VAT and company cars - The Luxembourg VAT authorities released Circular Letter 807 bis dated 28 April 2023 seeking to provide additional guidance to taxpayers

30/05/23

In Brief

The VAT treatment applied to company cars put at the disposal of employees by employers is a complex topic. The Luxembourg VAT authorities published a second Circular-Letter to give additional guidelines. However, certain aspects would still require some clarifications.

What we already know on the basis of Circular n°807 from 11 February 2021?

Circular Letter n°807 was issued to provide guidance on the VAT treatment applicable to company cars put by employers at the disposal of their employees further to the case QM C-288/19 from the Court of Justice of the EU. In a nutshell, the Luxembourg VAT authorities confirm that making cars available to employees will be considered as supplies made for consideration in the following three situations:

- When the employee pays the employer to benefit from the company car;

- When the employer deducts a portion of the gross salary of the employee in exchange for the company car;

- When the employee can choose between several advantages provided by the employer based on a common agreement stating that the employee could benefit from a company car if he/she renounces to other advantages.

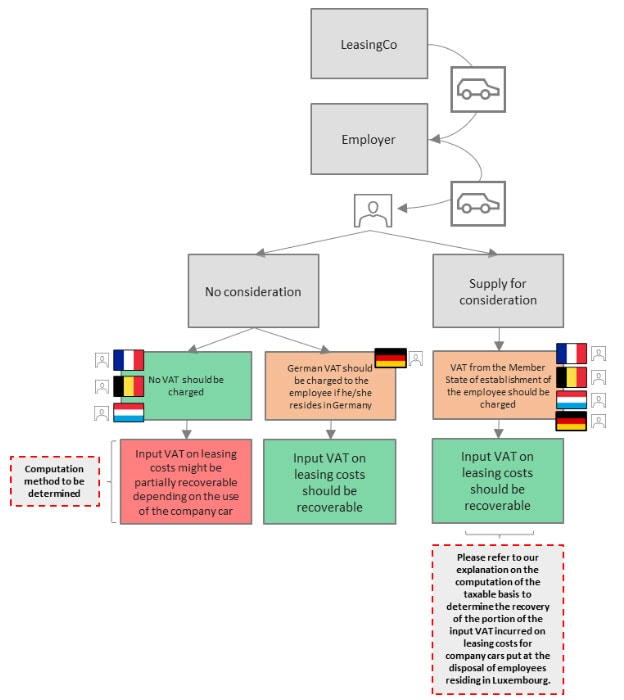

The position taken by the Luxembourg VAT authorities follows the same criteria as the ones provided by the EU VAT committee in a paper resulting from its 101st meeting of 20 October 2014. A similar approach is taken in Belgium, while the position of the German VAT authorities is stricter than the other countries as they consider that a supply is made for consideration even though the employee would not give up a portion of his/her remuneration.

Quick recapitulative of the situation in Luxembourg for the employer:

What’s provided by Circular n° 807bis?

What is the taxable basis?

The Circular states that a common car policy used by employers in Luxembourg consists in granting a dedicated budget to employees to benefit from a company car. Usually, the employee is free to choose between a cash compensation (or any other advantages) or using the budget for a company car. The Luxembourg VAT authorities consider that any employee that would use their dedicated budget to benefit from a company car or that would be compensated in case they would not use the budget, fully or partly, would be seen as receiving a service of long-term hiring of a means of transport from his employer.

Although not specified by the Circular, we understand that this also means that in case the employee can only use the dedicated budget for a company car (and would not get any compensation if he/she decided not to take a company car), no supply for consideration would be recognised. The employer should still be required to account for VAT on the private use of the company car by the employee (if the input VAT on the costs incurred by the employer was initially recovered in full or in part).

Now, back to the situation where the QM decision would apply, the supply is deemed to be done for consideration because the employee paid something or gave up another advantage. If an employee is residing in Luxembourg and benefits from a company car, the Circular states that the employer will have to apply Luxembourg VAT on the “open-market value” applicable to the supply. The following example is provided. If an employee is using his/her monthly car allowance of EUR 550 (exclusive of VAT) for a company car that actually costs EUR 450 (exclusive of VAT), the employer will have to apply 16% VAT on the actual amount taken by the employer from the employee’s remuneration, i.e. EUR 450. If the effective leasing costs amounted to EUR 600, the employer would have to charge VAT on a taxable basis of EUR 600. Note that this would also apply if the employer was capping the amount paid by the employee to the car allowance despite an excess. In this case the employee would use his car allowance of EUR 550 but VAT would have to be charged on an amount of EUR 600 by his/her employer.

Any additional costs incurred by the employer in relation to the leasing of the company car should in principle be taken into account in the taxable basis. This should include fuel costs, whereas one could argue that the insurance element should in principle be VAT-exempt (while this is the approach taken in Belgium, this is however not explicitly confirmed by the Circular).

