When it comes to the fight against financial crime, technological progress is a double-edged sword. On the one hand, it boosts crime prevention and detection capabilities, but on the other, it also bolsters bad actors’ arsenals. We are seeing financial criminals become increasingly sophisticated; efforts to prevent money laundering, terrorist financing, and the proliferation of weapons of mass destruction (abbreviated as ‘AML’ in this report) must rise to the challenge.

The EMEA AML Survey 2024

Although technology can be a great catalyst for progress in AML capabilities, respondents have consistently mentioned that finding qualified AML professionals that can implement new technologies is extremely difficult. This is quite a remarkable finding, since most, if not all, recent business trends involve some form of technological hype. Obviously, technology is also a key issue for our respondents, but they consider the shortage of qualified people as a major stumbling block to AML progress despite all the great opportunities technology and AI can offer; this tends to be underestimated in public discourse.

Our respondents are divided into nine major regions and three industries within the financial sector. Over half (52%) of respondents are banks, which have historically been the focus of AML regulations and are more used to being in the spotlight of AML news and events. Our Banks respondents also include 52% of all Global Systemically Important Banks (G-SIBs) and 59% of Global Systemically Important Institutions (G-SIIs). Asset managers represent 26% of respondents, while payment institutions make up a further 22%.

The Robots Are Not Taking Over (Yet)

Finding skilled staff is the most important factor for effective AML compliance. Without experienced staff, carrying out day-to-day processes and updating technologies and AML methodologies is extremely difficult and may not provide the right output and quality. As a result, despite the enormous potential that revolutionary technologies like AI hold, they cannot be implemented adequately without sophisticated and experienced human staff that know how to navigate the world of AML with its many risk-based areas of professional judgement and principles.

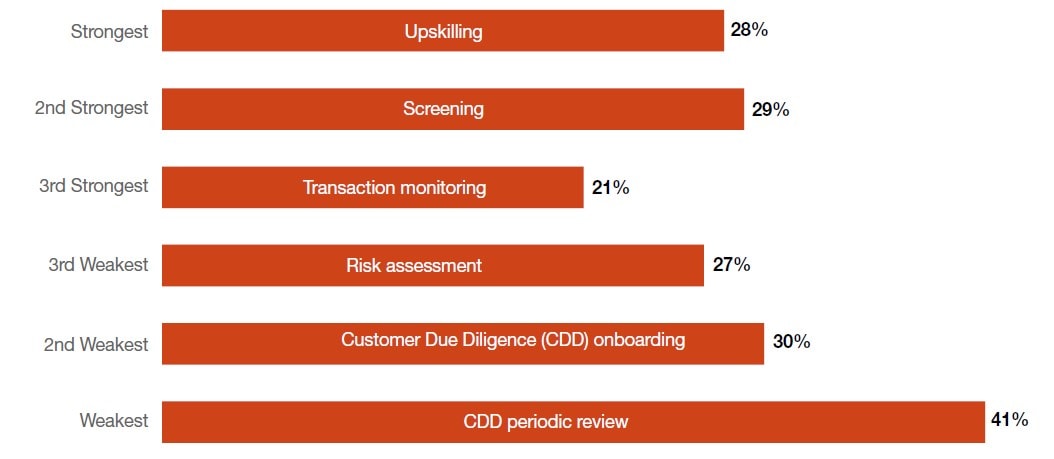

Among survey respondents, 28% indicated upskilling as the most effective AML control, while over one-third stated that the lack of skilled resources constitutes one of the main impediments to increasing the use of new technologies in their AML operations.

Most common answer when respondents were asked to rank AML controls by their level of effectiveness

Note: Respondents were asked to rank several controls from strongest to weakest. This was the most common answer for each ranking level (e.g., Training ranked as the strongest control more often than any other category, by 28% of respondents. Screening was ranked the second strongest most often, etc.)

Source: PwC Global AWM & ESG Research Centre

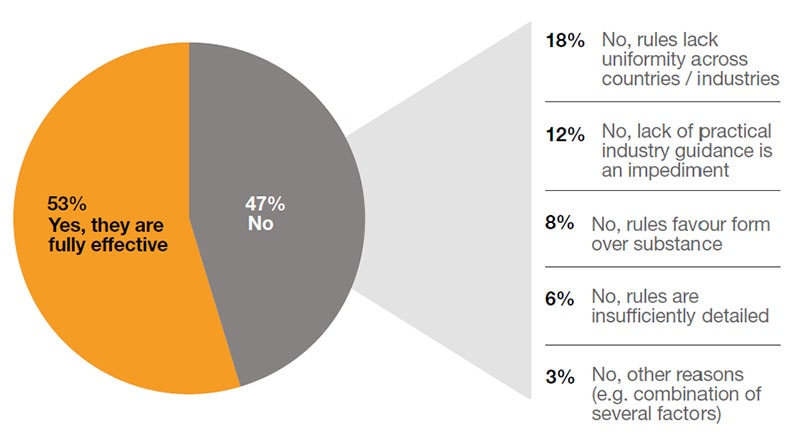

The Financial Sector Wants Pragmatic Regulations

Respondents are split on regulatory effectiveness. In the EMEA region as a whole, 53% of respondents believe that current or upcoming AML regulations are helpful. Among those who do not, they tend to think the rules lack uniformity across countries and industries (18%), that there is a lack of practical industry guidance (12%), that the rules favour form over substance (8%) or that the rules are not sufficiently detailed (6%).

