ESG in banking: what it means for Risk Managers

The tone on ESG has been cast, with regulators and expectations looming in the waters. The time to act is now: CSSF expects banks to start integrating ESG risks into their business strategy and risk appetite.

ESG, once a buzzword has rapidly developed a strong presence and has now translated into a growing number of actionable plans for players in the financial sector. The banking industry has a central role to play as they act as an important catalyser in reorienting financial flows towards sustainable activities, supporting industries and governments in meeting ESG targets.

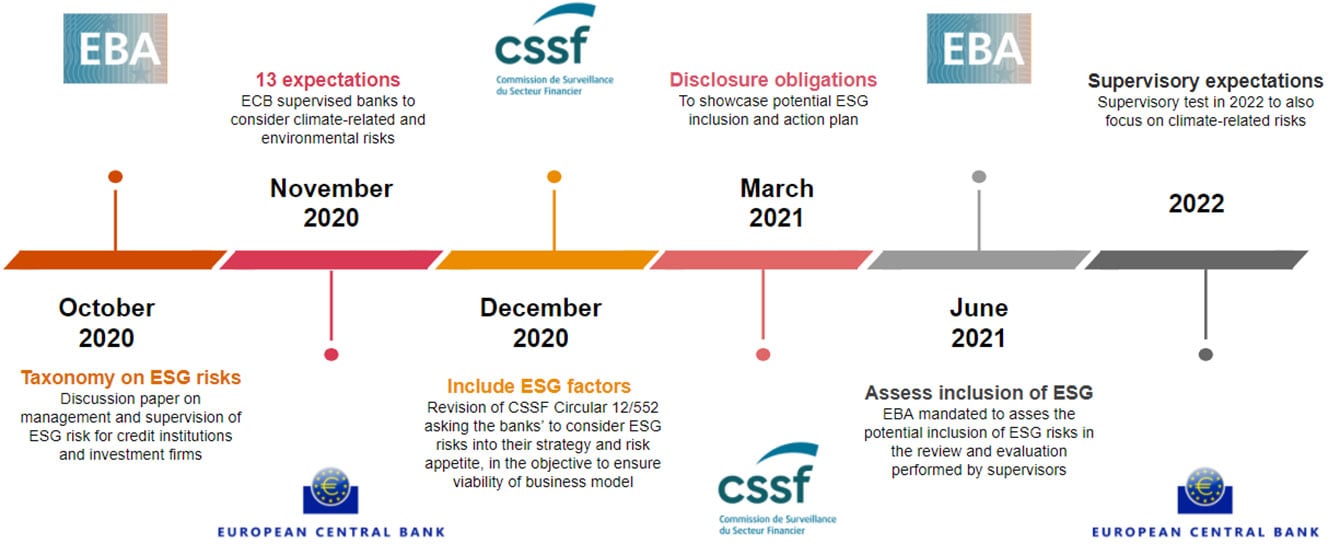

A wave of guidance and regulations have started to build up, making the topic a lot more tangible and actionable calling institutions to integrate ESG risks into their business model, risk appetite, internal risk reports and external disclosures. CSSF has also announced of an upcoming Circular that will target the Less-Significant Institutions soon.

Why banks should not wait any longer

Growing interest

Investors, customers and regulators are increasingly showing interest in climate-related and environmental, social and governance risks.

Traction at EU level

Since 2019, the European Central Bank (ECB) has placed climate-related risks as one of the 11 key risk drivers in the 2020 Single Supervisory Mechanism Risk Map.

Published guides

ECB published its final guide on climate and environmental risks; and EBA is consulting market participants to finalise the European requirements on ESG risks to include Pillar 1 capital requirements, ICAAP, ILAAP (Pillar 2) and Pillar 3 requirements.

Growing regulatory traction on ESG-related activities

How can banks act now

How PwC can help

Risk officers may be wondering : Where do I start?

Examples of questions a Risk Officer should think of and consider as priorities into their 2021 agenda:

Do I have a strategy for integrating sustainability risks across my risk management framework?

Did I try to conduct climate scenario analysis across my client portfolios?

Did I ever look at the ESG disclosures of my Asset & Wealth Management customer base?

Will their result change my risk appetite and overall risk profile?

What changes are needed to my control framework to implement the new regulations / ESG strategy?

PwC has developed frameworks and approaches to support you in tackling these initial challenges and enhance your organisation's risk management framework. We will help bridge the gap in integrating ESG into your firm's DNA, show you how to incorporate climate and ESG risks into the existing risk taxonomy, and how to enhance key concepts and processes, such as risk appetite, while keeping in line with the requirements.

How PwC can help integrate ESG into your DNA

Workshops & Trainings

Organise workshops and tailored trainings with case studies to create awareness and strengthen bank's understanding of ESG risk culture;

PwC's one experience centre workshop will also be utilised to help banks explore, design and build relevant strategies and approaches to tackling ESG risks. Such sessions can be either targeted at the essentials for the management body but also go all the way to detailed technical aspects.

Readiness assessment

Identify material impact of ESG attributes on your business model (lending, investment, but also your corporate ESG responsibility);

Identify material impact of ESG attributes on your existing risk framework (financial and non financial risks);

Assess your bank’s resilience and capacity to integrate and monitor ESG risks.

ICAAP Update

ICAAP review to integrate forward-looking assumptions pertaining to ESG risks (a key concern for competent authorities, as per the recent update of Circular 12/552)

Integration into model

Define a target state and road map for implementation, taking into account the institution's strategy and expected changes to the business and operating environment;

Adjust your Risk Management framework including policies, processes and control environment to identify, measure and monitor ESG risks.

Quality Assurance

Sounding board to challenge and compare your ESG risk management documents against regulatory/supervisory expectation and developments in the market

Project Management

Support in project management during identification of areas impacted by ESG risks and definition of your road map and Implementation of your ESG road map