The adoption of Generative AI (GenAI) presents banks in Luxembourg with a unique challenge, distinct from any technological disruption they have encountered before—whether it be the internet, open banking blockchain, or cloud migration. Unlike these past innovations, which gradually reshaped the banking sector, GenAI is revolutionary in both its nature and its rapid pace of adoption. While historical parallels can be drawn with these previous innovations, the transformative potential of GenAI in the banking landscape earns it a spot as the new face of banking disruption.

Banking Trends & Figures 2024

GenAI: The new face of banking disruption

We have captured in this year’s report the potential of GenAI to drive efficiency, enhance customer experience, and bolster security measures. As the banking sector grows more complex, we believe GenAI will stand out as a critical tool for optimising operations and meeting the evolving expectations of customers through personalised and predictive services. Additionally, its sophisticated algorithms can strengthen security by detecting and responding to cyber threats in real time, providing robust protection against fraud and other security breaches.

However, realising the full potential of GenAI in Luxembourg’s banking sector requires navigating a complex array of challenges. In addition to a fragmented regulatory landscape, evolving employee expectations, and the transition from legacy systems, banks must also prioritise addressing critical concerns around data protection, security, and the growing risk of malicious use by increasingly sophisticated cybercriminals. The need for upskilling employees to effectively work with GenAI also cannot be underestimated. These factors not only create opportunities for GenAI integration but also highlight the importance of robust governance frameworks to ensure that these risks are proactively managed.

To navigate these challenges, we recommend some key steps that are necessary for the GenAI adoption journey for banks in Luxembourg.

Key steps

Luxembourg's Banking Sector Evolution

Number of banks

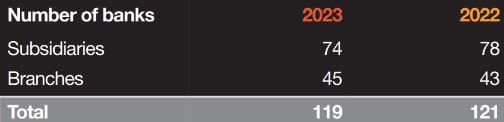

With 119 authorised banks at the end of the financial year 2023, the number of banks decreased by two.

Countries of origin of banks established in Luxembourg

In terms of geographical representation in the Luxembourg financial centre, German banks still make up the largest group at 12.6% despite a slight decrease, followed by Chinese banks with an 11.8% share. Luxembourg banks, Swiss banks and North American banks both register a 10.1% share.

Balance sheet total (in EUR million)

In 2023, the balance sheet total marginally increased by EUR 5.9 billion (+0.6%). The upward trend was primarily due to the increases in loans and advances to credit institutions (EUR +31.2 billion; +9.2%) and fixed-income and variable-yield transferable securities (EUR +6.0 billion; +4.8%).

Banking Trends & Figures 2024

GenAI: The new face of banking disruption

Contact us

Julie Batsch

Audit Partner, Banking and Capital Markets Leader, PwC Luxembourg

Tel: +352 62133 24 67

Björn Ebert

Financial Services and Managed Services Leader, PwC Luxembourg

Tel: +325 621 332 256

Patrice Witz

Advisory Partner, Technology Partner, Member of the Advisory Leadership Team, PwC Luxembourg

Tel: +352 62133 35 33