The distinctive solution to comply with your CRS & FATCA reporting obligations

AEoI Reporting Solution

Context

The laws of 24 July 2015 and 18 December 2015 on FATCA and CRS (“AEoI”) respectively and their subsequent amendments have introduced stringent obligations for the Reporting Financial Institutions in Luxembourg and abroad.

Non compliance with these obligations could result in maximum penalty of EUR 250,000 applicable for each regime and, in case of absence, late, incomplete or erroneous reporting, the Luxembourg tax authorities can add a penalty amounting to 0.5% of the amounts that should have been reported (with a minimum of EUR 1,500).

Your challenges

FATCA and CRS regulatory requirements compel Reporting Financial Institutions (such as banks, insurance, investment funds and private equity vehicles) in Luxembourg and in many jurisdictions abroad to notably:

- Obtain, assess and monitor the FATCA and CRS status of their clients, investors (“investor due diligence”);

- Report annually to the relevant tax authorities personal and financial information on the reportable clients and investors;

- Implement internal controls and keep an audit trail of the performed actions;

- Present details on the IT systems used for your reporting purposes and a detailed description of internal and external controls implemented.

As the implementation of a reporting system within your company could be time consuming and expensive, especially with regards to the complexity of the technical aspects defining the format of the FATCA and CRS reports, we can assist you during the entire reporting process and provide you with a tailor-made assistance based on your needs and operational constraints.

How it works

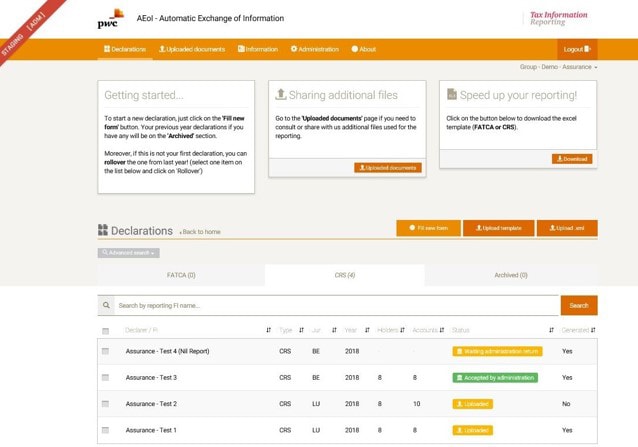

This Automatic Exchange of Information (AEoI) reporting tool is a collaborative, web-based application that helps you to report the right information quickly, securely and in accordance with the guidelines issued by the tax authorities in Luxembourg or in several foreign jurisdictions (e.g. BVI, Cayman, Jersey, Guernsey, France, UK, Emirates, New Zealand…).

The tool allows you to achieve the highest levels of efficiency, reduce the reporting operational burden and keep a track of the supporting documentation of the preparatory work, the XML reports filed (with a pdf version) and the validation feedbacks from the relevant tax authorities.

Our aim is to provide comfort to our clients on the quality of the data and to respond to their operational challenges in a pragmatic way considering the market insights. The reports are prepared by FATCA and CRS experts who are able to answer technical questions.

Your benefits

- Exchange confidential information with the PwC FATCA and CRS expert team directly through our encrypted secure channel. Upon request, we may assist you with ad-hoc questions related to the investor due diligence and the content of the information to include in the report;

- Generate reporting by converting raw data from your IT systems (or the one of your service provider such as Transfer Agent or Domiciliation Company) into the required XML format in accordance with regulatory requirements of the relevant tax authorities;

- Ensure reporting format compliance with built-in coherence check mechanisms of the raw data to be in line with the requirements of the circulars;

- Review draft reports easily with the built-in PDF pro-forma generation functionality. Our experts perform quality checks on the reports generated by the tool;

- File your reports via a direct, secured and encrypted connection to the Luxembourg tax authorities via Fundsquare (one of the two authorized official transmission channels);

- Receive directly into the tool the filing feedback issued by the Luxembourg tax authorities which you may easily download for your internal records;

- Monitor your reporting process with the built-in dashboard overview allowing you to easily keep track of the current filing status of your different funds;

- Keep an audit trail of the reporting process with the built-in tracking functionality showing you who did what and when.

Value

Our price offer is considered on a case-by-case basis, depending on the scope of assistance and volume of reports to be filed for our clients.

Sponsor

Pierre Kirsch

Partner, PwC Regulated Solutions