MiFID II Timeline

The first Markets in Financial Instruments Directive (MIFID) came into force on 1 November 2007, replacing and expanding upon the Investment Services Directive.

The objective was to increase the integration and efficiency of EU financial markets by establishing a harmonised regulatory framework for the provision of investment services in financial instruments across the EU and for the operation of regulated markets by market operators.

Following the global financial crisis, the European Commission (Commission) decided to review the MiFID framework and on 20 October, 2011, published proposals for (i) a revised Directive (MiFID II) and (ii) a new Regulation (MiFIR).

On 15 April 2014, the Council of the European Union adopted the final texts of MiFID II and MiFIR (Level 1 texts).

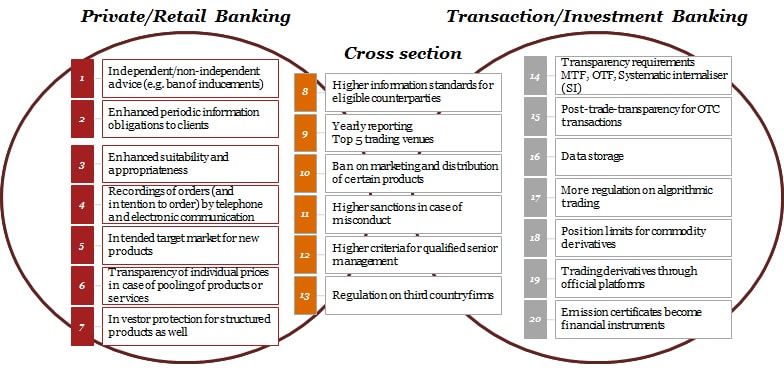

These new texts intend to address a number of shortcomings of the initial MiFID framework as well as some sources of systemic risk which became apparent during the financial crisis.

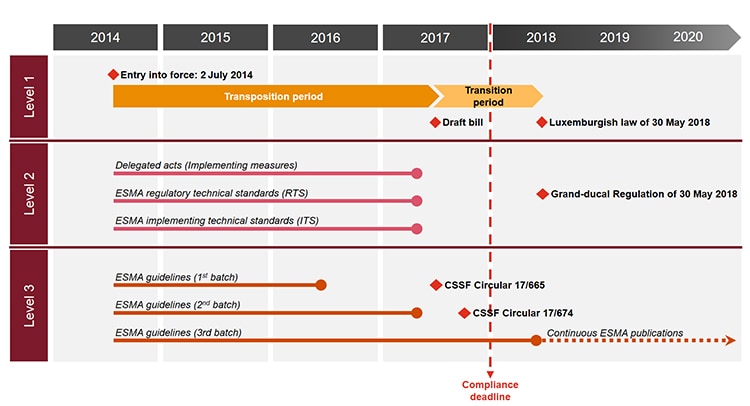

MiFID II timeline: a significant amount of documentation issued since mid-2014

MiFID II expected EU legal framework

Since entry into force of MIFID II the 2nd July of 2014, ESMA published more than 100 papers (delegated directives, delegated regulations, RTS, ITS, guidelines…) on MiFID II/MiFIR topics to ensure a proper implementation across Europe. As from compliance deadline (1st of January 2018), ESMA issued more than 10 guidelines and other related MiFID II documents, which compel MiFID entities to perform ongoing monitoring on new requirements.