Luxembourg Limited Partnerships

With the improved Luxembourg limited partnership regime and the Luxembourg special limited partnership and its legal arsenal of investment vehicles dedicated to the alternative investment industry, Luxembourg offers state-of-the-art solutions as a fund jurisdiction to alternative investment funds operations, to alternative investment fund managers and promoters in general.

This publication summarises the main legal, accounting, valuation and tax rules pertaining to both regulated and unregulated Luxembourg limited partnerships and Luxembourg special limited partnerships.

Alternative investments in Luxembourg

Source: Preqin data, based on domiciles for PE, RE, Infra and Debt funds – 2024

Thanks to its efficient and flexible tax and legal environment, Luxembourg has become the preeminent jurisdiction for structuring Alternative Investments Funds (AIF), private market deals as well as for Alternative Investment Funds Managers (AIFM). All strategies are represented in the country: Private Equity (PE), Private Debt (PD), Real Estate (RE), Venture Capital (VC) or infrastructure.

Following the entry into force of the Alternative Investment Fund Manager Directive (Directive 2011/61/EC - AIFMD) in Europe, and the general trend for more regulation and investor protection in the alternative investments industry, Luxembourg is now regarded as one of the primary jurisdictions for re-domiciling (unregulated) offshore funds and setting up a Europe-based AIFM.

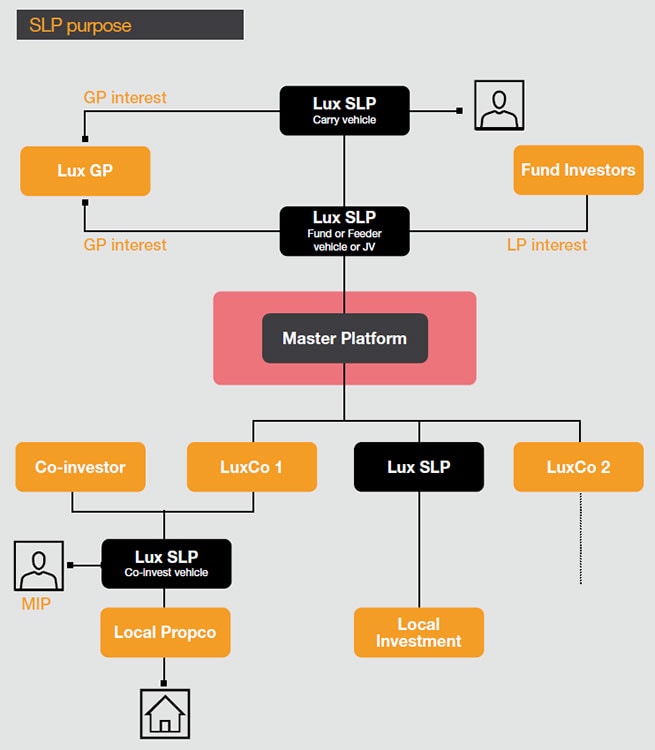

The Lux SLP, a multi-purpose vehicle

The SLP is a legal form that aims at extending the range of legal solutions available in Luxembourg for structuring both alternative investment funds, and dedicated vehicles to the alternatives industry. It may be used as a fund vehicle, either regulated (SIF, RAIF or part II UCI) a joint venture, a co-investment vehicle, a carry vehicle, or an acquisition vehicle... Indeed, the only limit may be the imagination.

Legal features of the Lux LP and Lux SLP

The corporate features of the limited partnership regime are set out by the amended law of 10 August 1915 (the Company Law).

There exist two types of partners in a Lux LP or Lux SLP: the ‘limited partners’, whose possible responsibility is capped at the amount of their commitment (the LPs), and the ‘unlimited partners’, who can be liable without limitation for the debts of the partnership that cannot be met out of the assets of the partnership (the GPs).

The main legal feature of the Lux LP and Lux SLP is contractual freedom. Most of the rules governing the Lux LP or Lux SLP may be freely determined in the partnership agreement, as is generally the case for Anglo-Saxon LPs.