23rd Annual Global CEO Survey

Navigating the rising tide of uncertainty

In 2018, PwC’s Annual Global CEO Survey revealed a record level of optimism regarding worldwide economic growth. This year, as CEOs look ahead to 2020, we see a record level of pessimism.

What is clouding the view from the top? In a word, uncertainty.

PwC's 23rd Annual Global CEO Survey, which involved 1,581 chief executives in 83 territories, explores the sources and manifestations of uncertainty and how CEOs are taking action to address it. Conducted in September and October of 2019, this survey focuses on CEO insights in the following top-of-mind areas: growth, technology regulation, upskilling and climate change.

Learn more about your sector’s trends

The predictive power of CEO confidence

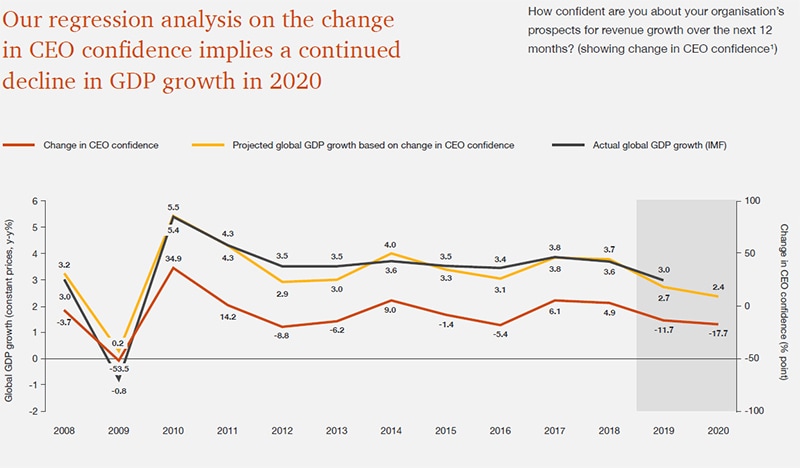

When we performed a detailed statistical analysis of survey responses dating back to 2008, we found that CEO attitudes are quite accurate in anticipating both the direction and the strength of the global economy. Specifically, the change in their confidence regarding their own organisation’s revenue growth prospects in the year ahead correlates strongly with actual global economic growth.

The orange line shows the change in 12-month CEO confidence based on our survey data, and the yellow line is the expected GDP growth rate we impute from that change.

Mapping this projected GDP growth rate (yellow line) against actual GDP growth (black line) recorded a year later reveals just how accurate this analysis has been in predicting global economic growth. Indeed, CEO revenue confidence can be said to be a leading indicator of global economic growth. Using this analysis, we estimate from this year’s survey responses that global growth could slow to 2.4% in 2020 - well below the October 2019 IMF forecast of 3.4%. (1)

(1) Gopinath, G., 2019. The World Economy: Synchronized Slowdown, Precarious Outlook, IMF Blog, https://blogs.imf.org/2019/10/15/the-world-economy-synchronized-slowdown-precarious-outlook

Source Image: PwC, 23rd Annual Global CEO Survey

We calculate change in CEO confidence by taking the change in the net balance percentage of CEOs answering ‘very confident’ or ‘somewhat confident’ minus the percentage of respondents answering ‘not confident’ or ‘not confident at all’ to the question: ‘How confident are you about your organisation’s prospects for revenue growth over the next 12 months?’

Note: 2019 global GDP data is from the IMF October 2019 forecast

Base: Global respondents (2020=1,581; 2019=1,378; 2018=1,293; 2017=1,379; 2016=1,409; 2015=1,322; 2014=1,344; 2013=1,330; 2012=1,258; 2011=1,201; 2010=1,198; 2009=1,124; 2008=1,150; 2007=1,084)

Key Results

In this year’s survey, four key themes emerged:

23rd Annual Global CEO Survey

Threats: Crossing uncharted territory

The general theme of uncertainty hindering progress moved to the fore in our survey’s ranking of threats to organisations’ growth prospects. Although over-regulation remained the top threat cited globally, CEO concern over uncertain economic growth surged from number 12 to number three. The other concerns registering prominently on CEOs’ radar are trade conflicts, cyber threats and policy uncertainty.

