Latin America's flourishing opportunities

Asset & Wealth Management Revolution

The world's Asset & Wealth Management (AWM) industry has turned its eyes to the Latin American (LatAm) region, with many fund managers looking for growth in the burgeoning market.

The fabric underlying the industry is set to be upended in the coming years as new clients enter the space and the existing, bank dominated, distribution model begins to face challenges as clients look for new, and cheaper, ways of buying products.

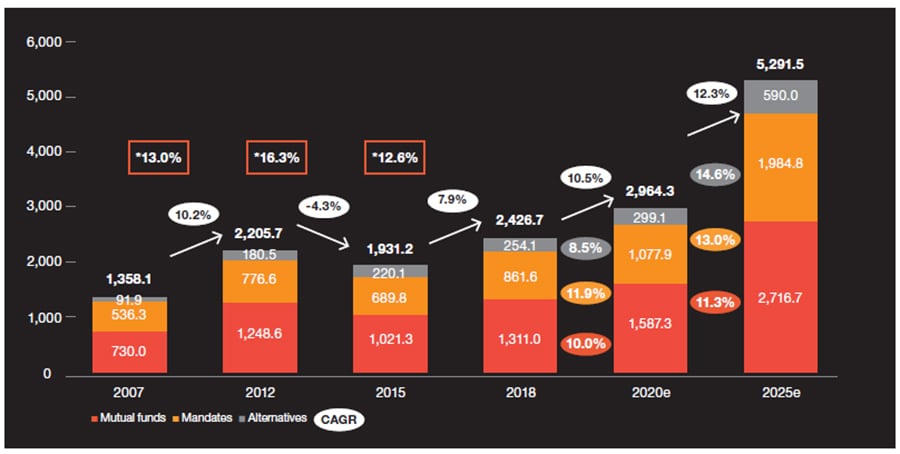

Growth in the LatAm AWM industry has been strong in recent years, with assets growing at a 13% CAGR post Global financial crisis. Despite global economic uncertainties, as well as rising political and trade tensions, we believe that short-term effects will be shrugged off post 2020 and assets (in US dollars) will rise by 2025. In fact, we predict a 12.3% CAGR between 2020 and 2025, with assets reaching above the US$5 trillion mark.

Figure 1: Evolution of AuM (in US$ billion)

Source: PwC Global AWM Research Centre, National Regulators, Lipper, IMF, FSB, ANBIMA

*Note: percentage values within red squares respond to the CAGR for each respective period when fixing the constant US$ exchange rate at 2007.

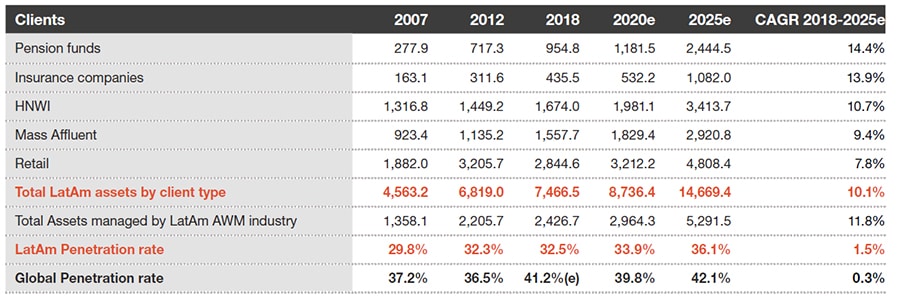

Institutional investors, namely pension funds and insurance companies, will be the main drivers of asset growth - especially as the rising middle class begins to save for retirement. Additionally, as the younger generation comes into a massive wealth transfer globally, we expect to see ETFs becoming more popular and commonplace.

Figure 2: LatAm Client Assets (in US$ billion)

Source: PwC Global AWM Research Centre analysis. Past data based on Lipper, Brazilian Financial and Capital Markets Association (ANBIMA), Cámara Argentina de Fondos Comunes de Inversión (CAFCI), Mexican Venture Capital and Private Equity Association (AMEXCAP), Asociación Colombiana de Fondos de Capital Privado (ColCapital), Asociación Chilena Administradoras de Fondos de Inversión (ACAFI), IMF, ICI, Asociación Internacional de Organismos de Supervisión de Fondos de Pensiones (AIOS), Superintendencia de Banca de Perú (SBS), Financial Stability Board (FSB).

Four trends shaping the change in the LatAm AWM industry

In this report we expand on the four trends we identified in our Asset & Wealth Management Revolution: Embracing Exponential Change report, with a specific focus on Latin America. By 2025, we believe that these trends will be the drivers of change in the LatAm AWM industry.

Asset & Wealth Management Revolution

Contact us

Olwyn Alexander

Global Asset & Wealth Management Leader

Partner, PwC Ireland

olwyn.m.alexander@pwc.com

+353 0 1 792 8719

Moisés Pérez Peñaloza

Pensions & Wealth Management Leader

Partner, PwC Mexico

moises.perez@pwc.com

+52 55 5263 6659

Caio Arantes

Asset & Wealth Management Leader

Partner, PwC Brazil

caio.arantes@pwc.com

+55 11 3674 2570

Gustavo Villafana

Asset & Wealth Management Leader

Partner, PwC Peru

gustavo.villafana@pwc.com

+51 1 211 6500

Borja Claro

Director of Institutional Distribution,

SURA Investment Management

borja.claro@sura.cl

Dariush Yazdani

Global Asset & Wealth Management Research

Centre Leader, Partner, PwC Luxembourg

dariush.yazdani@pwc.com

+352 49 49 48 2191

Fanny Sergent

Asset & Wealth Management Assurance

Partner, PwC Luxembourg

fanny.sergent@pwc.com

+352 49 49 48 2478

Francisco Selame

Asset & Wealth Management Leader

Partner, PwC Chile

francisco.selame@pwc.com

+56 2 2940 0000

Gonzalo Falcone

Head of Global Distribution

SURA Investment Management

gonzalo.falcone@sura.cl