Support in development / enhancement of Recovery Plan

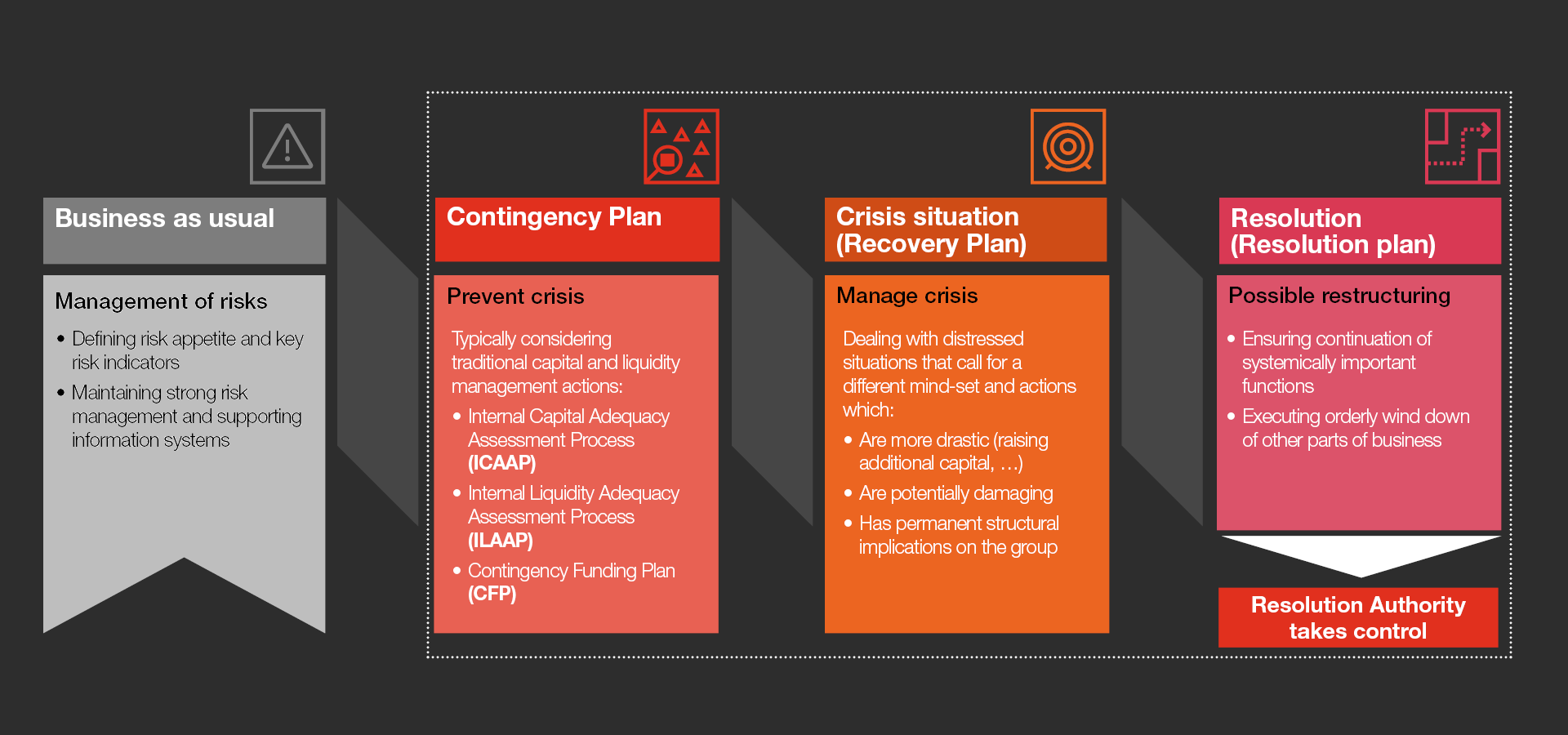

The Recovery Plan within the crisis management framework

The Recovery Plan is designed to ensure that the Bank is well prepared to meet the challenges that may arise from potential future financial crisis. The main objective of the Recovery Plan is to define a crisis management framework with all necessary components (escalation process, potential management actions, communication,…) to prevent the Bank entering into a recovery state.

