Retailisation of private markets: opportunity or threat for traditional asset- and wealth managers?

Introduction – evolving needs of private- and retail investors

Historically, private markets – or private equity – have only been accessible to institutional investors and specialised investment firms (nowadays AIFMs). Private investors, including high-net-worth and ultra-high-net-worth-individuals, but in particular retail investors, were barely able to invest in private equity for a number of reasons, most notably the significant complexity of such investments as well as the mostly tremendous capital requirements. As such, the significant amount of investable capital held by this group of investors was more or less inevitably directed to “traditional” investments like UCITS funds which is – one could argue – part of the reason why those vehicles have enjoyed such tremendous success in past decades.

However, times are changing. The focus of private- and retail investors is increasingly shifting towards alternative investments – in other words the private markets.

However, times are changing. The focus of private- and retail investors is increasingly shifting towards alternative investments – in other words the private markets. This development is mainly triggered by the ever-lasting quest for ever-more ROI and was of course fuelled by historically low interest rates over the past decade.1 Private equity in particular has demonstrated its ability to offer further portfolio diversification, lower volatility and to generate superior returns. In 2020, for example, European buy-out funds achieved a net IRR of 15.06% (three times higher than comparable companies covered by MSCI Europe), growth funds 13.66% (two times higher) and venture funds 11.09% (1.4-times higher).2

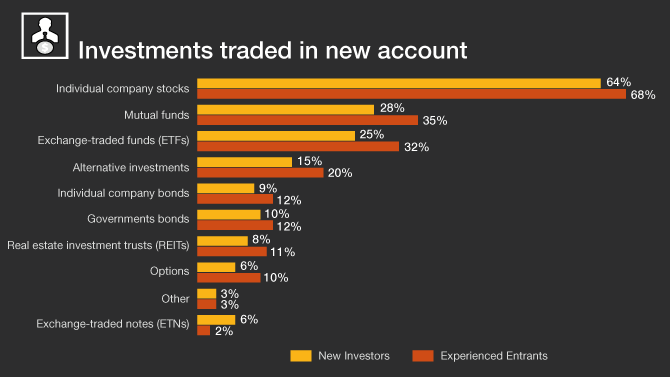

In addition, a PwC study identified an increasing deal activity of 13,823 (10,677 €bn) in 2021 over 11,300 (9,437€bn) in 2016 which represents a CAGR (compound annual growth rate) of 4% in the European market only3. This obviously also triggers a significant interest from private- and retail investors. In fact, already in 2020, alternative investments were in fourth place in terms of preferred investment vehicles of private- and retail investors – both experienced and new – only shortly behind mutual funds and ETFs (cf. figure 1).

In turn, these “new” investors from the private- and retail segment are increasingly gaining attention by key players in the PE industry who have recognised this group as a potential significant driver for their business particularly with investors above the age of 45 appearing to hold interesting liquidity reserves (cf. figure 2). These players now start to develop new products specifically targeting this segment and to form internal sales teams to tap into this huge pool of capital.

Some Alternative Investment Fund Managers even build up separate internal departments to increasingly focus on the development of new distribution channels and on products which are more understandable and accessible for this investor group. Ultimately, they’re pursuing one goal: the retailisation of private markets.

Figure 14: Investments traded in new account

Figure 25: Account balance by age

Existing solutions: how private- and retail investors can access private markets

One key challenge in this context is the very choice of fund structure that can be used to cater to the needs and preferences of this new client segment. There are various options for fund houses – each one offering different and unique opportunities but also challenges and disadvantages.

ELTIF

The European Long-Term Investment Fund (ELTIF), which was introduced on 19 May, 2015 to facilitate infrastructure investments and be marketed to all types of investors — including retail investors— across the European Union (EU). By limiting the asset classes in which ELTIFs can invest, the regulation aims to ensure that the new vehicles offer investors long-term stable returns and help to promote employment and economic growth in the EU. As such, it is indeed a suitable instrument to enable access to private markets for private and even retail clients.

