Applying for the new Luxembourg investment tax credit regime

In brief

On 22 December 2023, Luxembourg Parliament voted to approve bill n°8276 (hereafter “the Law”) revamping the investment tax credits available under article 152bis of the Luxembourg Income Tax Law (“LITL”). The aim of the Law is notably to support Luxembourg companies in their digital and ecological/energetic transformation.

The Law entered into force as from fiscal year 2024 (i.e. financial year closing on or after 1 January 2024).

For details on the provisions of the new Law, please refer to our previous PwC Flash newsletters posted on 20 November 2023 and 22 December 2023.

As a reminder:

- The existing 13% for the additional investment tax credit is fully repealed; and

- The existing tax credit for global investment remains in place through existing Form 800 but with an increased rate reaching now 12% and a repeal of the EUR 150,000 threshold.

Our article focuses here on the introduction of a 18% tax credit for investments and operating expenses connected with digital and ecological transformation.

In detail

Article 152bis LITL has been amended to extend the scope of the investment tax credit regime to investments and operating expenses related to digital transformation and/or green transition projects.

In short:

The Law is applicable as of January 2024.

It focuses on ecological and energy transition as well as on digital transformation stemming from substantial process and organisational innovations supported by technology.

Introduction of a 18% tax credit for investments and operating expenses connected with digital and ecological transformation (“the DET tax credit”).

For investments qualifying in tangible depreciable assets, the DET tax credit will be limited to 6% considering that these assets are expected to benefit from the 12% tax credit for global investment, hence reaching the expected 18% tax credit overall.

Investment and expenses have to be made/incurred by Luxembourg taxpayers while the associated projects can be implemented anywhere in the European Economic Area.

Multi-annual (up to 3 years) projects are eligible.

Eligible investments and expenses are those made/incurred after the filing of the application for the Eligibility Attestation.

An application process based on an Eligibility Attestation and an Annual Compliance Certificate needs to be completed.

The DET tax credit would be creditable against the corporate income tax due for the relevant fiscal years and can be carried forward on 10 subsequent years.

The DET tax credit should not be eligible as qualified refundable tax credits under the Luxembourg Pillar II rules. As such, the tax credit will reduce the effective tax rate for Pillar II purposes.

Luxembourg taxpayers from the financial sector, such as banks, may benefit from the DET tax credit. Such taxpayers may take the opportunity of this new tax incentive to develop their digital transformation “on the outside” by the use of new/emerging technologies that enable improvement of customer experience (e.g. remote transactions, digital payment, service centre and bots, steering activities through customer journeys, customer services and self-service, cybersecurity, cloud security, data and accesses, etc.). Innovation “on the inside” is also a key element for the banking industry and could lead to DET tax credits (e.g. new ways of working, core systems transformation, process automation and innovation, etc.).

Therefore, taxpayers operating in the financial sector have an interest in assessing whether current or future projects may be eligible for the DET tax credit.

What is Digital Transformation?

Digital transformation involves integrating digital technology into all aspects of a business, fundamentally changing how it operates and delivers value to customers. Digital transformation is a holistic process by which a company integrates digital technologies to rethink its operational and organisational model as a whole. This involves the implementation and use of digital technologies, including new and innovative digital technologies such as (indicative list) artificial intelligence, big data, internet of things, blockchain technologies, cloud technologies, supercomputers, cybersecurity, as well as augmented reality and virtual reality technologies.

Digital Transformation key aspects:

Technological integration: Utilising advanced technologies and software like Enterprise resource planning, Cloud, Artificial Intelligence, Internet of Things, Big Data, and blockchain to enhance operations.

Cultural change: Encouraging innovation and adapting to a digital-first mindset.

Customer experience: Improving engagement and personalisation through digital channels.

What is Green Transition?

Ecological transition refers to the comprehensive shift in a company’s operations and strategies towards sustainability and environmental responsibility. Green Transition is not just about compliance, but about seizing opportunities for innovation and long-term growth in a world increasingly focused on sustainability.

Green Transition key aspects:

Sustainable practices: Adoption of processes that reduce environmental impact, such as waste reduction and energy efficiency.

Renewable energy: Transitioning to green energy sources like solar, wind and hydro power.

Circular economy: Emphasising the reuse and recycling of materials to minimise waste.

Exclusions from the DET tax credit

The following items are not eligible to the DET tax credit:

Assets that are depreciable over a period of less than three years.

Automotive vehicles.

Investments and operating expenses aimed at bringing the company into compliance with obligations arising from legal and/or regulatory provisions.

Eligible investments and operating expenses

The scope of eligible investments and expenses is broad and covers the following items:

Investments in tangible depreciable assets other than buildings, live agricultural livestock and mineral and fossil deposit;

Investments in software or patents and expenses incurred for the use or the right to use patents or software (i.e. licence fees), other than those acquired from or granted by a related company;

Expenses for consulting, diagnostic and technical support services provided by external providers that are not related to the company’s normal operating expenses (e.g. recurrent tax or legal advisory services or advertising expenses);

Personnel expenses directly assigned to the company’s digital transformation or ecological and energy transition;

Training expenses for personnel directly assigned to the company’s digital transformation or ecological and energetic transition.

