Challenge: A leading Alternative Investment Management Company faced the challenge of deploying an AML/CFT governance framework that would remain aligned with the financial targets while ensuring effective compliance with relevant legislative requirements in Luxembourg.

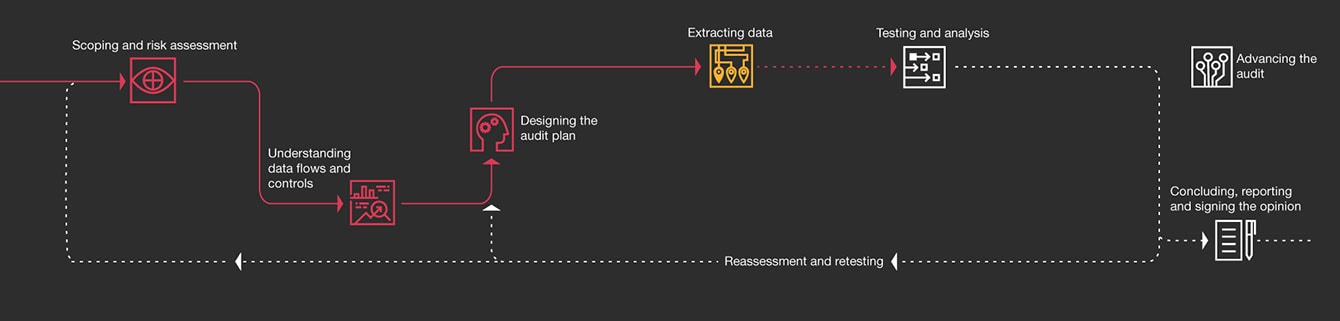

Solution: PwC Luxembourg has deployed a dedicated team of AML Subject Matter Experts, providing year-round support to the RC of the Funds managed by the AIFM, involving the review, development and execution of the full set of regulatory required policies, procedures and controls, across the Funds, their investors, assets and delegates. The RC of the AIFM directs the PwC team and maintains controls.

Benefits: The AIFM effectively benefitted from the structured and comprehensive AML/CFT framework deployed across the whole population of Luxembourg Funds, increased coherency in the procedural and operational dimensions, significant decrease in the control’s execution timing through the integration of the digital solutions as well as an exhaustive reporting setup, tailored to the specific responsibilities and needs of the stakeholders.