Among the numerous AML-related challenges faced by EMEA financial institutions, the increase in regulatory pressure came to the forefront, with over one-third of respondents (38%) citing it as the most challenging issue, while 34% also highlighted how regulations complicated operational processes.

Do you think that the current AML rules are helpful to prevent money laundering and terrorist financing, or are they too far removed from operational reality?

Note: Percentages may not add up to 100% due to rounding.

Source: PwC Global AWM & ESG Research Centre

Operations: The Human Factor Comes First

Having experienced staff continues to be one of the main determining factors of AML teams’ ability to improve and leverage technology to its full potential. Upskilling is therefore likely to be a major investment driver in the coming years. Expertise and experience are becoming even more important than before since they are more necessary than ever to leverage technology’s full potential. Increasing effectiveness via digital tools or upgrading existing tools are also key investment drivers, particularly when it comes to AI.

Over half of our respondents (51%) have seen their AML compliance costs rise by at least 10% over the last two years, with banks (62%) seeing the biggest increase among respondent categories. On average, AML costs have increased by 14%. Staff increases and investments into new digital tools have been the main cost drivers.

In addition to having skilled staff, respondents tend to view transaction monitoring and screening as the most effective AML controls.

Technology: Are New Digital Tools the Answer?

While all regions are considering implementing AI solutions to their AML operations, financial institutions in the Nordics (94%), Africa (93%) and the Middle East (93%) are the most enthusiastic. Transaction monitoring and screening are the main AML functions respondents are planning to use AI for, highlighted by 79% and 59% of respondents, respectively. However, adopting AI solutions is not all smooth sailing. Over half of respondents (55%) are concerned that the maturity of their AML processes is a constraint to AI adoption, while 52% are concerned about data-sharing with external providers.

What percentage of your AML budget do you expect you will invest in digital tools in the next 24 months?

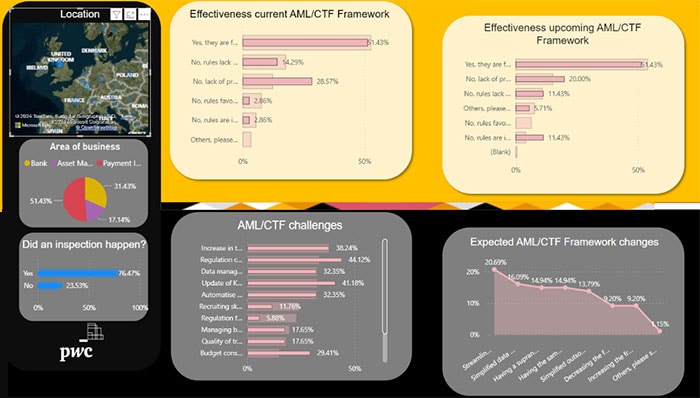

EMEA AML Survey benchmarking tool

Thanks to the data quality achieved by the EMEA AML Survey 2024, we developed an AML benchmarking tool designed to provide organisations with unique and tailored insights on regulations, operations and technology in the EMEA AML market.

- Organisations will be able to see where they stand compared to EMEA and local industry peers.

- Dynamic dashboards will empower organisations and stakeholders to make informed decisions. We can provide you with tailored presentations for your Board or Executive Committee sessions.

- Organisations may also be benchmarked if they have not taken part in the EMEA AML Survey. Please contact us and we would be happy to organise with you a benchmarking session specific for your needs.

Book a demo to know more about our AML benchmarking tool

Download the executive summary

Download the full report

Contact us

Michael Weis

Advisory Partner, Forensics & Anti-Financial Crime Leader, PwC Luxembourg

Tel: +352 49 48 48 4153

Partner, Global AWM Market Research Centre Leader, PwC Luxembourg

Tel: +352 49 48 48 2191

Alessandro Casarotti

EMEA AML Survey Coordinator, Anti-Financial Crime Director, PwC Luxembourg

Tel: +352 62133 35 28

Partner and Forensic Services and Financial Crime Leader, PwC Switzerland

Tel: +41 58 792 17 60

Mahmoud Al-Salah

Partner, Financial Services and Deals, Financial Crime Compliance, PwC Middle East

Sébastien d’Aligny

France and Francophone Africa Anti-Financial Crime Leader, Partner, PwC France

Tel: +33 156 571 532