CEOs express increasing concern over uncertain economic growth, trade conflicts and other global disharmonies

Source image: PwC, 23rd Annual Global CEO Survey

1. ‘Increasing tax obligation’ was worded as ‘increasing tax burden’ prior to 2020

2. 2020 was the first year CEOs were asked about ‘tax uncertainty’

Base: Global respondents (2020=1,581; 2019=1,378)

Source: PwC, 23rd Annual Global CEO Survey

It is worth noticing that, although “availability of key skills” didn’t rank among the top five threats at global level, it remains top-of-mind. Indeed, Western Europe CEOs still consider it the fifth most worrying threat.

Similarly, although "climate change and environmental damage" is just outside the survey’s ranking of top ten threats globally, the share of CEOs citing it as an ‘extreme concern’ rose from 19% to 24% and, to Western Europe CEOs, it ranked 10th.

Uncertainty undermines outlook

In the survey, CEOs express a record level of pessimism regarding the global economic outlook in 2020, with 53% projecting a decline in the rate of global economic growth, up sharply from 29% last year. The number of CEOs who believe global economic growth will improve in 2020 dropped by a record share, from 42% to 22%.

Although the reversal is dramatic, CEOs’ outlook is consistent with most economic forecasts as the global economy heads into its 11th year of expansion.

To learn more, download the 23rd Annual Global CEO Survey here.

I look at the pace of change; I look at the uncertainty in geopolitics; I look at the massive dislocation and rearrangement of global supply chains - there's no way anybody can predict what’s going to happen in five years... The uncertainty we see today is unprecedented in the last 40 years. As a result, it’s taking growth out of the global economy.

Setting up guard rails in cyberspace

Technologies that leverage big data - artificial intelligence (AI), robotics, the Internet of Things (IoT) - and bring the physical and digital spheres together are now propelling the Fourth Industrial Revolution.

The private sector’s implementation of these innovations is outpacing the development of regulatory systems and standards to mitigate their risks.

Silicon Valley introduced the notion that more data was better, that data was an asset. What we’re saying is that personal data is actually a liability. People are placing it on the wrong side of the balance sheet.

The debate rages on as to whether governments should adapt their existing frameworks to emerging standards, or draw new boundaries on data privacy, content moderation, and the size and reach of dominant platforms (e.g., Facebook, Google, Amazon, Apple).

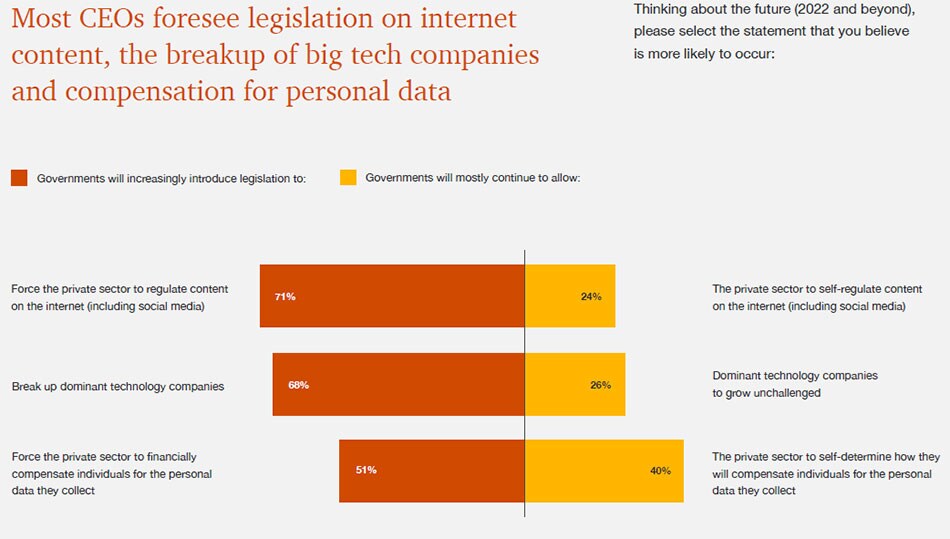

This year, we asked CEOs to think about the future (2022 and beyond) and select from a series of opposing statements on whether and where they thought governments would intervene in regulating the technology sector. Nearly seven out of ten CEOs see the government increasingly introducing legislation in two areas: (1) to regulate content on the internet (including social media) and (2) to break up dominant tech companies. Interestingly, a majority foresee the government compelling the private sector to financially compensate individuals for the personal data they collect.