A number of conditions have been laid down to protect investors, in particular if the ELTIF were to be marketed to retail investors. For example, it must be ensured that investors with a portfolio of up to 500,000 EUR do not invest more than 10% of their portfolio in ELTIFs, provided that the initial amount invested in one or more ELTIFs is at least 10,000 EUR. However, as the ELTIF scheme did not bring the desired success, the European Commission adopted a legislative proposal for a regulation amending the ELTIF in November 2021.

While the original ELTIF regulation focused more or less exclusively on real estate investments, the proposal now enables a much broader exposure for investors by allowing investments in real assets, securitisations and target funds.

While the original ELTIF regulation focused more or less exclusively on real estate investments, the proposal now enables a much broader exposure for investors by allowing investments in real assets, securitisations and target funds. It now allows more flexible fund rules, including the facilitation of fund of fund strategies, removes certain barriers that previously effectively excluded retail investors and introduces an optional liquidity window mechanism to provide additional liquidity to ELTIFs and new subscribing investors. The minimum investment in eligible assets has been reduced from 70% to 60%. In addition, the 30% load limit and the requirement for investors with a portfolio of less than 500,000 EUR to not invest more than 10% in ELTIFs shall be repealed. The proposal would also allow investors to invest less than 10,000 EUR in the future, as well as provide a number of further facilitations.

The plans to make the ELTIF more attractive to investors follow the introduction of an equivalent scheme in the UK, the Long-Term Asset Fund (LTAF). The LTAF was introduced to make private, less liquid investments accessible to retail investors. Although the two funds are similar, the LTAF is an open-ended fund and seeks direct paid-in pension assets, while ELTIFs have a broader distribution focus.

While the proposal is not tackling all the issues (for example the level of investor protection, especially for retail investors) it will be an important step in making the ELTIF a more successful regime, accompanying the increased market pick up of that framework over the last two years.

UCI Part II Fund

The Part II fund is a fund set up under Part II of the Luxembourg Law of 17 December 2010 on undertakings for collective investment (UCIs). Part II of this law applies to AIFs that are not covered by a specific product law (on SIFs, SICARs or RAIFs) and are not established in purely corporate form. The Part II fund is able to invest in all types of assets and, theoretically, allows private- and retail investors to invest in alternative investment funds – i.e. while actively, the Part II Fund may only be marketed to professional investors, it may accept any type of investor. The passport is also one of the key benefits, assuming that an EU AIFM has been appointed. Concerning the legal form, the Part II fund can be established as an open-ended/closed-ended common contractual fund (i.e. FCP) or as an open-ended/closed-ended investment company with variable capital (i.e. SICAV/SICAF).

Master-feeder fund structures

A model that is becoming increasingly popular in recent years to achieve a “retailisation of private assets” is the use of master-feeder fund structures – one of the main features of the UCITS IV Directive – for instance as used by so-called investment platforms (e.g. Moonfare) which specifically target private and also retail investors with the opportunity to invest in private equity – quite similarly to professional investors.

In such structures, investments – often starting with a minimum investment of 100 kEUR – are pooled in independent Luxembourg-based feeder funds, which invest directly into the underlying target funds. There are two basic pooling techniques: "entity pooling" where assets are combined in a single legal vehicle and "virtual pooling" (falling outside the scope of the UCITS IV Directive) where assets are pooled without the need to set up a legal entity. The legal ownership of the assets remains with the vehicles involved.

The more efficient management of a larger investor group and the simultaneous decrease in management costs are a positive aspect.

The more efficient management of a larger investor group and the simultaneous decrease in management costs are a positive aspect. While required minimum investment of this size may still be a veritable hurdle for retail – and even some private – investors, this concept is a significant opportunity for such investors to access markets that they otherwise could not. By using a master-feeder structure, the number of fund vehicles requiring tax calculations for investors can be decreased and cost-efficiencies can be profited from. Feeder funds are increasing more and more in popularity and they are a preferred instrument for raising capital from private investors and now used by a wide range of private equity fund managers. The master and feeder funds may be structured as funds of funds. As a minimum, however, a master fund must have a UCITS feeder and may also have other types of investors.

Opportunity or threat for traditional asset—and wealth managers—particularly those based in Luxembourg

What does this mean for the traditional AWM industry, though? Does it mean that liquid asset managers must necessarily develop a product offering in the alternatives space and – if so – which approach is the best one to take?

