Corporate Sustainability Due Diligence Directive - A focus on your entire value chain

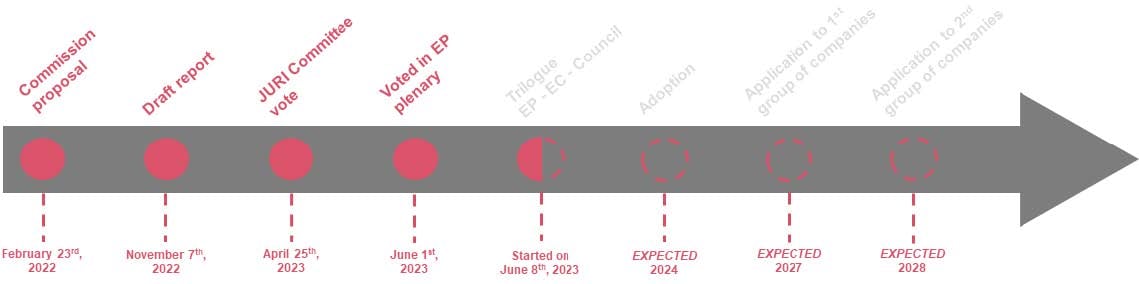

The Corporate Sustainability Due Diligence Directive (CS3D) has been finally adopted by the European Parliament (EP) on 1 June 2023. The proposal sets out a horizontal framework of obligations for companies with an EU footprint (whether based in Europe or providing goods or services into the EU), governing how they address actual and potential adverse impacts on human rights and environment through their global value chains, including operations of subsidiaries and business partners. Notably, the proposal includes provisions on the consequences for violations of the Directive’s obligations, including civil liability for those companies that cause or contribute to harm by failing to carry out due diligence. By requiring companies to address their impacts on human rights and the environment, the CS3D will respond to a lack of harmonized legal framework on corporate due diligence obligations across Europe. This article presents the main concepts and requirements of this new directive on Corporate Due Diligence.

The next step for the CS3D will involve trilogue discussions between the European Parliament (EP), the European Council, and the Commission, aiming to finalise the text by the end of 2023. It is expected that the directive will be adopted by the EU in 2024. Thus, changes / modifications can still happen until then!

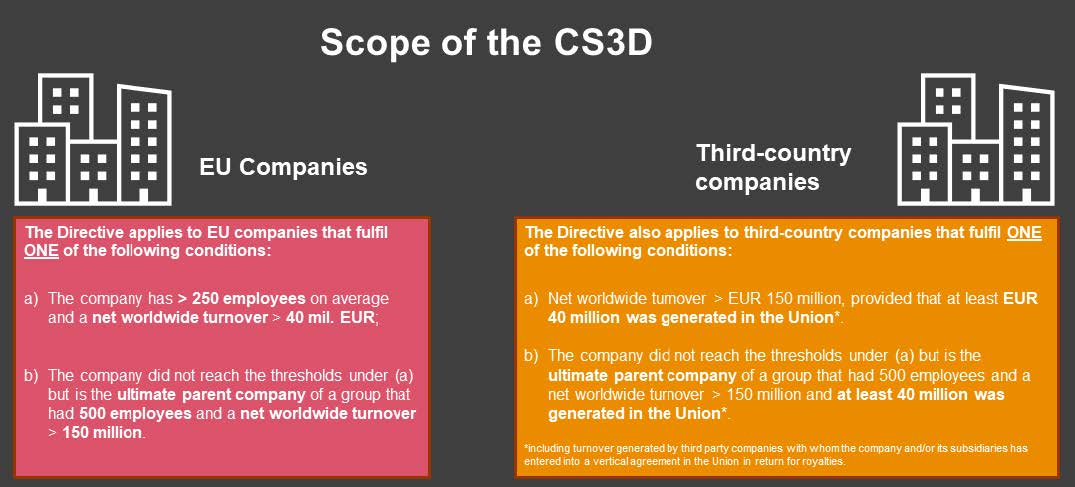

Scope

Applicable Timeline

After the period of transposition of the Member States in the national law, the Directive will be applicable to companies under scope in differentiated timelines, depending on their turnover and number of employees.