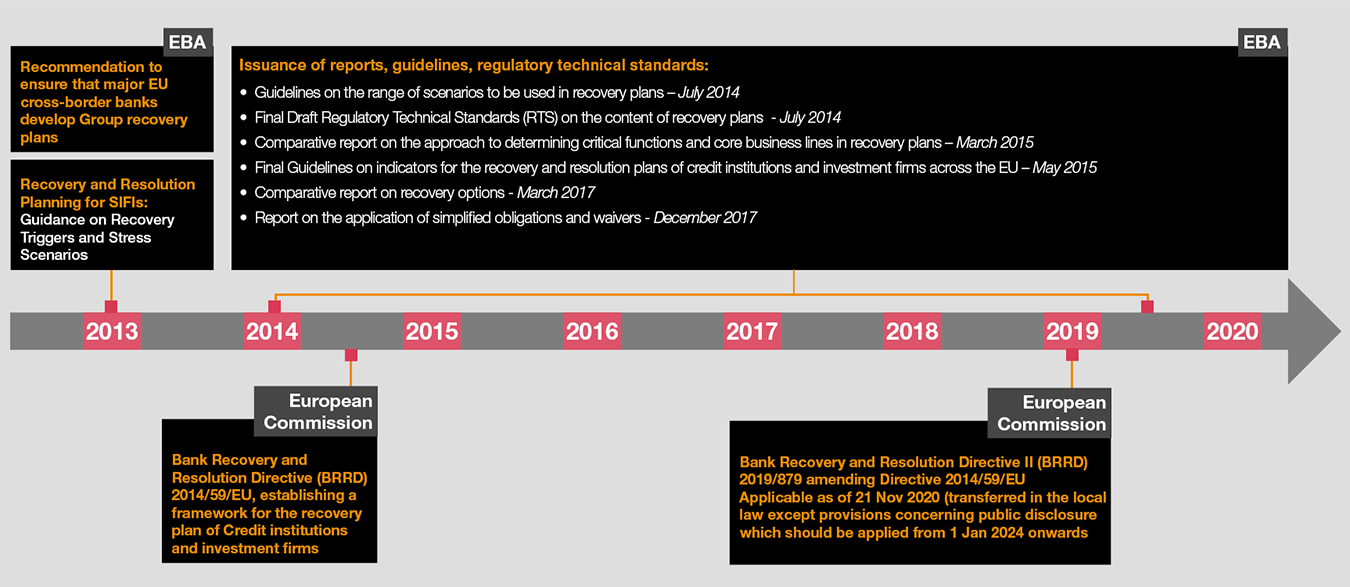

Background and EBA expectations

Structure of a recovery plan

Aligned with regulatory recommendations the recovery plan is structured around 5 areas: summary, strategic analysis, preparatory measures, governance, and last but not least, communication and disclosure plan. Together they provide specific insight in the financial institution’s business model, its vulnerabilities and instruments to recover from a severe stress.

Overview of simplified obligations

Pursuant to Article 4(1) of the Bank Recovery and Resolution Directive*, competent and resolution authorities may simplify recovery and resolution plans, respectively with regard to:

- The contents and details of recovery plans;

- The date by which the first recovery plans are to be drawn up and the frequency for updating recovery plans;

- The contents and details of the information required from institutions; and

- The level of detail for the assessment of resolvability

The assessment of eligibility for simplified obligations should be made by each authority separately. The impact that the failure of the institution could have on financial markets, on other institutions, on funding conditions, and on the wider economy will drive the authority's decision.

*2014/59/EU Directive establishing a framework for the recovery and resolution of credit institutions and investment firms (BRRD)

Simplified obligations in Luxembourg

The institutions should consider a systemic scenario with different levels of severity that are linked to the identified key vulnerabilities and are not required to perform an idiosyncratic and a combined scenarios.

The list of mandatory indicators from the EBA has been shortened to the four indicators listed below:

- Capital: Common Equity Tier 1

- Liquidity: Liquidity Coverage Ratio

- Profitability: One forward looking indicator

- Asset quality indicator: Net non-performing loans/Equity

The CSSF considers that banks subject to simplified obligations do not have any critical functions (i.e. systemic impacts that the bank could have on the real economy or financial stability) and no analysis on critical functions is therefore required.

The plan should be reviewed and updated at least every two years.

Under simplified obligations, the scope of the communication plan and the preparatory measures has been shortened.