Our solutions to comply with FATCA and CRS requirements

FATCA and CRS compliance

Your challenges

You must mitigate any risk of non-compliance with your FATCA and CRS obligations, but you are facing following operational challenges:

- High level of expertise needed to monitor legal updates and comply with diverse obligations

- FATCA/CRS classification and registration (if required) of your entities in different jurisdictions and correct completion of self-certification forms

- Plausibility checks of FATCA/CRS self-certification forms received from investors / clients

- Compliance with filing obligations in different jurisdictions (incl. IT systems, gathering of financial data, etc.)

- Set-up of compliance framework (incl. audit trail, performance of oversight over delegated functions, etc.)

- Communication with tax authorities and clients / investors

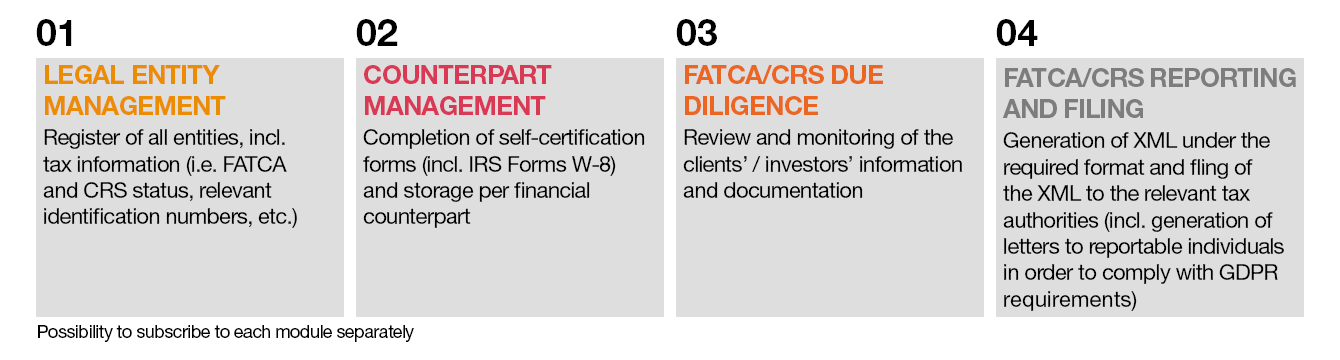

Our FATCA/CRS services

In order to help you reaching a full FATCA/CRS compliance, we offer you a complete range of FATCA/CRS services with our FATCA/CRS Compliance Suite of Services as well as our hotline:

We can also provide you with ad hoc advice regarding questions arising during your day-to-day operations in the form of a hotline.

Full FATCA/CRS compliance

Our FATCA/CRS Compliance Suite of services

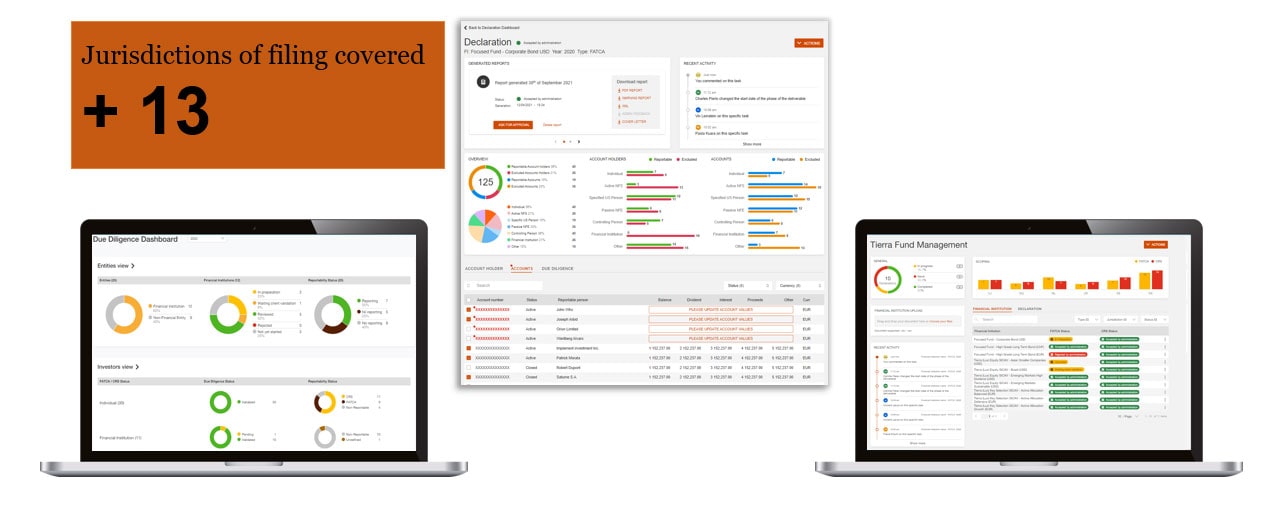

- We have developed a web-based operational solution which allows you to monitor FATCA and CRS compliance at group, entity and client / investor level.

- Our collaborative solution enables you to have a centralised view of the FATCA and CRS obligations of all entities in your jurisdictions in scope.

- Your oversight is documented in an audit trail.

Our services are supported by innovative and secure digital solutions with extensive market coverage and constantly updated with market changes.