Banking Trends & Figures 2023

Technology - an enabler or a threat?

The financial services industry has historically lagged behind when it comes to adopting new technologies. However, in the post-COVID era, maintaining any form of competitive edge without leveraging technology has become almost impossible. Digitalisation has revolutionised the way financial services are delivered, empowering customers with convenient and accessible channels for banking. This digital transformation is already leading to increased efficiency, reduced operational costs, and improved customer experiences. Consequently, banks need to undertake specific modernisation efforts in order to shift from a sole dependence on legacy systems if they are looking to maintain or expand market share, meet security and compliance requirements, optimise cost efficiencies and attract talent.

This year’s edition of the PwC Banking Trends and Figures takes a deep dive into the state of technology within the banking sector, outlining six ways in which banks are leveraging it to shape their value proposition:

- Cloud Computing is Sparking Industry-Wide Technological Transformation;

- Al is at the core of automation, personalised services and security;

- Collaboration with FinTech firms is accelerating digital transformation initiatives;

- Digital solutions are enhancing customers’ experience and relationships;

- Banks are optimising operational efficiency through emerging technologies;

- Evolution of regulatory frameworks has impacts on further technology adoption.

The report identifies four key considerations that, if implemented, will facilitate banks’ journey towards the future of banking within the rapidly evolving technological space:

- Leverage AI and data analytics to improve customer experience and service costs;

- Foster digital trust by investing in cybersecurity and data protection;

- Attract and retain talent through continuous upskilling;

- Develop an agile culture in a swiftly evolving digital landscape.

Ultimately, banks’ ability to successfully deploy technology hinges on an ability to navigate the nuances between harnessing technology to drive progress and proactively dealing with related risks. This balancing act would also need to be complemented with strategic decision-making aimed at driving their digital transformation efforts.

Luxembourg's Banking Sector Evolution

Number of banks

With 121 authorised banks at the end of the financial year 2022, the number of banks decreased by three.

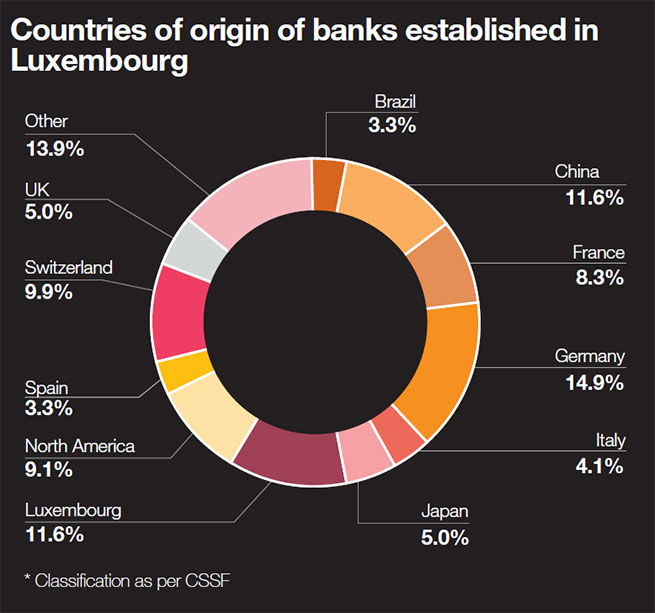

Countries of origin of banks established in Luxembourg

In terms of geographical representation in the Luxembourg financial centre, German banks still make up the largest group at 14.9%, followed by Chinese and Luxembourgish banks both registering an 11.6% share, Swiss banks with 9.9% and North American banks with 9.1%.

Balance sheet total (in EUR million)

In 2022, the balance sheet total dropped by EUR 30.1 billion (-3.2%). The downward trend was primarily due to the decline in deposits from investment funds and intra-group entities which likewise impacted the drop in loans and advances to central banks.

Banking Trends & Figures 2023

Technology - An enabler or a threat?

Contact us

Julie Batsch

Audit Partner, Banking and Capital Markets Leader, PwC Luxembourg

Tel: +352 62133 24 67

Björn Ebert

Financial Services and Managed Services Leader, PwC Luxembourg

Tel: +325 621 332 256

Jörg Ackermann

Advisory Partner, Banking Consulting Leader, PwC Luxembourg

Tel: +352 49 48 48 4131

Patrice Witz

Advisory Partner, Technology Partner, Member of the Advisory Leadership Team, PwC Luxembourg

Tel: +352 62133 35 33