Six statements and five charts about tax controversy in Luxembourg

In brief

Taxpayers are confronted with uncertainty in a complex tax world. Like in many other countries, the Luxembourg tax landscape has shifted from a realm of certainty (often captured in a tax ruling) to a territory of tax risk management (sometimes ending in a tax dispute with tax authorities). The combination of sophisticated tax rules, the lack of clarity in their interpretation, the significant amount of tax-related information exchanged between tax authorities on a national and international level, and the pressing need for governments to collect additional revenues inevitably leads to significant uncertainty when it comes to the assessment of tax risks.

This article gives a short overview of the current tax controversy landscape in Luxembourg. It reflects the statistical and practical experiences from past years. Taxpayers may be hopeful that the appointment of a new head for the direct tax administration who takes office in May 2024 will bring a new wind of increased collaboration. In October 2024, a new head will also be appointed for VAT administration. The current head of VAT administration announced his retirement. It remains to be seen how these new winds will change the Luxembourg tax landscape. Hopes are high!

In detail

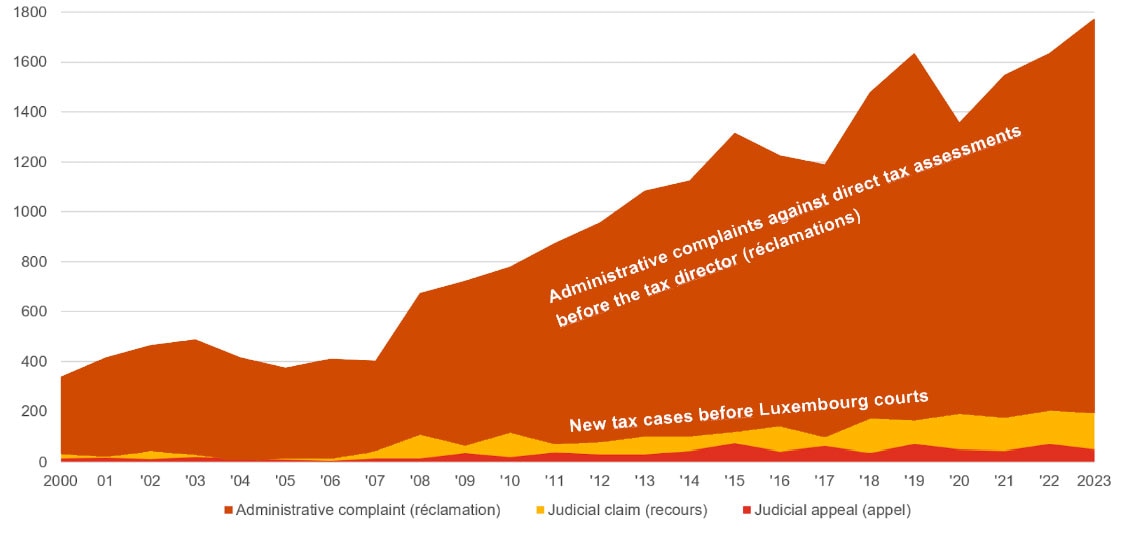

The number of tax disputes increased steadily over the past years. This trend is expected to continue in the future.

Looking at the annual reports from the Luxembourg direct tax authority (Administration des contributions directes), there is a clear and steady trend towards more tax disputes:

Source: PwC Luxembourg

The already high number of administrative complaints against tax assessments is likely to increase in the future. Complex tax legislation has been implemented in the last couple of years, like the Anti-Tax Avoidance Directives (ATAD 1 and ATAD 2) with rules on exit taxes, controlled foreign companies, interest limitation rules and hybrid mismatch rules. These set of rules took effect in 2019 and given the complexity of these rules many uncertainties remain regarding their implementation, in Luxembourg and other countries. Tax disputes about the interpretation and application of these rules locally and cross-border can thus be expected in the not-too-distant future. This is because the tax assessments for 2019 must be issued by the Luxembourg tax offices before the end of 2024 to meet the prescription period. In other countries the process may take even longer with the result that potential double taxation will only emerge in a few years’ time.

