MiFID II Framework

MiFID II is changing the logic of the initial MiFID I framework. The MiFID regulation intended to regulate the financial markets, the financial intermediaries and the financial services rendered to the investors by those intermediaries.

With the MiFID II framework the EU has expanded the reach of the regulation, i.e. the guidelines are relevant for (i) financial intermediaries and distributors of financial products, (ii) the financial markets and execution venues and, this is clearly a move up the value chain, (iii) the manufacturers of financial products.

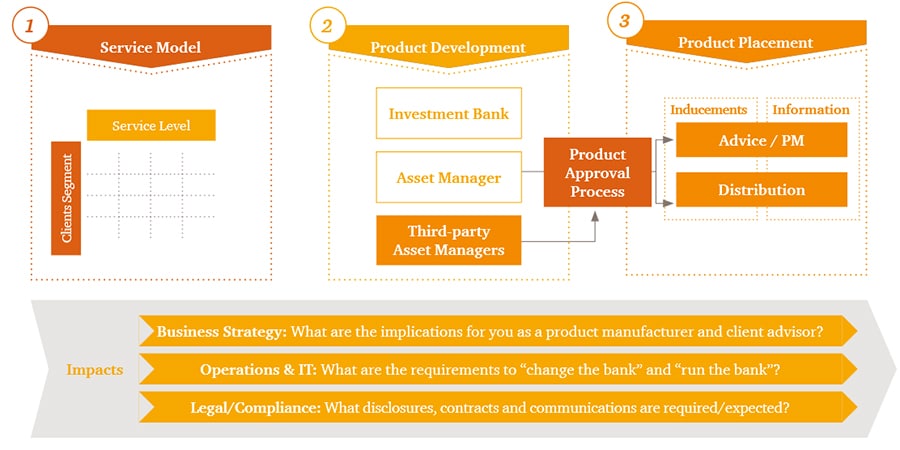

The dynamics of the MiFID II framework is encompassing three main aspects:

1. Service model

The regulation will have substantial impacts on the service model of any financial group in the EU and beyond.

The main drivers for these impacts are:

- Inducement ban/ repayment in case of 'independent advice' or discretionary portfolio management;

- Enhanced investor information and transparency rules regarding 'cost of advice' and 'cost of products';

- Re-definition of execution venues (i.e. systematic internalisers and organised trading facilities (OTFs)).

- Increased transparency requirements on transactions and quoting for banks, brokers and trading venues;

- Stricter transaction reporting regime for participants in the financial markets;

- New trading obligation and clearing obligations.

2. Product Development

The manufacturers of products who are MiFID firms (e.g. structuring firms) or Management Companies with 'extended licences' (e.g. discretionary portfolio management, investment advice and execution of trades) are subject to new distinct rules under MiFID II for these services.

These new rules are complementary to the product regulations governing the products themselves (e.g. UCITS, AIFMD).

The guidelines prescribe a set of requirements regarding:

- the governance of the product manufacturing process (i.e. how is a product created?);

- the definition of product target markets (i.e. strategy, risk level, cost and performance);

- the obligation to create, maintain and provide the product information to distributors and investors.

3. Product Placement

The third pillar of MiFID II are the enhanced provisions regarding the product placement.

These provisions are focusing on shortcomings of MiFID I as well as on:

- the 'remuneration' of advice; and

- the placement of products to investors.