EU Private Markets: ESG Reboot

PwC’s new report, which uses Preqin data, shows how creating alpha and meeting investors’ needs is a matter of survival in the private markets industry.

As the world around us evolves, it’s increasingly apparent that environmental and social challenges – and the actions we must take in order to address them – will define this century. ESG and sustainable finance will become the levers to meet the needs of sustainability-conscious investors, increased regulatory requirements, and societal expectations. It’s clear that ESG investing is evolving into a veritable paradigm shift – particularly within the EU, and this is having a profound effect on the region’s private markets (PM)1 industry. Adapting to the paradigm will be a challenge, but as a recent PwC report shows, the opportunities are vast.

The bulk of the discussion surrounding the sheer transformational impact of ESG on the modern asset and wealth management landscape has historically focused on the traditional realm. That said, in recent years we’ve seen a historic asset and sentiment shift within European private markets, with LPs, society, and regulators all doubling down on their ESG demands.

As a result, the volume of PM ESG assets domiciled in the region has almost tripled since 2015 – reaching €252.9bn as of end-2020. While this evolution is nothing short of formidable, the recently published report by PwC – EU Private Markets: ESG Reboot2 – concludes that the PM landscape may still be in the nascent stages of an ESG metamorphosis, and fast approaching the precipice of a ‘reboot’ of historic proportions. We believe that ESG is set to primordially reinvent the European PM landscape at a rate and magnitude unparalleled since the ratification of the AIFMD in 2011.

Fig. a: European PM ESG AUM: Asset Class Split (€bn)

