"There is no alternative" – a sentence that emerged in the mid-19th century and which found its way into common political and economic parlance, reflecting the commonly-held conviction that inaction is not an option, even in a world of imperfect alternatives. What if we applied TINA to the environmental, social and governance (ESG) paradigm that has been shaping the global asset and wealth management (AWM) industry? Regardless of one’s views and hesitations on ESG – whether its benefits ultimately outweigh its costs – one thing is clear: ESG is here to stay, as both the AWM industry and policymakers appear set on an irreversible course of action.

Bolstered by a change in policy, important shifts in societal expectations, and the ever-increasing sophistication of regulatory rules, ESG considerations today represent an important characteristic of a material number of global Asset Management products and investment strategies. This has seen Global ESG Assets under Management (AuM) skyrocketing more than eight-fold since 2015, surging at an impressive 42.7% CAGR to reach USD 18.4tn as of end-2021.

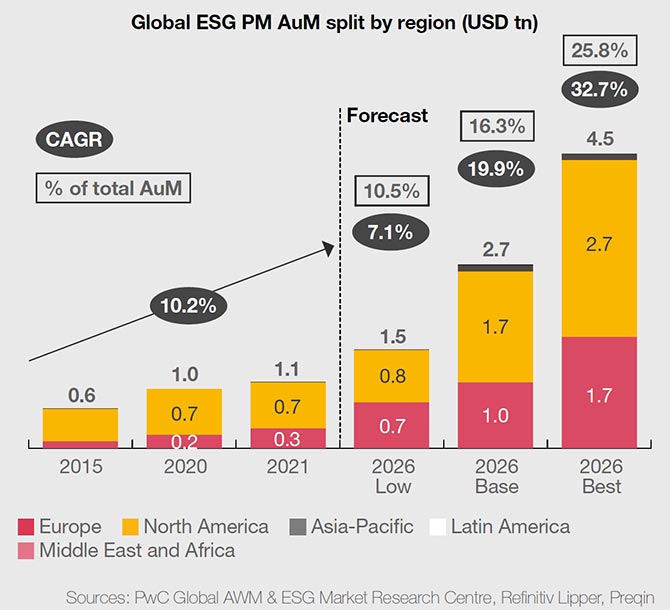

While this seismic transition has been largely driven by the world’s public markets, Private Markets (PM) have not stood idly by. An all-encompassing reboot saw ESG PM AuM nearly double since 2015, as the industry’s stakeholders attribute an unprecedented degree of importance to sustainability considerations. Today, ESG represents an unyielding focal point of the global PM landscape and is set to rapidly transform it. Our forecasts attest to this anticipated growth, with Global ESG PM AuM poised to surge between two- and four-fold according to a base- and best-case forecast scenario.

About our European Sustainable Finance Series and this report

Since 2020, our European Sustainable Finance Series has been offering surveybacked perspectives on the era-defining opportunity that ESG represents for Asset Managers across Europe's public and private market landscapes. Across the three reports published to date, we have taken stock of the key trends propelling the 'ESG shift' across the region's mutual funds, private markets and fixed income industries – formulating key actions that the Managers operating in these spaces should consider taking in order to seize the ESG opportunity with both hands.

Given the rate and scale with which the ESG paradigm shift has expanded into a truly global trend since the start of this series, this report – the fourth of the series – will take a deep dive into how regulation has driven the ESG uptake across the EU, UK, US and APAC. Specifically, we will take stock of the past, present and expected regulatory developments of each region, delving into how these are perceived by LPs and GPs in each jurisdiction, as well as the challenges created, the opportunities unlocked, and the changes required.

We use our findings to make informed recommendations as to the key actions that General Partners should consider in order to navigate the changing ESG landscape and unlock the opportunities it presents. We have further enhanced our report based on a wide range of primary data gathered through a survey of 300 GPs and 300 LPs across all four jurisdictions.

Region-specific ESG disclosure standards & challenges: Overview

Given the rapid and global nature of this ESG shift, regulators have taken varying approaches towards tackling ESG issues, both in terms of urgency and strategy. This has resulted in a lack of uniformity in disclosure regulations and standards across different regions and jurisdictions, with each at a different stage of their respective sustainability journeys. As a result, LPs and GPs are encountering region-specific challenges and opportunities.

To gain insight into the various ESG reporting practices, requirements, and challenges faced by LPs and GPs, we have conducted a survey to identify the varying approaches taken by different entities in the ESG reporting space and help develop a better understanding of the current ESG landscape.

Key actions: Navigating the sustainability disclosure & data landscape

In light of the above, LPs across the world have been increasingly focusing on ESG considerations across the different PM asset classes, while GPs who fail to adapt to changing investor demands risk losing business from the fast-increasing number of increasingly ESG-oriented investors.

Here are some of the key actions that LPs and GPs active in the Private Markets landscape should consider when embarking on their ESG journey.

Reassess your deal sourcing and due diligence

The holistic integration of ESG considerations throughout the investment life cycle is essential for realising ESG’s potential value creation and protection opportunities while aligning with evolving regulatory demands and LP expectations.

This integration requires structural changes. With this in mind, we have identified three crucial steps that GPs should consider taking to incorporate ESG considerations throughout their investment life cycle.

Rethink your risk management and reporting procedures

As ESG becomes an increasingly central facet of the regulatory landscape, GPs are being encouraged to reevaluate their risk management processes to incorporate non-financial risks alongside financial ones. In this new backdrop, it is no longer sufficient to prioritise financial risk at the expense of non-financial risk. It is crucial to recognize that non-financial risks, such as environmental and social risks, can have a significant impact on the long-term financial performance of a portfolio company.

Upskill your workforce

As ESG considerations become increasingly entrenched in the operational DNA of Asset Managers across the globe – and as regulator and investor expectations mount – it is becoming increasingly crucial for GPs to deepen and integrate their ESG capabilities across their organisations. To successfully transition towards an ESG-driven approach, it is essential to cultivate a diverse and skilled talent pool that can bring fresh perspectives and support the organisation's transitionary efforts. This entails acquiring a broad range of practical and qualitative skills, such as ESG data/analytics, risk analysis, impact analysis, and policy monitoring

Manage the transition and timing

As long-term investors, alternative fund managers and GPs have always considered turnaround management, until now mostly focused on financial KPIs, as a core strategy for value creation. With the importance and valuation impact of non-financial metrics and performance, the management of these dimensions in terms of ‘transition’ is creating a major opportunity for value creation, but also a major threat if not properly managed, up to the material loss of value.

Upgrade your data collection & analysis capabilities

Successfully implementing the aforementioned action points requires mastering the data challenge. Timely, accurate, and relevant data is crucial not only for achieving regulatory compliance but also for effectively quantifying ESG-related risks and improvements. This, in turn, provides a quantifiable basis for assessing ESG's potential for value creation

Contact us

Olivier Carré

Deputy Managing Partner, Technology & Transformation Leader, PwC Luxembourg

Tel: +352 49 48 48 4174

Partner, Global Sustainability Markets Leader, PwC Netherlands

Tel: +31 (0)62 248 81 40

Tarek Shoukri

Private Equity, and Sovereign Investment Funds Strategy and M&A Advisory, PwC Middle East

Tel: +971 4 304 3100

Partner, Global AWM Market Research Centre Leader, PwC Luxembourg

Tel: +352 49 48 48 2191