And since 1 January 2024, the global minimum taxation for multinational enterprise groups (a.k.a. Pillar 2) is a new reality. This highly complex tax legislation provides plenty of material for more tax disputes in the future, in Luxembourg and worldwide.

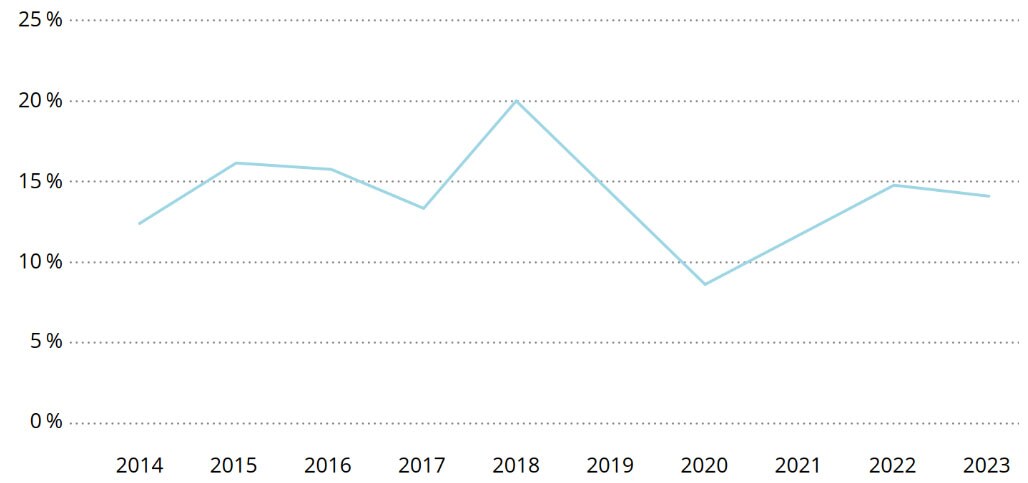

It is important to note that only a small number of disputes finally end up in Luxembourg courts. Looking at the annual reports of the direct tax authority, around 15% of the cases where a “réclamation” (claim) was lodged with the tax director ending up in court:

% of administrative decisions appealed to the Administrative Court

Source: Activity report 2023, Luxembourg direct tax authorities, page 135

Luxembourg courts are preparing themselves for an increase of the already high number of judicial claims and appeals in direct tax matters. Last year the administrative tribunal set up a new, fifth chamber which is supposed to deal with direct tax cases. The courts are also recruiting new judges, with a focus on talents specialised in tax law.

Tax disputes in Luxembourg are becoming more complex

The current disputes with the Luxembourg direct tax authority are varied in terms of technical focus and can cover items including branch exemptions, dividend distributions, impairments and expenses.

In a recent landmark case, the administrative court analysed a securities lending transaction and concluded that the lending party was no longer the legal nor economic owner of the loaned shares. In the final decision, Luxembourg judges took guidance from German case-law and tax circulars, referred to accounting rules in Belgium and France, analysed the contracts under Luxembourg civil law and also considered the EU directives underpinning the Luxembourg participation exemption regime. This case illustrates the high complexity of current tax disputes in the financial sector, not only as regards the facts of the case, but also with regard to the multiple layers of Luxembourg, international and European tax legislation.

Tax disputes are taking more time to be solved

The Luxembourg administrative courts were set-up in 1997. Over the period of the last 27 years it took on average 12 months to obtain a judgment (i.e. from the filing of the claim with the court until the judges render their judgment). In the last four years, however, this duration extended to 17.4 months. So, it will probably take 1.5 years if taxpayers lodge a claim today with Luxembourg courts in direct tax matters until they receive a final court decision.

