Crypto-Assets in Luxembourg: Persistence Amidst Headwinds

If 2021 was a year of strong post-pandemic recovery, 2022 staged a stunning reversal. War returned to Europe’s doorsteps, with dramatic global macroeconomic shocks ensuing. The crypto-assets landscape, which reached new heights in late 2021, has not been spared. A series of governance failures and the collapse of major sector players led to ripple effects across the crypto-assets ecosystem and a major correction in crypto-asset valuations.

The 2nd edition of our Crypto-Asset Management Survey, commissioned by the Luxembourg House of Financial Technology and conducted with the active support of the Association of the Luxembourg Fund Industry, aims to provide financial sector professionals with a comprehensive update on the space.

While the Grand Duchy has managed to weather the storms of 2022 well, questions remain over the present and future state of its crypto-assets landscape. How have professionals in Luxembourg’s financial centre reacted to the recent upheaval in the space, what adjustments are they making? How have their views on the asset class evolved, what are their views on the likely evolution of this highly specialised segment of the asset management segment in Luxembourg?

Will regulations – such as the EU’s long-awaited Markets in Crypto-Assets Regulation (MiCA) – serve as a springboard for further crypto-related growth and development? To answer these questions – and more – the Luxembourg House of Financial Technology (LHoFT) is proud to partner once more with PwC Luxembourg and the Association of the Luxembourg Fund Industry (ALFI) to present the second edition of our Crypto-Assets Management Survey report.

Signs of resilience: Luxembourg Financial Sector Professionals Remain Cautiously Optimistic

Despite the tumultuous events in global crypto markets since 2022, industry players in Luxembourg have not disengaged dramatically from the space but rather appear to take a pragmatic and cautious stance towards the space.

As a matter of fact, 39% of our respondents believe that the market is still in its early stages and has significant potential – a finding that remains virtually unchanged compared to the first edition of our survey. However, Luxembourg finance professionals are signaling reduced customer demand, a lack in relevant expertise and a lack of infrastructure maturity as significant impediments to increased service and product development in the space. Download the full report below to get the full picture!

Rising Confidence: Luxembourg Gains Ground as a Maturing Crypto-Asset Hub

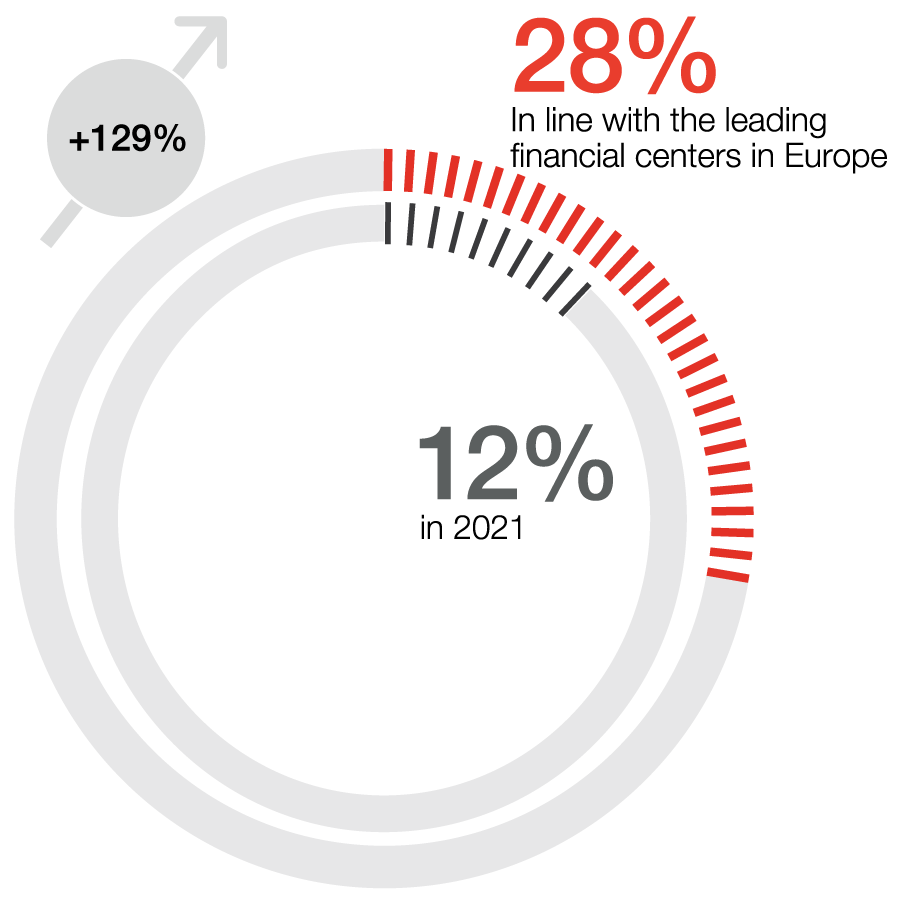

This year’s survey shows a growing belief that Luxembourg is maturing as a jurisdiction for crypto-assets. In 2021, one-third of respondents felt that Luxembourg lagged behind most EU countries, but in the current survey, that figure has decreased to 21%. Similarly, the number of respondents who consider Luxembourg to be in line with leading European financial centers in terms of crypto-asset maturity has increased from 12% in 2021 to 28%.

"While the value proposition of crypto-assets has not changed, the events of 2022 clearly impacted market participants' trust which must now be rebuilt. So far markets have shown resilience in 2023 and it is now up to the crypto-asset industry to prove itself. Time has come for a reset and the entry into force of MiCA will certainly act as a catalyst here."

Next steps

Luxembourg stakeholders need to contend with changing market dynamics while being presented with distinct opportunities to capitalise on coming-of-age crypto-markets.

1. Maintain dialogue with market participants

2. Address skill and expertise gaps

3. Maintain positive momentum

Contact us

Steven Libby

Audit Partner, EMEA Asset & Wealth Management Leader, PwC Luxembourg

Tel: +352 49 48 48 2116

Partner, Global AWM Market Research Centre Leader, PwC Luxembourg

Tel: +352 49 48 48 2191