Transaction services

Vendor Due Diligence

A Vendor Due Diligence (VDD) helps accelerate deal execution by providing an in-depth report on the company that is for sale. This significantly decreases the time necessary for buy-side due diligence and decreases business interruptions by eliminating unnecessary meetings and reducing information requests.

But more importantly, it provides vendors with greater control over the sales process and the timing of the sale which in turn can help secure a fair price for the business.

Buy-side due diligence

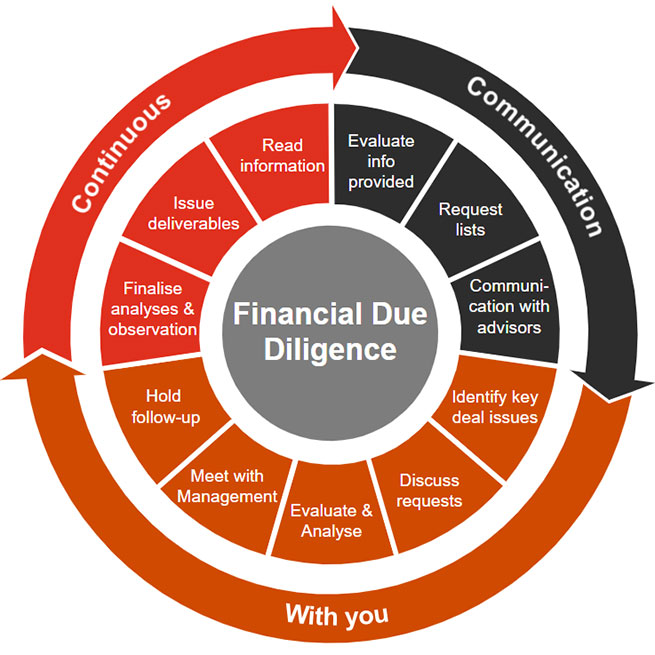

A due diligence report, analysing in detail, the financial health of the company that is for sale, is often a necessary pre-requisite for the completion of the sale. Our due diligence process focuses on identifying risks, exposures, and opportunities early in the process, typically focusing on the following areas: