What does this mean for Product Distributors?

Product distributors have been since 2007 regulated by the MiFID rules. The MiFID II guidelines are neither changing substantially the logic of investor classification (i.e. suitability and appropriateness) nor the principles of execution of trades.

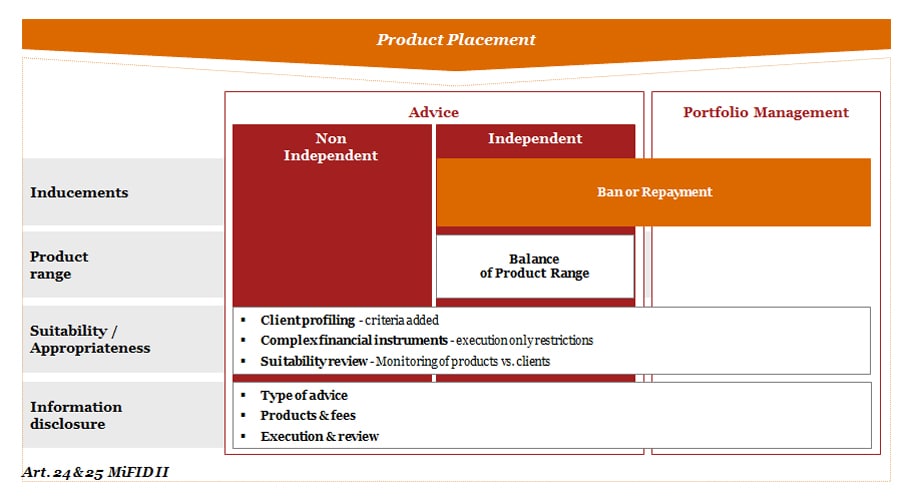

However, MiFID II has been drafted post financial crisis and after more than 10 years of 'track record' with MiFID I. As such, the approach to financial intermediaries within the EU has undergone major shifts, in particular regarding product placement remuneration (advice fees) and the complexity of financial products (i.e. complex vs non-complex financial instruments).

Some member states (e.g. UK, NL) are spearheading the change in product placement rules by imposing very strict national laws banning 'inducements' (i.e. indirect revenues of the distributor stemming from the product manufacturers). The MiFID II rules are not going as far as the national regimes already in existence, yet they are providing for a 'game changing' impact, which will impact the distribution and business models within the EU.

The most bespoken impact of MiFID II on the product placement in the EU is certainly the ban or repayment duty on inducements in case of 'independent advice' or discretionary portfolio management. Such ban does trigger a re-assessment of the post-MiFID II distribution models (i.e. fees, profitability and client segmentation), the product shelf (i.e. which products for which investor at which price) as well as the service level per client segment (i.e. independent advice or non-independent advice).