Measures to prevent money laundering, terrorist financing, and the proliferation of weapons of mass destruction (all of which are abbreviated as “AML” in this report) have improved significantly over the last decade, evolving from a compliance check in some jurisdictions, to one of the financial system’s main security measures. In recent years, regulators in Luxembourg, the EU, and beyond as well as international bodies like the Financial Action Task Force (FATF) have begun shifting their perspective on how to regulate AML practices and have increased their focus on effectiveness. Whereas previously AML compliance had been mostly concerned with whether AML systems were in place or not, more recent initiatives are instead examining whether these measures are effective and how they can be harnessed to contribute as much as possible to the fight against financial crime.

The EMEA AML Survey 2024 - Luxembourg Competing for effectiveness

After the release of the first EMEA AML Survey in April 2024, we now explore the results from Luxembourg respondents to the EMEA survey, to offer a granular picture of how AML is being tackled in the Grand Duchy. The survey had 396 respondents, 10% of which were from Luxembourg, across 40 countries in total. It should be noted that to carry out the survey PwC reached out to the key stakeholders in each territory and in many cases interviewed large, institutional respondents directly. As such, we ensured that the responses are representative of the overall financial industry in each territory, including Luxembourg. Indeed, the Luxembourg respondents include a significant portion of the systemically important banks in the Grand Duchy, including 39% of the Financial Stability Board’s ( ) 2023 Global Systemically Important Banks (G-SIBs) and 43% of the European Central Banks’ ( ) Luxembourg Systemically Important Institutions (O-SII), which are the institutions considered integral to the Luxembourg financial centre.

The Path Forward for Luxembourg

Luxembourg needs to step up its effectiveness in the face of increasing international competition. In recent years other financial centres have been increasing their footprint in the AWM industry as fund domiciles, particularly for exchange-traded funds (ETFs). Luxembourg must continue to assert itself as the main European financial hub; AML is a crucial part of this process.

Regulations: A Call for Clarity

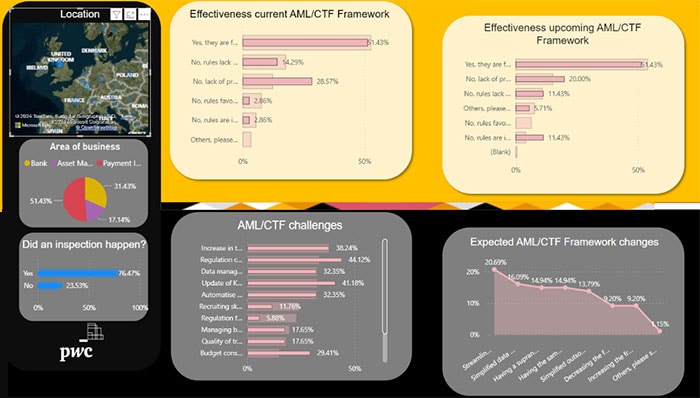

Luxembourg respondents are more sceptical of current and upcoming AML rules than their EMEA counterparts. Only 22% of Luxembourg respondents believe that current and upcoming AML rules are fully effective. Meanwhile, 53% of EMEA respondents are confident in current rules and 54% in upcoming rules.

90% of Luxembourg respondents believe implementing universal regulatory standards would significantly improve AML effectiveness. This view is held by 100% of Luxembourg asset managers and 86% of bankers. Since Luxembourg is an international financial hub where AML teams interact with clients from various jurisdictions, it follows that they would value regulatory consistency.

Which regulatory changes would significantly improve your AML effectiveness?

Source: PwC Global AWM & ESG Research Centre

Operations: Human and Machine Resources

AML costs in Luxembourg have increased by 18% over the last two years, compared to 13% in the rest of EMEA. 69% of Luxembourg respondents have seen their AML costs increase by at least 10% while 31% have seen them increase by at least 30%.

Luxembourg respondents tend to believe upskilling their staff is the least effective AML control, with 38% reporting as much. This suggests Luxembourg respondents are undervaluing the positive impact of upskilling their employees as a measure to boost effectiveness and solve the labour scarcity issue they face.

Respondents who claimed that recruiting skilled staff is one of the biggest AML challenges - Selected territories

Despite this scepticism, recruiting skilled staff is one of the biggest AML operational challenges in Luxembourg, according to 44% of respondents. For comparison, only 24% of EMEA and 25% of EU respondents cite this as an AML challenge. Having skilled staff is necessary for any increase in AML effectiveness. Even technological upgrades cannot be undertaken without an appropriately trained workforce. The main impediment for Luxembourg financial entities to grow their workforce is the salary package, according to 31% of respondents; there is a lot of internal competition in the Grand Duchy for skilled AML professionals.

Source: PwC Global AWM & ESG Research Centre

Technology: A Key to Effectiveness

Legacy AML operating systems are a persistent problem in Luxembourg. 38% of Luxembourg respondents claim their systems are “outdated”. This impedes adopting newer technologies such as AI, which are incompatible with older operating models. Indeed, 65% of respondents say that the maturity of their operating systems is a constraint to AI adoption. Data quality is the most often-cited impediment to increasing AML technological capabilities in Luxembourg, according to 53% of respondents. This issue is directly related to system maturity and the lack of skilled employees. Without modern systems and the necessary staff to operate them, the high-quality data needed for effective AML cannot be collected or processed.

Percentage of respondents in selected countries that cited "Outdated systems" as an impediment to implementing new digital tools

Luxembourg AML teams tend to be more reluctant to adopt new technologies than their EMEA counterparts. This may be holding Luxembourg’s AML effectiveness back. The Grand Duchy must bet on technology to set itself apart from its competitors, although the complexity of its financial products makes streamlining AML processes difficult. Only 13% of Luxembourg respondent have implemented cloud solutions compared to 53% in EMEA. Similarly, only 53% in Luxembourg are considering adopting AI compared to 81% in EMEA.

Besides being disinclined to adopt new technology, Luxembourg respondents are also reluctant to invest in it, with banks being the least willing to invest. 13% of respondents say they will not allocate any of their AML budget to new digital tools over the next two years. This figure is 5% in the rest of EMEA. Meanwhile 42% of Luxembourg respondents will allocate over 10% of their budget to digital tools, compared to 56% that will do the same in EMEA.

Source: PwC Global AWM & ESG Research Centre

EMEA AML Survey benchmarking tool

Thanks to the data quality achieved by the EMEA AML Survey 2024, we developed an AML benchmarking tool designed to provide organisations with unique and tailored insights on regulations, operations and technology in the EMEA AML market.

- Organisations will be able to see where they stand compared to EMEA and local industry peers.

- Dynamic dashboards will empower organisations and stakeholders to make informed decisions. We can provide you with tailored presentations for your Board or Executive Committee sessions.

- Organisations may also be benchmarked if they have not taken part in the EMEA AML Survey. Please contact us and we would be happy to organise with you a benchmarking session specific for your needs.

Book a demo to know more about our AML benchmarking tool

Download the executive summary

Download the full report

Contact us

Michael Weis

Advisory Partner, Forensics & Anti-Financial Crime Leader, PwC Luxembourg

Tel: +352 49 48 48 4153

Alessandro Casarotti

EMEA AML Survey Coordinator, Anti-Financial Crime Director, PwC Luxembourg

Tel: +352 62133 35 28

Partner, Global AWM Market Research Centre Leader, PwC Luxembourg

Tel: +352 49 48 48 2191