There is one exception: For cases dealing with requests for the exchange of tax information, a fast-track procedure has been implemented. Taxpayers are increasingly confronted with orders to provide information under the threat of a penalty of up to EUR 250,000 (so-called ‘décision d'injonction’). Often, full disclosure of confidential documents, such as board minutes, employment contracts or bank statements, are requested and must be submitted within a deadline of one month to the Luxembourg tax authority which will forward this information to the requesting foreign tax authority. Typically, this exchange of information is requested by foreign tax authorities in the course of a tax audit. Luxembourg is obliged to comply with these foreign information requests under the international framework of administrative cooperation. So as not to delay this administrative cooperation for too long, the court case must be decided by the Luxembourg judges in the first instance within three months. An appeal with the administrative court must be lodged within 15 days and the final judgment must also be delivered within three months.

Luxembourg authorities and courts take a formalistic approach to tax disputes

Often, cases are dismissed by the tax director or the judges because of missed deadlines, missing signatures or other formal or procedural mistakes, like unclear proxies or poor evidence.

By law, the tax director and the judges are required to analyse in a first step whether a legal remedy is admissible, whether it has been lodged on the right form and whether it was filed within the legal deadline. Only if remedies meet these formal hurdles, the tax director and judges will in a second step look into the merits and substance of the case.

There is a high risk that taxpayers, especially those that are not advised by tax experts, lose their case simply on formal and procedural grounds.

The formalistic approach of the tax authorities and courts may not only be explained by the methodology prescribed by law. It is also due to the fact that the procedural law is very stable. The procedure to challenge direct tax assessments in front of the tax director derives from the Abgabenordnung from 1931. The procedure for tax litigation in the administrative courts dates back to 1999. It was only changed four times, but very little. And for VAT, the procedure goes back to the year 1979. Over time, the authorities and courts have a built up a huge expertise in this domain of procedural law. On the other hand, the tax law changes every year. Our latest PwC Flash News from December bear witness to that:

- Vote of the law amending the personal income tax scale

- Vote of the law for the implementation of Pillar Two minimum taxation rules in Luxembourg

- Vote of the new Luxembourg investment tax credits regime to accelerate sustainability transformation

- The new Luxembourg government releases its coalition agreement

Confronted with ever-changing tax laws, the tax authorities and the courts have a natural tendency to sidestep technical discussions about the application and interpretation of new tax rules. Quite naturally, the case handlers are more inclined to dismiss a legal remedy on formal and procedural grounds.