First group

The CS3D provisions will most likely be applicable as from 2027 for the first group of companies, comprising:

- EU companies or groups of companies with over 1,000 employees and a net worldwide turnover exceeding EUR 150 million and,

- Third-country companies and groups with a net turnover of more than EUR 150 million in the European Union.

Second group

The CS3D provisions will most likely be applicable as from 2028 for the second group of companies, comprising:

- EU companies or groups of companies with over 500 employees and a net worldwide turnover exceeding EUR 150 million.

- EU companies with over 250 employees and a net worldwide turnover of more than EUR 40 million*.

- Third-country companies with a net turnover of EUR 150 million, of which more than EUR 40 million generated in the EU.

*By way of derogation, EU Companies in the second group with a net worldwide turnover of more than EUR 40 million but not more than EUR 150 million may decide not to fulfil the obligations of the Directive until 2029.

What does the CS3D imply in practice?

The CS3D will require companies to integrate Corporate Due Diligence into their policies by including:

- A description of the company’s approach to due diligence, including short-, medium-, and long-term horizons.

- A code of conduct applicable throughout the company and its subsidiaries across all operations.

- A description of due diligence processes implemented.

- A description of monitoring measures taken to ensure compliance with the code of conduct.

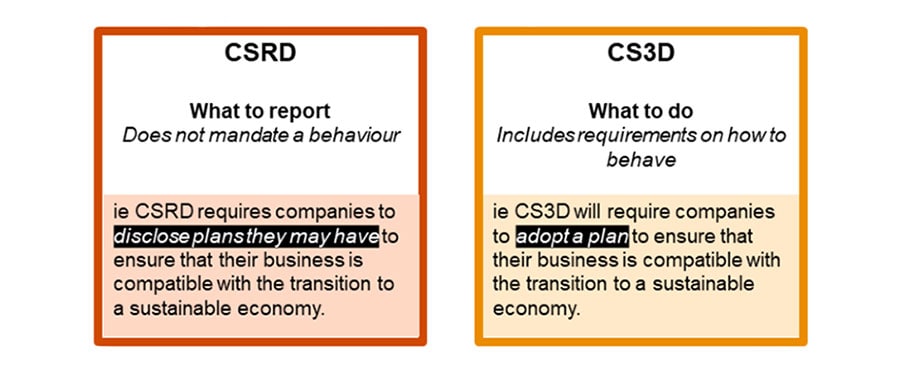

Corporate climate transition plan

Besides the introduction of due diligence obligations, the proposed directive would also require companies to adopt a plan to ensure that the company's business model and strategy are compatible with the transition to a sustainable economy, including limiting global warming to 1.5°C in line with the Paris Agreement. The concept of a climate transition plan was first introduced in the EU area by the CSRD, but while the latter focuses on disclosure requirements, its scope does not include requirements around the preparation and implementation of such plans. Here, the CS3D complements the CSRD by requiring companies to not only develop a credible transition plan but also implement it, providing insights into the practical aspects of the transition process.

In Article 15 of its latest amended version, the CS3D sets out how the transition plan of a company should include a description of the following items:

- Business resilience: the resilience of the company’s business model and strategy to risks related to climate matters.

- Opportunities: the opportunities for the company related to climate matters.

- Decarbonisation plans: where appropriate an identification and explanation of decarbonization levers within the company’s operations and value chain, including the exposure of the company to coal-, oil- and gas-related activities.

- Business impacts on stakeholders and climate: how the company’s business model and strategy take into account the interests of the company’s affected stakeholders and of the impacts of the company on climate change.

- Strategy adaptation: how the company’s strategy has been implemented and will be implemented with regard to climate matters, including related financial and investment plans.

- Emission targets: the time-bound targets related to climate change set by the company for scope 1, 2 and, where relevant, 3 emissions.

- ESG Governance: a description of the role of the administrative, management and supervisory bodies regarding climate matters.

Directors’ responsibilities towards a sustainable econom

Article 25 of the CS3D states that directors of EU companies should take into account the consequences of their decisions for sustainability matters. On top of this, Article 15 states that directors are responsible for overseeing the obligations set out in this Article (i.e. setting up climate transition plans), and that companies with more than 1000 employees on average have a relevant and effective policy in place to ensure that part of any variable remuneration for directors is linked to the company’s transition plan. The broader regulations regarding directors' legal responsibility for the implementation and supervision of the due diligence process did not successfully pass the EP vote.