The same reasoning would apply if the employer was the owner of the car. The taxable basis of the supply would be the depreciation value of the car over a 5-year period including all the ancillary costs.

When the employee also uses the company car for business purposes, the Luxembourg VAT authorities indicate that an additional step can be taken to reduce the taxable basis. This part of the Circular letter is quite complex, so let’s take two examples to look at the reasoning behind it:

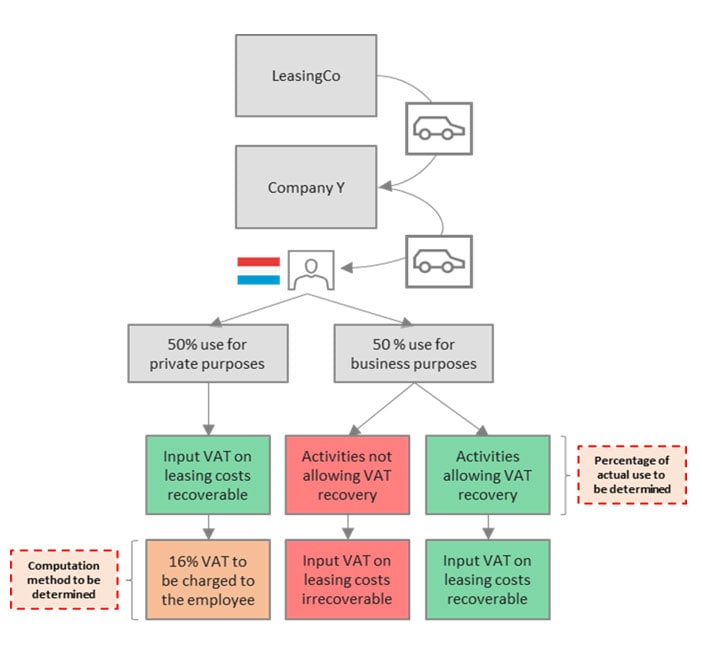

Case n°1 - Company “Y” has two activities, one allowing input VAT recovery (10%) and another not allowing input VAT recovery (90%):

An employee of Company Y, residing in Luxembourg, is giving up on a portion of his/her salary to benefit from a company car for which the open-market value is EUR 500. Company Y has to apply 16% VAT on EUR 500 and collect the related amount to remit it to the Luxembourg VAT authorities.

The circular provides no details on the computation method to be used (e.g. a vehicle logbook to track the actual use of the company car, the method used to compute the benefit in kind from a personal tax perspective or another lump sum approach). Assuming that the company car is used 50% of the time for business purposes (either for the activity allowing input VAT recovery or the other), Company Y could reduce the taxable basis of the supply made to the employee. In our example, the actual taxable basis of the supply to the employee is reduced to EUR 250.

Having said that Company Y would have to ensure to:

collect 16% VAT on EUR 250 from the employee;

use a direct allocation method between the leasing costs incurred and the actual use of the company car to correctly determine the amount of recoverable VAT. In our case, the company car was used for 50% of the time for business purposes. Although Company Y has a recovery right of 10%, the employee might be exclusively using the company car for operations that fully entitle to recover VAT. Hence Company Y needs to track the actual use of the company car to be able to determine the amount of recoverable VAT on the leasing costs.

Case n°2 - Company “X” has a VAT recovery right of 100%:

The situation is the same as for Company Y although in this case Company X only has to collect 16% VAT on EUR 250 from the employee. The input VAT incurred on leasing costs is fully recoverable.

If VAT is payable in other Member States, how to adjust past years?

The Luxembourg VAT authorities indicate that if VAT would be due in other EU Member States (where the employees reside), corrective annual VAT returns could be filed in Luxembourg for the years still within the 5-year statute of limitations period (irrespective of whether a tax assessment has been issued). Businesses that will file corrective annual VAT returns will have to inform the Luxembourg VAT authorities by mail and justify the corrections with supporting documentation.

As such, if a company was required to collect and pay German VAT on the leasing of the company cars to its employees since 2013, it could file corrective annual VAT returns in Luxembourg starting with the year 2018. The correction would in principle allow the company to fully recover the input VAT on the costs incurred for the leasing of the cars that were granted to employees residing in Germany.

It is important to note that the circular does not clarify as to when the new rules should apply to Luxembourg residents. Should we assume that the authorities consider that the publication date of QM should be the triggering event, i.e. February 2021? For example, the Belgian authorities have clarified that they expect corrections from 1 July 2021 onwards.

Ending remark:

If not already done, businesses should take the following actions:

Assess if the decision applies to their current situations (based on the applicable company car policy).

Check on a country-by-country basis the potential VAT amount that would be due and take protective measures.

Prepare the calculations for Luxembourg and the supporting documentation that will accompany the corrective returns.

Note that potential personal tax implications could also arise depending on your situation (notably on the computation of the benefit in kind). Do not hesitate to reach out to us if you need any assistance in that respect.