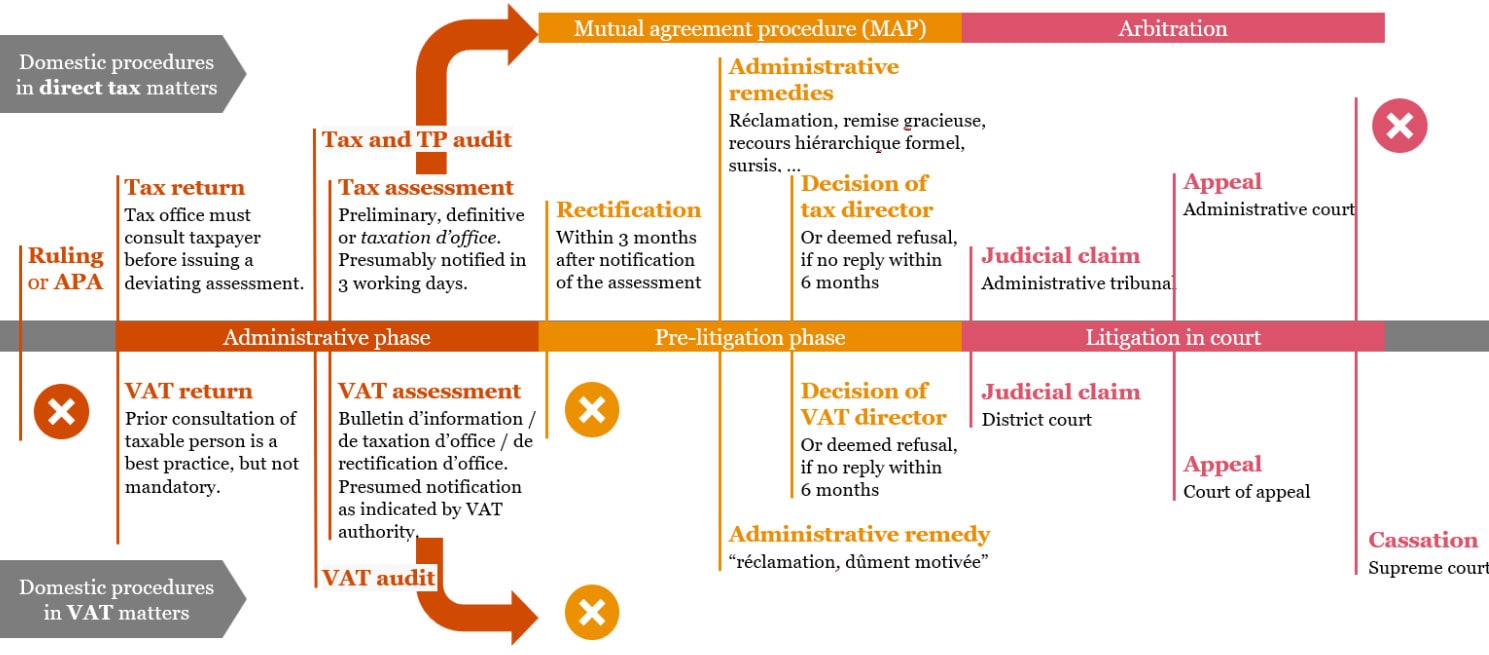

The tax dispute resolution processes in Luxembourg are still paper based and analogue

The tax compliance process in Luxembourg is to a certain extent digital. Corporate and individual taxpayers can file direct tax returns online on the guichet-platform. This is also standard for VAT returns.

The tax dispute resolution mechanism, however, is still paper based in Luxembourg. Most disputes start with a letter and often end with a letter.

Tax assessments are printed on paper and sent by post. Tax audits are notified in a letter. If taxpayers want to challenge the assessment or tax audit notice, they will have to send a letter to the tax authorities. Telefax is also an option, provided that this old technology is still available. Administrative complaints (réclamation) should not be sent by email: The complaint would be rejected as inadmissible due to a formal deficiency. The complaint must be filed on paper with the tax director, and this letter must arrive at the offices of the tax director before the end of the three-month deadline. The decision of the tax director on the complaint will also be notified in a (registered) letter, and the litigation in court is running fully on paper (except for urgent cases of interim legal protection).

So, it is crucial that taxpayers put in place the right controls and functions to ensure that letters from the tax authorities are well received, quickly reviewed and, if required, properly challenged within the time limits. These controls and functions start with the reception at the office. The receptionist or facility management must open, scan, save, forward and archive the letters from the tax authorities. The tax function should then take the necessary steps to review and reconcile the assessments with the return. And, if necessary, initiate the pre-litigation phase by preparing and filing a complaint within three months after receipt of the assessment.

