Set-up / licencing

The first step to enter the PFS world.

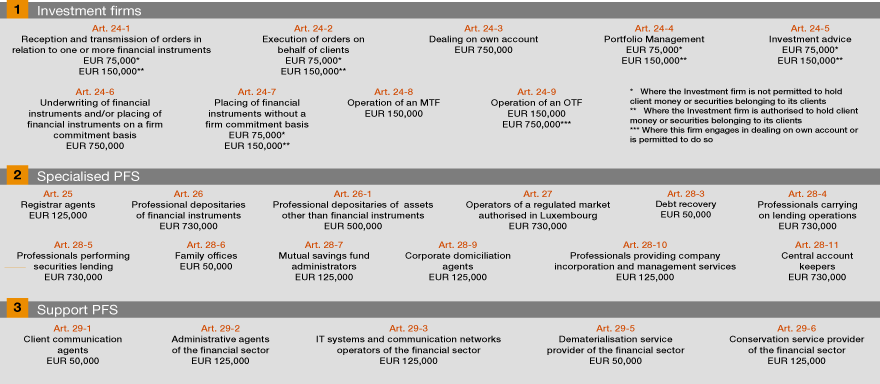

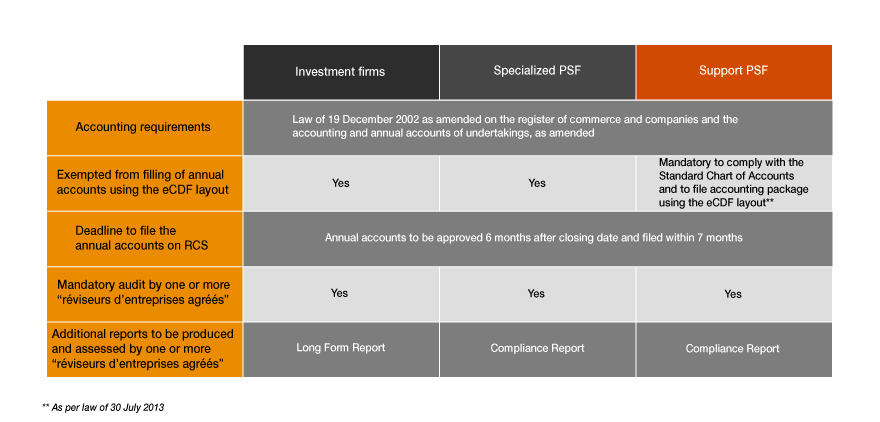

PFS are key actors of the Luxembourg framework of the financial sector and can have various types of licences granted under the overall PFS name (from support PFS to specialised PFS to investment firms). Entering into regulated work can be a real challenge when facing the constantly evolving regulatory environment.

The Commission de Surveillance du Secteur Financier (CSSF) is the local authority responsible for PFS. Any application file will be approved by the CSSF. We strongly recommend new players to meet the CSSF prior to filing an application. Indeed, this is the best way to create a contact and understand also adequately all the steps for filing an application file. It is also key to be accompanied by professionals to enable you to have a smooth process for the application file. Our experts have the regulatory experience as well as market and regulator’s expectation to enable you to obtain your licence in a timely manner. Being regulated brings also a set of regulatory constraints that are important to be understood by applicants.