Releasing Captive Value: Practical Guide on Captive Insurance and Reinsurance in Luxembourg 2023

This guide gives you practical information on captive insurance and reinsurance and shows how PwC Luxembourg can help you.

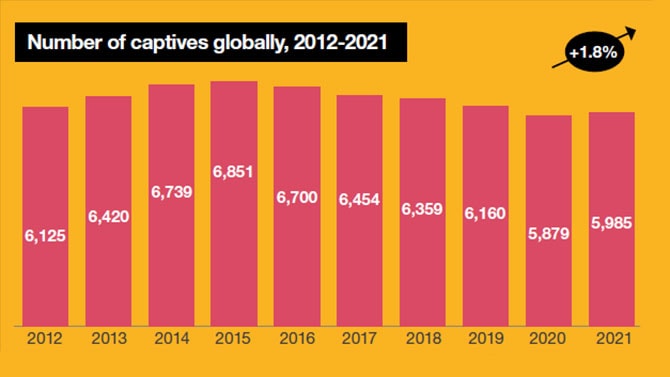

For the past few years, captives are experiencing a resurgence of interest. The number of captives globally has risen sharply in recent times, from around 1,000 in the early 1980s to almost 6,000 worldwide by 2023. They have been used by a wide range of entities, from the largest listed companies to non-profit organisations.

The accelerating interest in captive can be explained by a number of reasons, including inter alia the disengagement of traditional insurers regarding certain number of risks, their degree of exposure compared to certain Groups, the broadening of the risk profile of multilaterals and the significant increase in fees.

The latest developments associated with the broadening of the exposure spectrum of Groups (cyber risks, climate risks, consumer protection and pandemic risk) have made reinsurance captives more attractive to multinational Groups from a regulatory and tax point of view.

Luxembourg continues to position itself as Continental Europe’s preferred market, home to over 200 insurance and reinsurance captives.

A key element that differentiates Luxembourg from other territories has to do with the strong understanding from the Regulator - CAA (Commissariat aux Assurances) - towards the captive business model, including enhancing proportionality and reducing regulatory requirements that are not justified with regards to the way captives operate.

Luxembourg’s policymakers have played a pioneering role in Europe in respect of captives. They anticipated the 2005 European Directive on reinsurance (2005/68/EC); and they established a prudential framework for reinsurance as far back as 1991. They also remain the main advocates for the recognition of a special treatment within Solvency II for captives. This anticipation of the future European framework highlights the Luxembourg authorities’ experience and understanding of the advantages of insurance and reinsurance.

So, this guide is designed to present a general overview of the main advantages entailed in creating a captive and using Luxembourg as the captive’s domicile.

While all reasonable care has been taken in preparing this guide, there is no substitute for regulations. Should you have particular problems or need further information, please contact one of the team members listed at the end of this guide.

We hope you will enjoy reading this guide.