Source: PwC

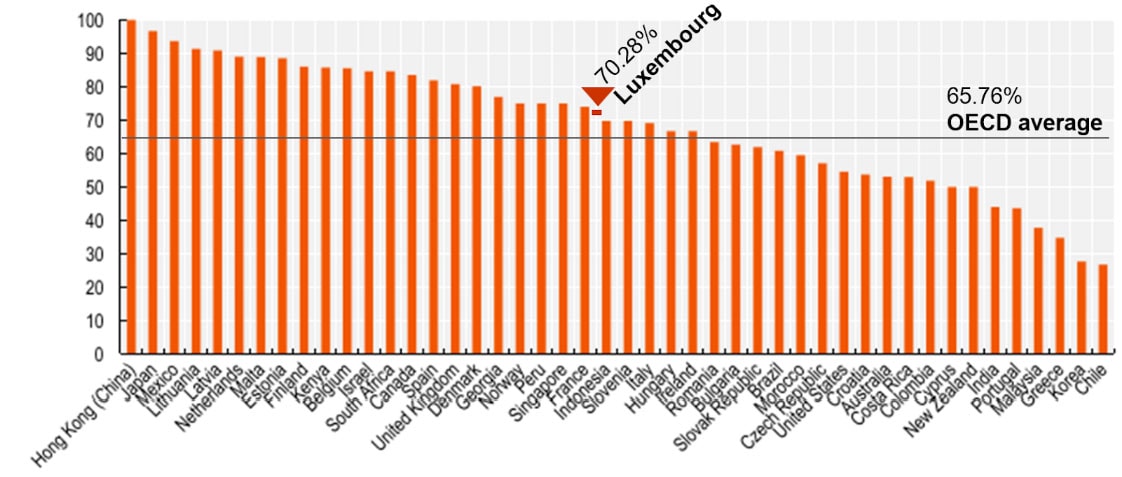

The success rate for taxpayers in the Luxembourg courts is in line with the OECD average

In January 2024, the number of direct tax cases that have been decided by the Luxembourg administrative courts amounted to 2,997. This impressive number includes cases about corporate income tax, municipal business tax, net wealth tax, double tax treaties, withholding taxes, exchange of information upon request, tax penalties for non-compliance with FATCA rules or personal liability cases of management for corporate taxes. According to data from the OECD, in the year 2021 tax administrations in the OECD member states were successful in more than 50% of the issues contested in court. Here, Luxembourg takes a middle place with a success rate for the Luxembourg direct tax administration of 70.28%.

Source: OECD, Tax Administration, 2023, page 127 (with annotations by PwC Luxembourg)

So, in three out of 10 cases in the year 2021, Luxembourg taxpayers won in court. This low success rate for taxpayers in the courts may seem discouraging, even deterring. However, there are various explanations for this. In contrast, for international tax disputes and particularly for cross-border transfer pricing cases, the mutual agreement procedure (MAP) is a good alternative to tax litigation, where international instruments can be invoked. According to the latest MAP statistics from November 2023, the success rate was 88% for Luxembourg taxpayers:

Next steps

More than ever, a robust tax governance is needed. If taxpayers adopt a solid tax risk management to identify and anticipate tax risks, this will reduce the likelihood and intensity of tax audits and inquiries from tax authorities. Tax controversy should then no longer constitute a high risk.

Today, not only direct taxes (e.g. income and business tax), withholding taxes and indirect taxes (like VAT and subscription tax) require effective risk management. Transfer pricing, automatic exchange of information (FATCA and CRS), transactional reporting for EU payment service providers (CESOPS) should also be included into tax risk management nowadays.

Financial institutions without a solid tax risk management are more likely to be exposed to risks of increased tax liabilities (e.g. due to estimated assessments), penalties (e.g. due to late filing of returns), missed opportunities (e.g. non-application for tax credits) and reputational damage towards shareholders and stakeholders, including the tax authorities. Operational problems in responding to inquiries from the tax authorities in a timely and accurate manner may lead to reputational issues and negatively impact the working relationship with the tax authorities.

Therefore, we recommend having a well-managed tax control framework consisting of:

A strong tax governance with an agreed strategy;

A clearly defined strategy for the communication of the tax risk management process internally and externally;

An in-depth understanding of where tax risks lie within the business with effective and efficient controls in place to mitigate identified risks;

Ongoing monitoring activities in relation to the key tax controls.

These recommendations will also allow compliance with the Commission de Surveillance du Secteur Financier (CSSF) circulars relating to AML and tax crimes. Moreover, it allows compliance with the new requirement from the CSSF which launched a data collection exercise on sustainability-related disclosures (SFDR) to be reported by investment funds and institutions for occupational retirement provisions. Finally, in the context of the EU Corporate Sustainability Reporting Direcitve (CSRD) and the EU Taxonomy it is noted that companies are required to indirectly report on tax risks and tax governance.