Sustainable Finance, a new era for asset managers

The last few years have seen a rally towards Environmental, Social and Governance (ESG) products and ESG integration, with sustainable funds capturing a significant portion of inflows in Europe and some asset managers announcing that they will integrate ESG within their entire range of products. And this trend is likely to further accelerate in the next two years among others due to the expected regulatory developments in Europe.

Deep dive into our publication and get more insights on the impact of the expected measures related to ESG on Asset Management operations.

Action Plan main measures and timeline

What’s new?

European Commission consultation on Renewed Sustainable Finance Strategy

On 8 April 2020, the European Commission (EC) issued a consultation on Renewed Sustainable Finance Strategy. This consultation follows up several actions already undertaken by the recently appointed European Commission towards the objective of a greener and more sustainable European economy.

Taxonomy

The “Taxonomy Proposal” does not aim at defining or classifying ESG approaches, but tries to define sustainable investments through a focus on the activities financed by a financial product, aiming at defining “environmentally sustainable activities”.

EU Climate Transition Benchmark and EU Paris-Aligned Benchmark Proposal

The “Benchmarks Regulation” will amend the Regulation (EU) 2016/1011 (i.e. the Benchmark Regulation) in order to include a “Climate Transition Benchmark” and also an “EU Paris-Aligned Benchmark” definition to impose ESG factors disclosure requirements.

Disclosures Regulation

The “Disclosures Regulation” distinguishes between (i) disclosure on sustainability risks applicable to all financial market participants, advisors and all financial products, and (ii) further disclosures applicable to sustainable investments and to products promoting environmental or social characteristics.

Amendments to existing level 2 measures

Amendments to MiFID suitability tests – ESG preferences

The proposed amendments will modify MiFID II suitability test requirements, asking for a systematic inquiry about investors’ ESG preferences. Whilst amendments to a level 2 text could go relatively rapidly, timing is expected to be aligned with the “Disclosures Regulation” mentioned above due to cross reference between the two texts (sustainable investment definition).

Amendments to MiFID, UCITS and AIFMD to include sustainability risks

Following the mandate granted by the EC, the European Securities and Markets Authority (the “ESMA”) has issued advice on possible amendments to MiFID II, UCITS and AIFMD level 2 texts in order to include references to sustainability risks and factors within organisational requirements, operating conditions and resources, risk management and product governance requirements. Such changes would require all management companies, AIFMs and MiFID firms to review processes and resources as well as to include sustainability risks within risk management processes.

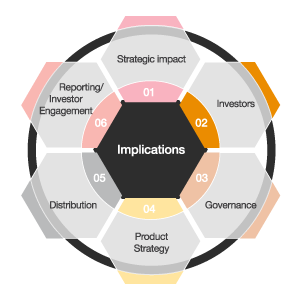

Impact for Asset Managers (“AMs”) – How to surf the wave

- Decide on ESG/RI strategy (leader or follower)

Assess interaction with local regulations as well as global developments (US/Asia)

Decide on products strategy (e.g. which proportion to redefine, active or passive, etc.)

Assess strategic impact with benchmark regulation and other EU regulation (SRD II)

Assess impact on current investor base (which percentage are likely to have ESG preference(s)? Sustainable activities products?)

Decide on market positioning and communication strategy

Assess and monitor engagement activities

Update suitability tests as required

Upskill management/board

Embed ESG within corporate culture

Assess ESG risks and decide upon corporate approach

Review product governance

Interaction with stewardship code

Decide on whether more ESG products (or to remap existing ones) more thematic/sustainable activities

Review existing product range, assess gap and decide on actions

Categorise existing and amend documentation (prospectuses, marketing documents, KIDs)

Launch additional products as required

Decide on whether product label shall be required

Refine target market definition and communicate to intermediaries

Assess current distributors, intermediaries

Adapt distribution network and/or educate intermediaries as required

Review process to assess target market efficiency

Capture engagement activities, ESG activities and sustainable activities within organisation

Establish reporting lines and processes

Decide on communication plan (corporate, products), decide on whether minimalistic approach (versus “telling a story” to investors) and assess on whether to perform impact reporting

Perform gap analysis

Implement product reporting (interact with administrators and other suppliers) process including quality control aspects

Strategic Positioning – ESG, Do or Die?

Regardless of the journey that is being taken within individual jurisdictions, the sustainability / ESG agenda is not one which can be ignored - this will be a global long-term journey which every country and company will have to take, and therefore it is at the stage of “ESG …. do or die” for every country and for every company. No AM can continue to ignore industry-wide potential divestment costs from fossil fuels, tobacco, controversial weapons, animal testing products etc., and needs to assess the impact of future investments.

Investors – Where will the ESG agnostic be hiding?

For many years, investment decisions were not necessarily aligned with investors’ value or long-term concerns.

In 2019, we surveyed 750 institutional investors and 10,000 retail investors around the world in 2019. In our report “Asset and Wealth Management revolution: investors perspectives", ESG is ranked as the third priority in importance among investors surveyed, as a whole group, and it outranks fees.

Other major impacts

Our publication also highlights the expected changes in terms of Governance, Non-ESG products, Distribution, Business processes and operations, Reporting and Investor Engagement.

Zoom on

The people and skills challenge

ESG and sustainability trained resources will be required at all levels of the organisation (from top management, investment, analysts, product design, sales, oversight of delegates and outsourced functions, risk management, reporting, controls function and internal audit).

Recruitment of new talents will be the obvious answer, but skilled resources are limited. In the absence of an available pool of talents, upskilling can be the right tactical answer to this challenge. AMs should also anticipate the skills challenge faced by delegates.

Contact us

Michael Horvath

Advisory Partner, Sustainability Leader, PwC Luxembourg

Tel: +352 49 48 48 3612

Olivier Carré

Deputy Managing Partner, Technology & Transformation Leader, PwC Luxembourg

Tel: +352 49 48 48 4174

Geoffroy Marcassoli

Audit Partner, EMEA AWM ESG Leader, PwC Luxembourg

Tel: +352 49 48 48 5410