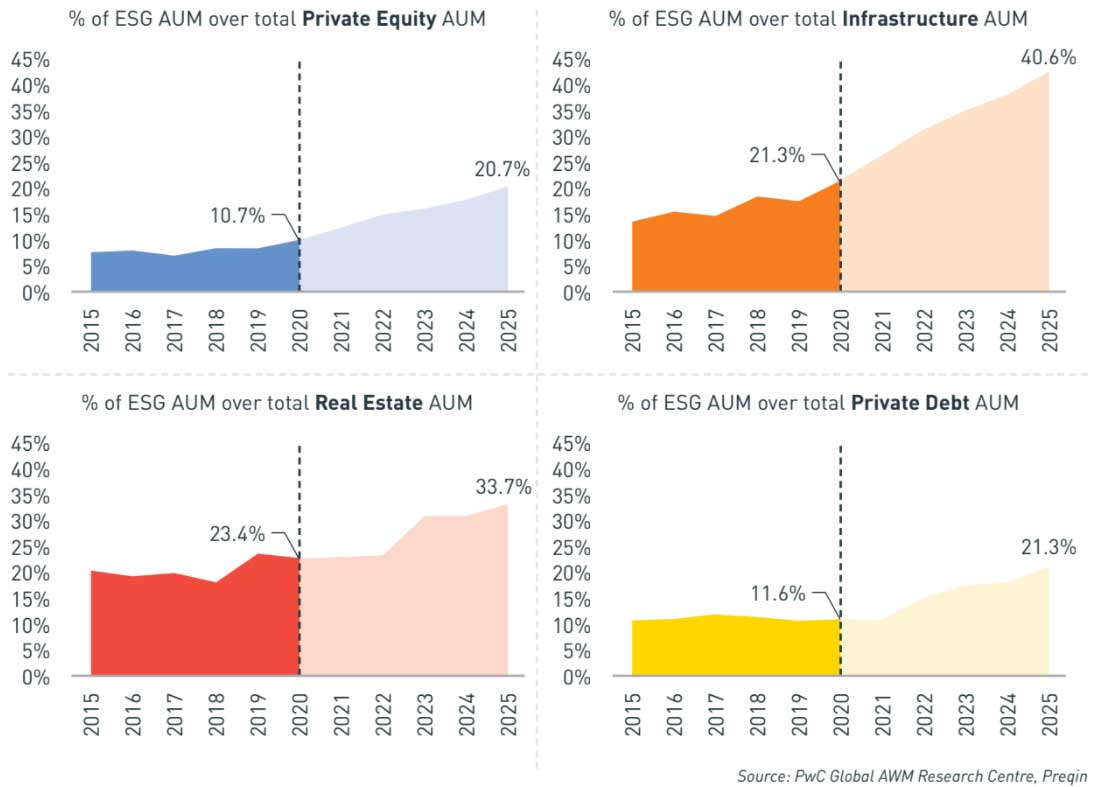

According to PwC’s forecasts, European PM ESG assets will skyrocket to between €775.7bn and €1.2tn by 2025 – accounting for between 27.2% and 42.4% of the entire industry’s asset base. Real assets, in particular, are poised to stand at the forefront of this surge; ESG assets are expected to account for 33.7% and 40.6% of real estate and infrastructure’s total respective AUM by 2025.

Four Key Catalysts Are Driving the Growth of ESG

PwC’s forecasts are based on the acceleration of four overarching catalysts that are driving change in Europe’s private markets, as well as the rise of asset-class-specific dynamics. Together, these drivers and dynamics are boosting transformation and placing sustainability/ESG concerns at the heart of the industry.

The four catalysts are:

1. Shifting societal values

2. Changing investment behavior

3. Policy shifts and regulatory changes

4. ESG value creation and risk mitigation

Spotlight on Asset Classes

Despite the aforementioned asset surge, PwC analysis shows that the penetration of ESG considerations within the industry remains limited and asymmetrical, with real estate – which has long represented ESG’s most prominent and vocal ESG proponent within PM – boasting a modest 23.4% of its AUM classified as ESG as of end-2020. This historically shallow penetration can be attributed to the relative nascence of ESG within the private markets landscape, but also to a number of structural and perceptual challenges that have historically hindered further ESG uptake therein.

Although the magnitude of these challenges varies by asset class, they are largely cross-sectional in nature. That being said, PwC research indicates that, these characteristic challenges notwithstanding, private markets’ long investment horizon, deep engagement with portfolio companies, and institutional investor prominence in fact lay a fertile soil from which ESG can truly flourish.

How to Create Value through ESG

In order to unlock the ESG opportunity, PM must deeply embed ESG within their portfolios and broader operations – positioning and differentiating themselves as true ESG leaders. The report outlines (in greater detail) six key recommendations that GPs should consider undertaking to create alpha through ESG and drive the effective, sustainable transition of their respective business models:

1. Master ESG at the GP level

2. Create a core ESG team

3. Construct an ‘ESG-enhanced’ portfolio

4. Actively manage ESG risk

5. Create distinct and transparent reporting

6. Master the data challenge

In summation, it’s clear that the wheels of change are turning in Europe’s private markets, and ESG is quickly becoming a ‘do or die’ type of matter, separating the GPs that thrive from those that merely survive.

Fig. b: Proportion of New ESG AUM to 2025 from New Funds Raised

Fig. c: Proportion of ESG AUM over Total AUM: Split by Asset Class

PwC Luxembourg's Alternatives practice is built on its unsurpassed knowledge, experience, and quality of service.

PwC’s Alternatives practice team, with over 700 experts, is the largest in Luxembourg. Its dedicated members are knowledgeable about the industry as a whole, and offer deep expertise in each of its six pillars: Private Equity, Real Estate, Infrastructure, Debt Funds, Hedge Funds, and Venture Capital.

Vincent Lebrun, Tax Partner - Alternatives Leader at PwC Luxembourg

Alternatives Leader since 2019 and previously Private Equity Industry leader since 2006, Vincent Lebrun is the leading Luxembourg tax specialist for private equity houses on M&A transactions and Fund Structuring. Vincent has wide experience in tax structuring and cross-border transactions, including acquisitions, refinancings, and disposals, and advises on fund structuring (including carry and co-invest structures).