Regulatory advisory services for instant payments

Payment services providers (PSPs) such as banks are expected to undergo significant transformations as a result of the entry into force of the Regulation (EU) 2024/886 on instant credit transfers in euro (so called “Instant Payments Regulation”).

The new regulation aims at making instant payments fully available in euro to consumers and businesses in the EU and in EEA countries, allowing transfer of funds within ten seconds 24/7 and 365 days per year.

PSPs which provide standard credit transfers in euro, will be required to offer the service of sending and receiving instant payments in euro. The charges that apply (if any) must not be higher than the charges that apply for standard credit transfers.

Under the new rules, instant payment providers will need to verify that the beneficiary’s IBAN and name match in order to alert the payer to possible mistakes or fraud before a transaction is made. This requirement will apply to regular transfers too.

The new rules will come into force after a transition period that will be faster in the euro area and longer in the non-euro area, that needs more time to adjust.

The impact of instant payment regulation on banks and other PSPs in Luxembourg can be remarkable, including modernisation of the payments infrastructure, enhancements to transactions processing, and improvements of the overall customer experience.

In conclusion, while the new rules present challenges for banks and other PSPs in Luxembourg, they also offer opportunities for innovation and growth in the rapidly evolving payments landscape. Adapting to these changes effectively will be crucial for maintaining competitiveness and meeting the evolving needs of customers.

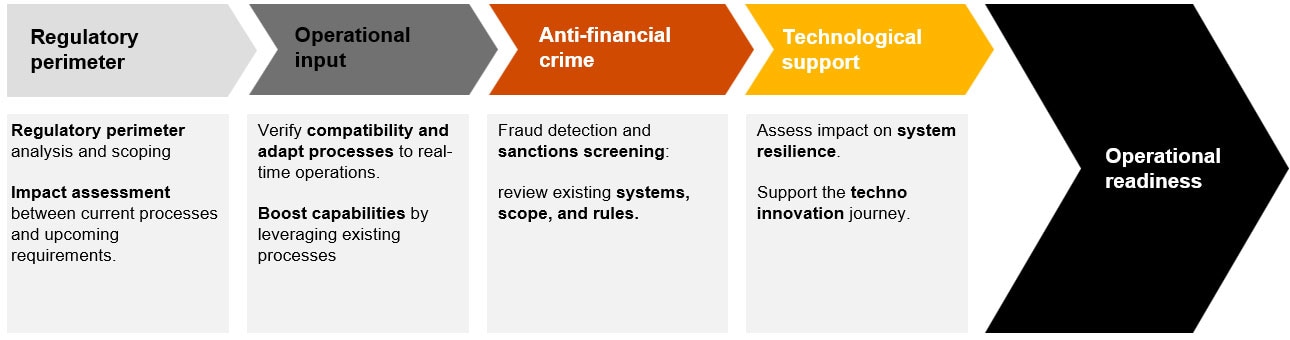

How PwC can help clients succeed

Team up approach to ensure that internal framework, policies, procedures, systems are scrutinised and aligned with organisational and regulatory requirements.