Obtaining the clearances from the Ministry of Economy

An application file is required to be completed and sent to the Ministry of Economy to obtain the Eligibility Attestation. Taxpayers applying for the DET tax credit must disclose the following information in the Eligibility Attestation application form:

Name and description of the company

Description of the project

Project location

Target objective according to §4 requirements (article 152bis LITL)

Elements to measure the achievement of the project

List of the people involved in the project,

Start and end dates of the project's implementation (not exceeding three consecutive operating fiscal years)

Implementation stages,

List of investments and operational expenses required, classified according to §4 classification (article 152bis LITL),

Financing plan,

Relevant elements to assess project qualities or specificities and expected effects,

Etc.

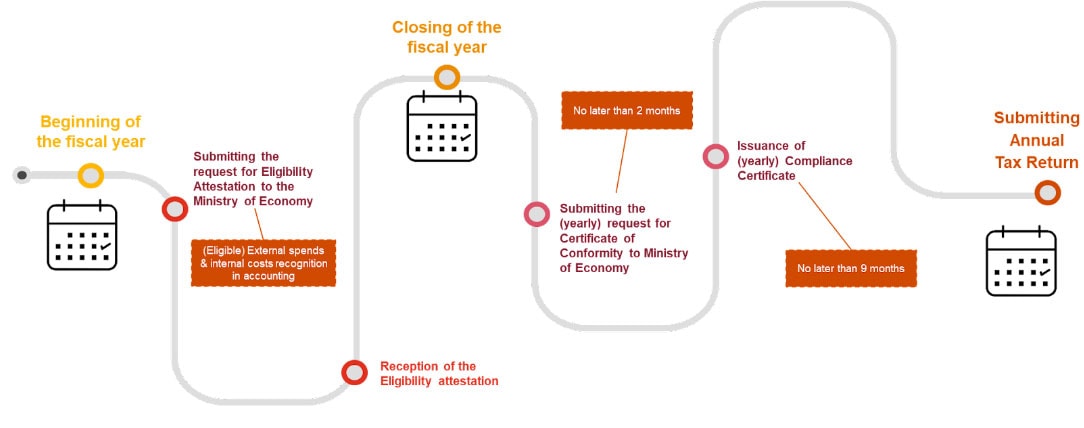

In addition, an annual Compliance Certificate must by applied for within two months following the fiscal year end. The information required to obtain such a certificate is as follows:

Supporting documents (e.g. invoices) detailing investments/operational expenses effectively made/incurred during the period.

Additional information and documents that might be specified by Grand-Ducal Decree.

The request must be submitted for each fiscal year during which investments or operational expenses have been carried out and granting of a tax credit is requested.

Next steps

Below are the recommended steps for applying for the DET tax credit:

Kick-off: Begin by reviewing the project portfolio in order to gain a broad understanding of the potentially eligible projects. Analyse these projects to identify features that enhance their eligibility prospects.

Drafting the Eligibility Attestation application: Prepare the application for the Eligibility Attestation for selected projects, including compiling all relevant supporting documentation. Submit the application to the Ministry of Economy. This step triggers the eligibility of costs for the DET tax credit.

Lifetime of the project: Establish project governance to evaluate the project's progress, ensure alignment with the disclosures in the Eligibility Attestation application and decide on potential corrective measures in case deviations (including proactively notifying the Ministry of Economy of any such deviations). Additionally, this phase could involve preparatory tasks (e.g. collecting and reviewing invoices, contracts, timesheets, etc.) for the upcoming phase.

Drafting the annual Compliance Certificate application: File the application for the annual Compliance Certificate, along with compiling the necessary supporting documents.

Preparation and Filing of Annual Corporate Tax Return: Finally, prepare and submit the annual corporate tax return, requesting the application of the DET tax credit. Ensure that the Compliance Certificate is included in the filing.

Recommendations

As mentioned in our previous Flash newsletters, timing is a key element when considering applying for the DET tax credit. Only investments made/expenses incurred after the request for the Eligibility Attestation will be eligible for the Investment Tax Credit (i.e. not the starting date of the Digital Transformation/Green Transition project). The Eligibility Attestation submission form available contains 10 pages of questions that can be very wide-ranging and require extensive and depth description of the project.

The DET tax credit is welcomed by the financial sector and the number of requests to the Ministry of Economy will increase considerably over the coming months. We therefore encourage the development of a structured approach to reviewing and assessing eligible projects, so as to not lose eligible investment made and expenditures incurred for the DET tax credit.

Contact us

Nenad Ilic

Tax Partner, Banking & Capital Markets Tax Leader, PwC Luxembourg

Tel: +352 62133 24 70