For starters, both decisions largely depend on the current positioning as well as existing product offering and client base of an asset manager – or rather on its ability to even target and reach those private –and retail investors seeking to invest in private assets. Secondly, developing a new and,in many ways very different, product offering is always associated with significant effort and investment. This is likely the key challenge in this context.

Despite there being some remaining points to be critically assessed and taken into account – such as, for instance, the development of the demand side following a recently new change in the interest rate environment or, the need of private markets for ever-more inflows considering that finding suitable investments proves increasingly difficult and while the extension of a traditional AWM service offering towards private markets undoubtedly comes with some challenges and risks, it seems fairly obvious that this development can be a huge opportunity for traditional asset- and wealth managers.

In particular, Luxembourg will play a vital role in the overall context of the “retailisation of private assets”. At PwC, we see three key factors which make Luxembourg the perfect market to capture this opportunity

1) Products

First of all, Luxembourg undoubtedly is the prime place to launch any of the above-mentioned structures and to manage the complexity and achieve critical mass. All of the relevant solutions are already very well established in Luxembourg and local asset managers and asset servicers have a long track record and experience with managing these.

For instance, Luxembourg has been one of the most active countries in introducing ELTIFs, allowing both the investment fund industry and the regulator to develop particular expertise in this area.

For instance, Luxembourg has been one of the most active countries in introducing ELTIFs, allowing both the investment fund industry and the regulator to develop particular expertise in this area. Luxembourg continues to be the preferred market for ELTIFs, with 18 funds, representing an overall market share of 35%6, being set up here, and retail ELTIFs in particular are mainly launched in Luxembourg. The upcoming revised ELTIF regime will be another opportunity for Luxembourg to demonstrate its “regulatory agility” and benefit from the regulatory changes before other markets as a result of faster adaptation.

As far as Part II Funds are concerned, the CSSF (Commission de Surveillance du Secteur Financier) has recently approved several funds with real estate, private equity and private debt strategies. Further ones are in the pipeline, especially in the infrastructure sector. As previously mentioned, master-feeder fund structures are also mostly regularly based in Luxembourg. Due to the international distribution experience, expertise and knowledge of international distribution rules and business practices in Luxembourg, master-feeder promoters find ideal conditions in Luxembourg.

2) Operations

From a pure operational perspective, it is clear that the relevant fund structures and strategies in the context of the “retailisation of private markets” have fundamentally different requirements than the “standard” UCITS business. However, it is evident that operational teams in Luxembourg do have the required resources, knowledge and expertise to manage these structures. Luxembourg-based players have extensive expertise in the entire structuring – or re-structuring process, incl. development of structures, analysis of structuring memos, or oversight of external participants.

There is clearly an unparalleled expertise in all relevant asset classes in Luxembourg.

3) Subject matter expertise in all asset classes

There is clearly an unparalleled expertise in all relevant asset classes in Luxembourg. Simply because it is one of the most important markets for alternatives – and accordingly has all of the key players situated here – Luxembourg is the natural place to start the development of a new product offering in this space.

Conclusion

Alternatives have moved from being a relatively small island in the investment world toward the mainstream in institutional investor exposures. Nowadays the focus of private- and retail investors is increasingly shifting towards alternative investments. Representing the world's second largest fund domicile, the Luxembourgish financial centre, with all major global AWM players, is well equipped to cater to this growth opportunity. Based on a recent PwC Luxembourg study, the Luxembourgish fund industry is recognised as one of the most attractive global financial centres in terms of setting up products and operation excellence. Furthermore, ALFI`s Ambition statement 2025 outlined the objective to broaden the access to alternative investments. We believe that the extension of their product- and service offering towards private markets is a huge opportunity for traditional asset- and wealth managers despite some challenges and risks. Catch it, if you can!

Notes

[1] It remains to be seen how an imminent return to more “normal” interest rates will affect this development.

[2] The performance of European private equity, 2021.

[3] Private Equity Trend Report 2022 – PwC

[4] FINRA Investor Education Foundation Investing 2020: New Accounts and the People Who Opened Them

[5] FINRA Investor Education Foundation Investing 2020: New Accounts and the People Who Opened Them

[6] ESMA (Register)