Flexible back-office operating models

In addition to their regular tasks, companies face increasing scrutiny from regulators for timely reporting and compliance to complex new regulations. In some instances, companies already have the necessary (people, process and technology) resources in-house to meet on-going accounting and tax reporting obligations in a scalable, manner. However, for many, regulatory obligations are a burden and a distraction from their core business activities.

An option for companies, hamstrung by people, process or technology dependent issues, is to outsource. Outsourcing is not about relinquishing responsibility. It is about delegating activities to a trusted third party service provider. It is not new, and not without risk. However, properly managed, with good governance, outsourcing leads to cost savings and positive long-term business results.

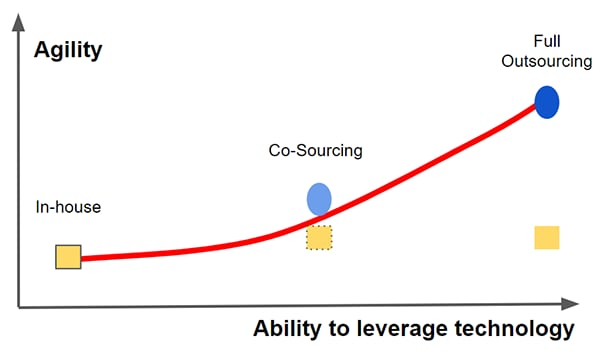

To meet specific and changing corporate needs with agility, we propose a Flexible Operating Model. It ranges from keeping everything In-house to Full Outsourcing.

Keeping tax and accounting functions In-house (insourcing) creates a dependency on dedicated internal resources and experts, and blocks the ability to leverage external technology applications and solutions.

Co-sourcing is effective when looking for gains on time consuming activities and filling gaps in internal capacity and expertise. It allows internal departments to focus on highly sensitive or acutely critical tasks. Leveraging external technology platforms and experts also reduces internal spend. (On-Demand Team Expansion: Accessing people with the required expertise to make up for skills gaps in the company's own resources, and Efficiency: Looking for gains on time comsuming activities.

Full Outsourcing calls on service providers to mitigate risks associated with fulfilling global accounting and tax compliance obligations. It frees internal resources to perform higher value activities such as strategic planning or investment monitoring, and realise cost savings by consolidating compliance operations. (Focus on Core Business: Needing to focus internal resources on core business activities and value added tasks, and Technical Risk Management: "Mitigating technical risks by using expert service providers).

Successful outsourcing

Third party suppliers need to be trusted partners. Their conduct will directly impacts the company’s reputation. Key considerations when outsourcing, regardless of whether it is for selected non-core tasks or otherwise, are:

A clear and agreed-to definition of roles, responsibilities and scope,

A thorough and transparent vendor selection process,

Strong governance with clear decision-making processes, and ongoing communication and information sharing.

Proper scope and task management will result in getting, and paying for the required outputs. Although by delegating the company will have less direct control on how tasks are performed, ultimately, outsourcing is about finding the right balance between cost, resources and control. Cost is proportional to the amount delegated to the third party provider. However, it is off-set by the amount the company would have to otherwise invest to get the job done. Resource-wise, rather than maintaining in-house staff, outsourcing provides the capability to leverage appropriately skilled external resources (as required).

Contact us

Pierre Donis

Tax Partner and Authorised Manager of the PSF, PwC Regulated Solutions S.à r.l.

Tel: +352 62133 51 15