Sanctions and liabilities

Penalties and liability for violations of the CS3D obligations leading to damage have been included and shall be applied by national supervisory authorities. Sanctions include measures such as “naming and shaming”, taking a company’s goods off the market, or fines of at least 5% of the net worldwide turnover. Non-EU companies that fail to comply with the rules will be banned from public procurement in the EU.

Actual and potential adverse impacts

Article 6 of the Directive focuses on actual and potential adverse impacts including issues on:

- Human rights like forced or child labour, inadequate workplace health and safety, worker exploitation, and

- Environment such as greenhouse gas emissions, pollution, and biodiversity loss.

As mentioned in our previous article on the subject, companies under CS3D will have to take specific actions to tackle these adverse human rights and environmental impacts stemming from their operations, products, services, subsidiaries, and value chains following the process below:

CS3D link with other sustainability reporting proposals

The aim of the proposed directive is to be complementary and closely related to the adopted Corporate Sustainability Reporting Directive (CSRD), to the EU Taxonomy’s minimum social safeguards, to the Sustainable Finance Disclosure Regulation (SFDR) and to other sustainability reporting proposals/ standards such as Directive 2011/36/EU on preventing and combating trafficking in human beings and protecting its victims, the Employers' Sanctions Directive, the Conflict Minerals Regulation, the proposal for a regulation on deforestation-free supply chains.

CS3D and CSRD

The proposed CS3D Directive is set to enhance reporting effectiveness and completeness under the CSRD. While ESRS 1 expands reporting boundaries and emphasises due diligence performance throughout the value chain, it lacks clear guidance on the implementation aspect. This is where the CS3D comes into play, complementing the approach and methodology for meeting due diligence requirements and aiding companies in identifying adverse impacts. Likewise, the CSRD complements the CS3D by covering the reporting aspect of due diligence obligations for companies subject to both regulations. This complementary relationship extends to the preparation, adoption, and implementation of climate transition plans, as mentioned above.

CS3D and SFDR

The provisions for financial market participants under the SFDR are consistent with the ones provided by CS3D, which will also complement the Sustainable Finance Disclosure by imposing obligations on companies to provide data and information on risks within their value chains that are linked to the respect of human rights or environment.

CS3D and EU Taxonomy

Minimum safeguards established in Article 18 of the Taxonomy Regulation refer to procedures companies should implement to ensure the alignment with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights. However, the Taxonomy Regulation does not impose substantive duties on companies other than public reporting requirements. By requiring companies to identify their adverse risks in all their operations and value chains, the CS3D complements the Taxonomy Regulation and aims at providing investors with more detailed information.

Challenges

- Provide for and oversee the due diligence implementation and its integration into the corporate strategy. · Meet the requirements of the new legislation while creating additional value for the company.

- Identify gaps between existing processes and measures in governance, risk, supply chain management, etc., and the Directive requirements.

- Identify the right individuals and/or departments that will have ownership and responsibilities over the due diligence strategy and processes.

- Upskill the company governance (board, management) in order to set a good compliance framework.

- Ensure appropriate data collection processes for reporting purposes are in place (availability, security, accuracy, and completeness).

- Select the right tools to support the identification of human and environmental rights risks in companies’ value chain(s).

- Update (if already existent) or put in place a remediation strategy in case of due diligence violations.

- Establish contractual provisions with business partners that will, on the one hand, ensure compliance with the company’s Code of Conduct and other due diligence requirements, while at the same time being fair and reasonable for all parties.

- Provide support for an SME with which the company has an established business relationship, in order to facilitate the SME's compliance with the company's code of conduct or prevention action plan.

- Liability in case it was unreasonable to expect that the action actually taken by the indirect partner (including as regards verifying compliance) would be adequate to prevent, mitigate, bring to an end or minimise the extent of the adverse impact.

Benefits of the value chain due diligence

- Valuable contribution to create a sustainable and fair economy and society.

- Contribution to bring the sustainability reporting on par with the financial reporting.

- Improvement of the organization risk assessment over the entire value chain.

- Decrease of reputational risks.

- Easier and cheaper access to financing.

- Consumer and employee's loyalty.

- Competitive advantage for early adopters.