during the legislative process following the comments from the State Council.

3. Increase from 8% to 12% of the rate applicable to the tax credit for overall investments

The existing TCOI remains in place but with (i) an increased rate reaching now 12% and (ii) a repeal of the EUR 150,000 threshold.

As a reminder, the TCOI applies to:

- investments in depreciable tangible assets other than buildings, livestock, and mineral and fossil deposits;

- investments in sanitary and central heating installations incorporated into hotel buildings (under certain conditions);

- investments in certain buildings qualifying as social investment;

- investments in fixed assets qualifying for special depreciation;

- acquisitions of software, insofar as they have not been acquired from a related company (to the extent not otherwise qualifying under the DET tax credit already).

We note that for investments in fixed assets qualifying for special depreciation, the applicable rate is increased to 14%.

The TCOI related to the acquisition of software is capped at 10% of the corporate income tax due for the fiscal year during which the financial year closed and the acquisition of the software was made. Similar as for the DET tax credit, income derived from the software would be out of scope of the patent box regime foreseen under article 50ter LITL.

4. General provision

The total of the DET tax credit and TCOI are creditable on the corporate income tax due for the fiscal years during which the investments or operating costs are realised and can be carried forward (except for the TCOI on software) during 10 subsequent fiscal years if it would not be fully used.

Conclusion

The Law reshaping the investment tax credit demonstrates a clear ambition of the Luxembourg Government to help companies achieving their digital and ecological transformation journey. This new regime takes effect as from the 2024 tax year (i.e. for financial years closing on or after 1 January 2024).

Uncertainties remain around the question of how the new investment tax credit fits into the upcoming Pillar 2 rules so as not to lose attractivity for Multinational Enterprises falling in the scope of Pillar 2. As currently enacted, the credits are not eligible as qualified refundable tax credits or marketable transferable credits that qualify as income for the Pillar 2 rules. Therefore, the tax credits will reduce the Luxembourg corporate income tax and the impact on the jurisdictional effective tax rate should be reviewed in detail for in-scope groups.

Contact us

Murielle Filipucci

Tax Partner, Global Banking & Capital Markets Tax Leader, PwC Luxembourg

Tel: +352 62133 31 18

Nenad Ilic

Tax Partner, Banking & Capital Markets Tax Leader, PwC Luxembourg

Tel: +352 62133 24 70