CSSF circular 20/762 introduces new requirements for the management of IRRBB in Luxembourg

With the recent circular 20/762 the CSSF adopts the EBA's most recent guidelines on the management of interest rate risk in the banking book in full.

While the CSSF had already adopted the 2015 version of the EBA's IRRBB guidelines in circular 16/642, the newly published CSSF circular now transposes the most recent EBA guidelines on management of interest rate risk from non-trading activities (EBA GL 2018/02) into binding requirements for all credit institutions and CRR investment firms in Luxembourg. This has implications across the entire range of IRRBB management, which may prove to be challenging for many institutions within its scope.

- What are the key changes for credit institutions and CRR investment firms in Luxembourg?

- What are the primary challenges resulting from the new CSSF circular?

- How should firms react?

What are the key changes for credit institutions and CRR investment firms in Luxembourg?

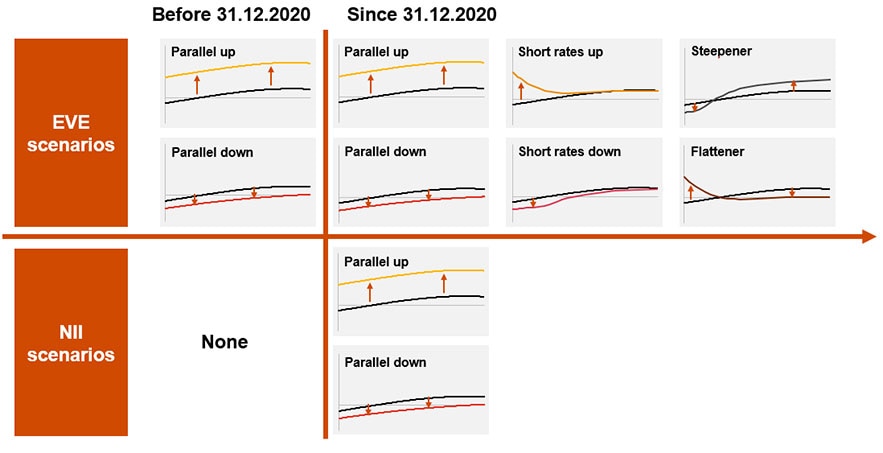

The supervisory outlier test (SOT), which previously only required firms to calculate the change in their economic value of equity (EVE) under a ±200 bps parallel shift of the yield curve, is extended significantly: Going forward, firms will have to quantify and disclose the change in EVE additionally under four prescribed yield curve scenarios and provide a breakdown of results by material currencies. In addition firms will have to calculate and disclose the changes in net interest income (NII) under ±200 bps parallel shifts.

Following the new CSSF circular, firms will have to expand their risk management framework to also include credit spread risk in the banking book in line with the EBA guidelines on IRRBB. In addition the circular provides additional details on measurement methodology for IRRBB that firms will have to take into account.

Going forward, IRRBB models will have to be included in a firm’s model risk management (MRM) framework.

What are the primary challenges resulting from the new CSSF circular?

A key challenge for many firms will be to adapt their IRRBB quantification capabilities to meet the requirements resulting from the new circular, both for internal purposes and for mandatory disclosures of changes in EVE and NII under scenarios.

This is exacerbated by the looming deadlines: The CSSF expects an immediate implementation of the updated requirements and a first submission of the stress test results for EVE and NII under the mandatory scenarios until March 15th 2021.

In the past, typical IRRBB and ALM models as used e. g. to project deposit volumes and loan prepayments have often not been within the scope of a firm’s model risk management framework in the past. This will have to change now. One can see this as a part of a broader general trend to gradually increase the scope of MRM and model governance.

How should firms react?

Firms should familiarise themselves with the new requirements and assess the resulting implications for them.

Firms will have to make sure that their IRRBB models are able to quantify the impact of all relevant scenarios on EVE and NII across all currencies and in line with the methodological requirements laid out in the new IRRBB circular and the EBA guidelines on IRRBB.

Firms should integrate the statutory IRRBB scenarios and the SOT thresholds into the overall IRBBB processes and risk appetite.

Firms should expand the scope of their model risk and model governance framework to also cover their IRRBB models. For some firms, this may mean that they will have to increase modelling rigour for IRRBB and ALM.

In addition we recommend firms to look for opportunities to improve the flexibility of their IRRBB models since we expect further sharpening and extension of regulatory requirements.

How PwC can help

1. We help you understand the implications and navigate the challenges arising form the new CSSF circular

We have extensive experience helping banks navigate the challenges of IRRBB management and we regularly support clients with improving their IRRBB and ALM models to meet internal and external expectations.

2. We help you quantify your IRRBB exposure and satisfy the updated disclosure requirements

In order to help our clients satisfy the most recent calculation and disclosure requirements for IRRBB we have developed a solution that allows firms to quantify the impact of the prescribed yield curve scenarios on EVE and NII in line with the requirements laid out by EBA and CSSF, providing firms with extensive capabilities for further analyses of the results.