The age of generative AI

Use of Data Analytics and Artificial Intelligence in Luxembourg - 2023 edition

2023 has been a formidable year for AI. Elaborated reports with a single click, studio quality photographs with a simple text query – we are truly living in the age of generative AI. Luxembourg’s companies are already investigating the use of this technology as part of their broader strategy around Data and AI.

PwC Luxembourg has conducted the third edition of this study to generate insights on the use of Data & AI technologies in Luxembourg. Our last study in 2021 highlighted how Luxembourg is increasingly data-driven, while facing a challenging talent and investment landscape. Things are progressing at astonishing speed. With new EU Regulations expected in the summer of 2023 and the explosion of generative AI solutions on the market, the time is right to look at this topic again.

The study also keeps on tracking the maturity in Data and Analytics of Luxembourg’s organisations, including the most common applications and challenges that they are facing in 2023. Thanks to an increased rate of respondents, we are now able for the first time to capture data from organisations in Banking, Asset & Wealth Management, Public Sector, Insurance and Operational sectors. We are also for the first time, collecting their opinion and wishes regarding the European AI Act, and how they see generative AI impacting our country.

Opportunities and risks of Europe’s AI legislation

The European AI Act is largely still an unknown or less-known factor in Luxembourg’s companies. Our survey revealed that only 12% of respondents felt well informed about it.

Interestingly, most respondents agreed that the European AI Act would facilitate innovation, indicating that businesses view the regulation as an opportunity to promote responsible AI development and create new growth opportunities. However, they also are of the opinion that it will increase requirements and cost of compliance.

What is your level of awareness on the upcoming European AI Act?

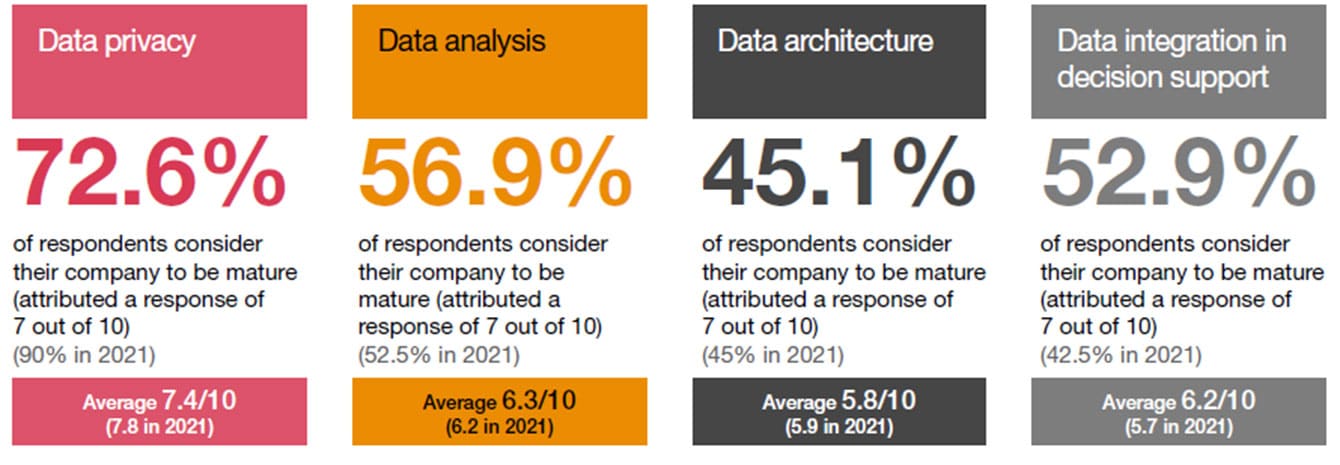

The current state of Data Governance in Luxembourg

Our survey found that the level of maturity of data governance practices in Luxembourg remained roughly the same as in the previous year. This indicates that the maturity of data governance is still relatively low and has seen little progression in the last two years.

On a scale of 1 to 10, how would you rate your company in terms of maturity with regards to…

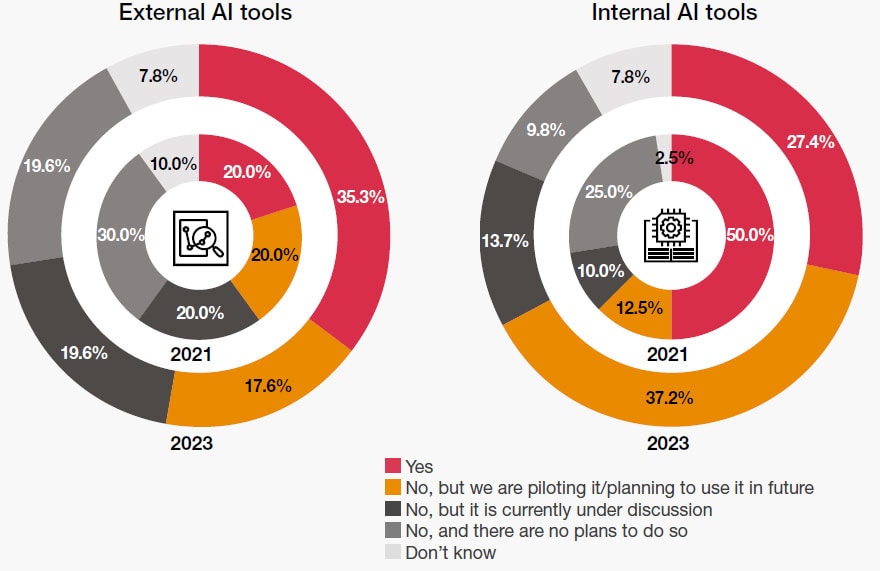

Are you currently using external AI tools (e.g. DeepL for translation, Ephesoft Transact for document analysis) or internally developed AI tools (e.g. self-developed machine learning algorithm with Python) in your company?

Increased maturity of the AI market

The market for AI is constantly evolving, with new tools and technologies being developed all the time.

One of the key findings of the survey is that external AI tools are more commonly used. In 2021, only 20% of organisations surveyed reported using external AI tools, while in 2023 this figure increased to 35%.

In contrast, the use of internal AI tools decreased from 50% in 2021 to 27% in 2023. This suggests that organisations are increasingly relying on external AI tools to meet their needs, rather than developing their own in-house solutions, as the market for those solutions has become more mature.

The age of generative AI

Which AI technologies are you using or would like to use?

The survey found that the current hype around generative AI is only partially translating into interest among Luxembourg’s companies. Specifically, 27% of respondents indicated that they would be interested in using generative AI for text generation, while only 4% expressed interest in using image generation or other forms of generative AI.

This is not surprising, as there are numerous open topics around the trustworthiness and compliance of the applications, as well as discussions of lawmakers on their regulation in Europe. Despite the current hype, Luxembourg’s organisations will need to investigate and experiment further.