Data privacy has been headline news and high on regulators’ priority lists. Inspired by the EU’s General Data Protection Regulation (GDPR), now close to two years old, governments are formulating their own guidelines on the use and flow of personal data. For example, the California Consumer Privacy Act (CCPA) and Brazil’s General Data Protection Law (LGPD) take effect in 2020. And other national and local governments are contemplating their own legislation.

To upskill? That’s no longer the question

PwC’s own analysis of more than 200,000 jobs in 29 countries15 argues that 30% of jobs are potentially subject to automation by the mid-2030s, and that workers with lower education levels will be hardest hit initially.

The Fourth Industrial Revolution has ushered in new business models and new ways of working that require critical new technical, digital and soft skills. Those skills are in very short supply. Indeed, the availability of key skills has been a top ten ‘extreme concern’ for the last decade, impeding innovation and prompting higher people costs (1). Businesses cannot hire their way over this skills gap at a price they can pay, so the imperative is clear. Employers and employees must join hands and invest in upskilling or risk irrelevance.

If you look at our known history, since the invention of agriculture, we’ve been trapped in repetitive work. And I think now we are on the verge of reversing this cycle. Automation technology will free people from doing work they don’t enjoy, because nobody likes to plow the fields, and nobody likes to do the jobs that we can automate. My biggest concern is what are people going to do if they don’t have work to do? Because work has a fantastic positive effect on people; it gives us a sense of purpose.

The supply of people possessing STEM (science, technology, engineering, math) skills and the uniquely human skills (e.g., creativity, empathy, collaboration) increasingly prized in today’s job market cannot keep up with demand.

In last year’s survey, the majority of CEOs agreed that significant retraining/upskilling was the most important way to close a potential skills gap in their organisation. Yet this year’s survey reveals that globally, fewer than one in five leaders (18%) believe their organisation has made ‘significant progress’ in establishing an upskilling programme.

However, there is good news! Across the board, organisations that have made the most progress in upskilling are achieving better business outcomes, including a stronger corporate culture, higher workforce productivity, greater business growth, improved talent acquisition and retention, greater innovation, and reduced skills gaps and mismatches.

One thing is true. business leaders alone cannot solve the global talent and skills crisis the world now confronts. It will take the concerted efforts of educators; national, regional and local governments; technology innovators; and the business community to ensure that people around the world stay productively engaged in meaningful work. For now, though, the 2019 Edelman Trust Barometer showed that in these uncertain times, when people have lost trust in institutions, ‘my employer’ is emerging as the most trusted entity of all (2).

(1) PwC, 2019. 22nd Annual Global CEO Survey: CEOs’ curbed confidence spells caution, https://www.pwc.com/gx/en/ceo-survey/2019/report

(2) 20. Edelman, R., 2019. Trust at Work, Edelman, https://www.edelman.com/insights/trust-at-work

Climate change: an opportunity cloaked in crisis

Today, there is general consensus among climate scientists that human activity, in addition to natural factors, contributes to climate change(1). We are seeing more frequent and intense extreme weather events, changing patterns of rainfall and drought, damaged communities and ecosystems, and rising sea levels.

As CEOs try to navigate disruptive weather impacts, fractured climate policy, rising expectations from the public and the demands of remaining competitive, they are facing a higher level of climate-induced uncertainty. 24% share of global CEOs who are “extremely concerned” about climate change and environmental damage, a 25% increase compared to 2019.

(1) National Aeronautics and Space Administration (NASA), 2019. Scientific Consensus: Earth’s Climate is Warming, https://climate.nasa.gov/scientific-consensus/

I think about climate change very differently. I look at it as the impact on the economies as a result of climate change, as opposed to the environment. For example, if you’re running Nigeria today, you should definitely have a plan for when oil goes away. We’re not planning enough, nor are a lot of other countries.

In general, CEOs in Western Europe and Asia-Pacific report being furthest ahead in assessing the risks of climate change initiatives, which is not surprising given that many governments that have committed to net-zero emissions by 2050 are located in these regions.

Investing in climate change

Compared with a decade ago, when we last asked the same question, global chief executives are twice as likely to ‘strongly agree’ that investing in climate change initiatives will boost reputational advantage among key stakeholders, including employees (30% strongly agreed in 2020 compared with 16% in 2010), and afford significant new product and service opportunities (25% in 2020 compared with 13% in 2010). And nearly three times as many (14% in 2020 compared with 5% in 2010) agree they will benefit from government funds or financial incentives for ‘green’ investments.