Insurance Distribution Directive

The Insurance Distribution Directive ("IDD") fully recasts the Insurance Mediation Directive ("IMD"), and introduces several significant changes and challenges, to the whole insurance distribution eco-system.

An integral part of regulatory changes impacting the financial services industry (e.g. PRIIPs, MiFID), the IDD will require all actors involved in the manufacturing and /or distribution of insurance products to review their business strategy, adapt their organisation, as well as rethink their future interactions.

It is important to bear in mind the minimum harmonisation character of the IDD, which will allow Member States to introduce more restrictive provisions. Manufacturers and distributors involved in cross-border activities, will not only need to ensure local compliance but also in all distribution's markets.

With the recent proposal to delay the application date of the IDD to 1 October 2018, one thing remains certain: there is less than a year to get ready and ensure compliance!

- Specificities of IDD transposition in Italy Read more

Insurance Distribution Directive (IDD): FROM WHAT IF TO WHAT AND HOW; part I

IDD, the internal audit perspective: how can Internal Audit perform a review of the IDD, and what questions it should be asking.

How we can help

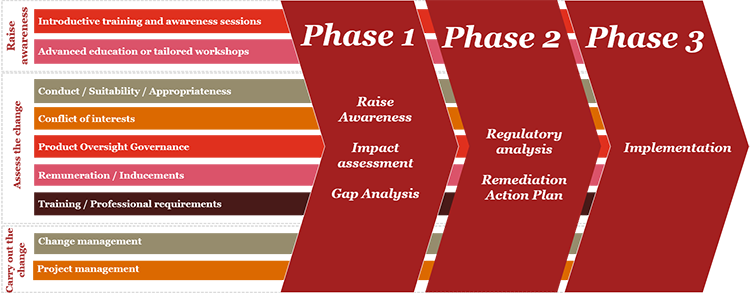

PwC can assist you at every step of your Insurance Distribution Project, and will gather the right experts for every aspect of your project, including from its extensive IDD international network.

Our flexible and modular approach will ensure you a tailored-made, efficient and cost-controlled delivery, according to your constraints, specificities and timeline.

IDD in a Nutshell

The IDD establishes new rules on insurance distribution and seeks to:

- Improve regulation in the retail insurance market and create more opportunities for cross-border business;

- Established the conditions necessary for fair competition between distributors of insurance products, for example, through an extension of the Directive to direct sales; and

- Strengthen consumer protection in particular with the regard to the distribution of insurance-based investment products (IBIPs).

Scope

- Insurance intermediaries

- Ancillary insurance intermediaries ("à titre accessoire" e.g. travel agencies, garage, etc.).

- Insurance undertaking with direct selling activities (including employees)

- Aggregators/price comparison websites

IDD Key items

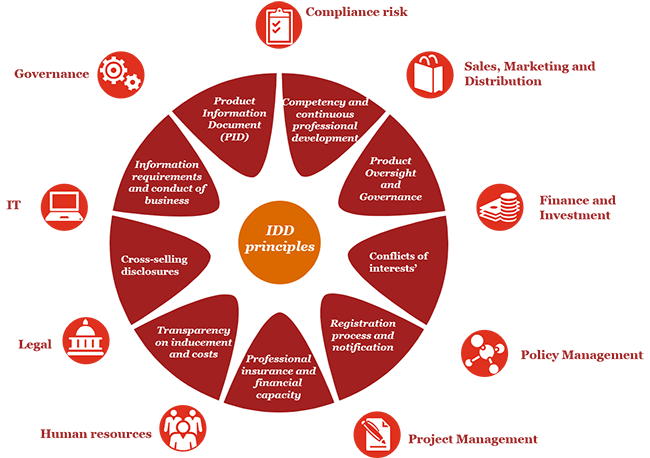

Competency and continuous professional development

will need to be ensured by all intermediaries and manufacturers’ employees involved in distribution, proportionally to the complexity of the products sold, as well as the distribution nature.

Product Oversight and Governance

requires insurers to set up and operate internal processes to make sure the products’ design, marketing and distribution strategy are adequately controlled and monitored before and after launch.

Conflicts of interest'

will now be subject to higher standards, (minimum measures to identify, prevent, manage and disclose these conflicts).

Registration process and notification

as well as cross-border activity provisions are included within IDD. All intermediaries have to register in the national register of their home country.

Professional insurance and financial capacity

requirements are clearly set in the IDD, which foresees a mandatory professional civil liability insurance for all intermediaries.

Transparency on inducement and costs

IDD, as a minimum harmonisation Directive, does not de facto prevent inducements. However, assessment of potential detrimental effect of inducements schemes needs to be undertaken and documented.

Cross-selling disclosures

will impose bundled products sellers to inform customers on the characteristics of each product's components (including costs and charges), and the possibility to buy each component separately.

Information requirements and conduct of business

have their roots in the principle that distributors must always "act honestly, fairly and professionally in accordance with the best interest of their customers". In this context, the assessment of appropriateness and suitability of the advice (when provided) has to be addressed cautiously.

Product Information Document (IPID) (non-life only)

Shall contain standard information on general/non-life products, provided to clients in the pre-contractual stage. The IPID has to be short, stand-alone, comprehensible, accurate and not misleading.

The whole organisation is impacted

Challenges are everywhere!

Product development

- Product design & testing (governance of products)

- Which market? Target market and justification (governance of market choice)

- Risk assessment on existing products / new products

- Suitability of products in light of costs impact and transparency of remuneration; net margin?

- (Re)education of distribution network and clients (market, segmentation of clients and type of products)

Market impacts (cross-border activities)

- Choice of market and/or distribution in light of "regulatory shopping"

- Enhanced competition in light of distribution strategies, clients & market segmentation

Operational impact

- Increased documentation burden

- Enhanced documentation (contractual and legal documentation to be revised: review of existing and new contracts)

- Training of sales work force (intermediary and direct)

- Management of larger volume of information: suitability of existing information systems, operational processes and storage

- Review compliance of marketing material

Timeline / Recent developments / Technical materials

Timeline

Recent developments

On 14 February 2018, EU ambassadors confirmed, on behalf of the Council, an agreement to delay the transposition deadline and application of new rules on insurance distribution. Read more

On 20 December 2017, European Commission has issued a legislative proposal to postpone the application date of the IDD, as well as the two Delegated Regulations to 1 October 2018. This will be enacted through an accelerated legislative procedure ("quick fix package").

Read more:

Technical materials

Directive text

- English version: Directive EU 2016/97 of 20 January 2016 on insurance distribution (recast) Read more

- Version Française : Directive UE 2016/97 du 20 janvier 2016 sur la distribution d’assurances refonte Read more

- Deutsche Fassung: Richtlinie EU 2016/97 vom 20. Januar 2016 über Versicherungsvertrieb (Neufassung) Read more

Delegated regulation

- information requirements and conduct of business rules applicable to the distribution of insurance-based investment products

- product oversight and governance requirements for insurance undertakings and insurance distributors