Key Highlights of the 2022 CSSF Annual Report for PFS

Introduction

Overall, the number of PFS (investment firms, specialised PFS and support PFS) has decreased in 2022 compared with 2021.

This variation is mainly driven by the mergers that have occurred in the Luxembourgish market together with some licence withdrawal for some entities.

In light of the market volatility, the investment firms have a lower performance compared to last year whilst the soundness of the financial sector in Luxembourg has positively contributed to the results of the specialised PFS.

We have summarised below the main highlights of the 2022 CSSF annual report published on 25 August 2023, per type of PFS.

1. Investment firms

Figures as at 31 December 2022

Investment firms |

Variation |

|

Number of PFS |

95 |

-6 |

Net Result |

77.2 Mio |

-33.22% |

Total B/S |

974 Mio |

-8.3% |

In 2022, CSSF has noted a fall in the number of Investment Firms due to cessation of regulated activities (2), change into specialised PFS (1), voluntary liquidation (2) and merger by acquisition (2). One new Investment Firm has been set up as an branch of an EU Member country entity.

According to the IFD / IFR classification, the Luxembourgish market is split as follows:

- No Class 1 investment Firm;

- 1/3 are Class 2;

- 2/3 are Class 3.

The decrease in the total balance sheet is mainly due to the decrease in the number of entities (-6). The decline in the assets under management led to a drop in the commission income, thus impacting the net result of the Investment Firms. CSSF also highlighted that 65% of the Investment Firms had a positive net result for the financial year 2022. The growing regulation requirements and repetitive indexes have an important impact on the staff costs of the Investment Firms. This is putting additional pressure on the profitability of the Investment Firms.

Key points taken from CSSF Annual Report

Prudential supervision

Capital base (assises financières)

During the year, CSSF had to intervene for 2 entities breaching the required capital base. While one entity has been able to redress the situation, the other has chosen to go into voluntary liquidation.

Other regulatory requirements

In 2022, the CSSF noted 5 breaches of the mandatory capital ratios following the entry in force of IFD/IFR package.

1 breach in terms of liquidity was also noted (none for concentration risk).

On-site visits and sanctions

The CSSF is increasing its pressure towards Investment Firms. Indeed, 17 on-site visits have been performed by the CSSF in 2022 (13 in 2021) on the following topics:

- Five AML/CFT on-site inspections;

- Four MiFID on-site inspections;

- Three corporate governance on-site inspections;

- Two IT Risk on-site inspections;

- Two ad hoc on-site inspections;

- One UCI administration on-site inspection.

Six fines (EUR 1,767,498.80) have been imposed by the CSSF in 2022 (3 in 2021):

One for non-compliance with AML/CFT professional obligations (EUR 210,000):

One for non-compliance with the legal and regulatory deadlines for submission of closing documents (EUR 5,000);

- Four imposed on one entity for:

- non-compliance with MiFID II-related organisational requirements (EUR 765,000);

- breach in relation to the detection and notification of suspicious orders and transactions (EUR 412,498.80);

- non-compliance with CSSF Circular 20/758 relating to the internal governance arrangements (EUR 250,000);

- breach in relation to the reporting of transactions in financial instruments (EUR 125,000).

2. Specialised PFS

Figures as at 31 December 2022

Specialised PFS |

Variation |

|

Number of PFS |

100 |

4 |

Net Result |

255.23 Mio |

+164.25 Mio |

Total B/S |

6,238.49 Mio |

+66.04 Mio |

In 2022, the number of Specialised PSF increased by 4%. This is mostly due to new registration (6) and conversion of licence (2) compensated by some deregistration (4).

Most of the specialised PFS are asset servicers for UCITS and alternative products.

The main activities performed by support PSF are corporate domiciliation agent (82 out of 100 entities), professionals providing company incorporation and management services (84 out of 100 entities) and transfer agents (71 out of 100 entities).

This underlying growth of the alternative business (in terms of numbers of products notably) strongly contributed to the impressive increase of the net result of those entities.

Key points taken from CSSF Annual Report

Compliance of the day-to-day management and governance

In 2022, the CSSF intervened by way of observation letters due to situations of non-compliance in the day-to-day management of specialised PFS, notably linked to insufficient presence and/or effective involvement of one of the two managers in the day-to-day management of the entity or to the need for reorganisation of the entity’s administrative or management body composition.

On-site visits and sanctions

16 on-site visits have been performed by the CSSF in 2022 (15 in 2021) on the following topics:

10 AML/CFT on-site inspections;

4 depositary on-site inspections;

2 corporate governance on-site inspections.

Two fines (EUR 464,750) have been imposed by the CSSF in 2022 (2 in 2021):

One for non-compliance with AML/CFT professional obligations (EUR 266,000);

One for breach of the Law of 5 April 1993 with respect to IT risk management, internal governance, professional secrecy obligation and requirements regarding communication to the CSSF (EUR 198,750).

3. Support PFS

Figures as at 31 December 2022

Support PFS |

Variation |

|

Number of PFS |

66 |

-3 |

Net Result |

90 Mio |

+19.6 Mio |

Total B/S |

1,680.3 Mio |

+51.4 Mio |

Compared to 2021, CSSF has noted a decrease in the number of Support PSF due to three entities deregistering during the year.

The increase in net results mainly driven by four support PFS.

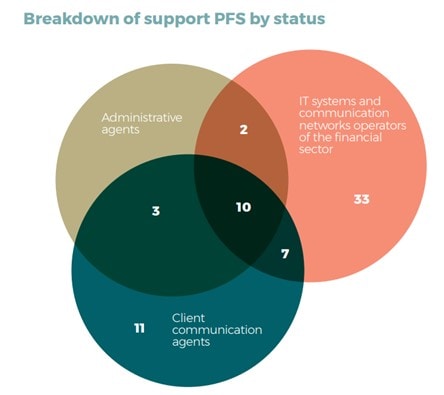

Considering the broad licence and various types of activity, CSSF has presented the following view on the activities performed:

Source: CSSF 2022 annual report

Key points taken from CSSF Annual Report

On-site visits and sanctions

2 on-site visits have been performed by the CSSF in 2022 (2 in 2021) on the topic of IT Risk.

Two fines (EUR 24,750) have been imposed by the CSSF in 2022 (1 in 2021):

- One for non-compliance with Article 17(2) of the Law of 5 April 1993 (EUR 18,750);

- One for non compliance with Article 17(2) of the Law of 5 April 1993 and Circular CSSF 05/187 (EUR 6,000).

Other relevant comments

In 2022, the CSSF has identified about 15 cases relating to changes (name, legal form, acquisition or creation of subsidiary / branch, change of external auditor, management body, etc.) made without communication to the CSSF and, thus, without prior approval.

The CSSF also highlighted the requirements of the Circular 22/806 related to outsourcing. Indeed, support PFS are subject to Circular CSSF 22/806 in two ways:

- on the one hand, as supervised entities which must comply with it if they rely themselves on service providers;

- on the other hand, as service providers of financial sector clients which must themselves comply with the requirements of the circular, whether these clients are based in Luxembourg or within the EEA if they fall within the scope of the revised EBA Guidelines on outsourcing arrangements included in the circular. Support PFS must therefore present their clients with agreements that include compulsory contractual clauses laid down in the circular.