What does this mean for service providers?

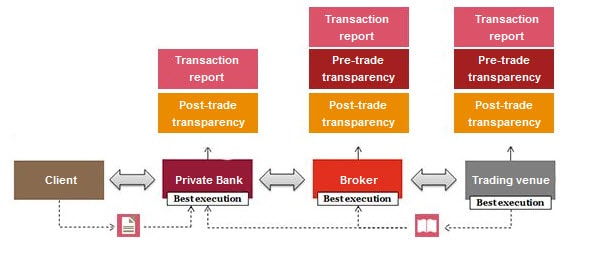

Providers in the financial markets are heavily impacted along the complete trading chain. As MiFIR aims to provide an integrated, efficient and transparent financial market through an increased and more in-depth transparency regime as well as new rules regarding the initiation and operation of trades and the handling of post trades, providers acting on the financial markets now face an increased operational effort in the handling of trades.

The new regulation dovetails with the existing regulatory agenda of EMIR, which is mainly a post trade topic, by adding on top equivalent rules and new obligations on the trade and pre-trade phases. The regulation includes also market operators of trading venues as they are impacted by the straight-through-processing concept for cleared and non-cleared OTC derivatives as well as by the prompt and increased data publication for transparency and best execution policies.

Any intermediary acting on the financial markets within the European Union will not come around this reshaped chain of trading and is affected either by its various precepts directly or indirectly through deliveries to and dependencies from providers acting on the financial markets.