Funds consolidation & Pillar Two

On 4 August 2023, the Luxembourg draft law to implement the global minimum tax was released (n°8292, hereafter "the draft law"). The draft law would transpose the EU Council Directive 2022/2523 of 15 December 2023 on ensuring a global minimum level of taxation for multinational enterprise groups and large-scale domestic groups in the Union, known as the EU Pillar Two Directive or the GloBE Directive (Global anti-Base Erosion Directive). The EU Pillar Two Directive aims to implement a jurisdictional minimum taxation of at least 15% and is based on the OECD Model Rules on Pillar Two that were released on 20 December 2021, with some necessary adjustments to guarantee conformity with EU law. On 13 November 2023, certain amendments were made to the draft law, notably to exclude Investment Entities and Insurance Investment Entities (within the definition of the Pillar Two rules) from the application of the qualified domestic minimum top-up tax. Please refer to our insight.

The draft Law closely follows the EU Pillar Two Directive and the OECD Model Rules, which set out the rules of the so-called Income Inclusion Rule (IIR) and Undertaxed Payment Rule (UTPR), with some necessary adjustments to guarantee conformity with EU law. The rules apply for groups with a consolidated revenue of at least 750 million euros in at least two out of four preceding years.

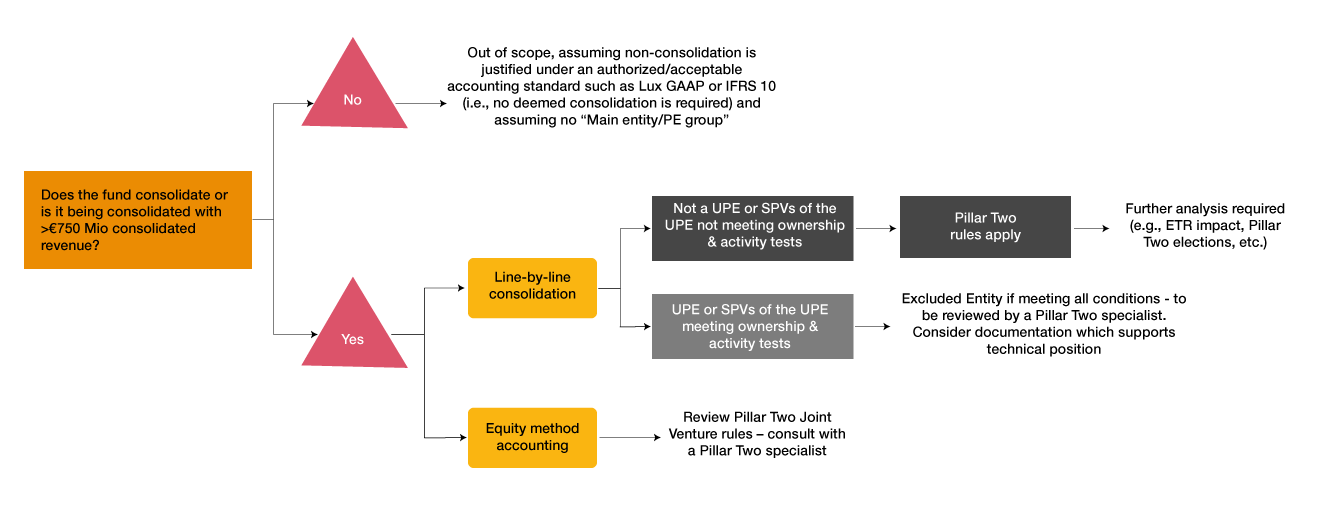

The draft Law foresees several exclusions, including for regulated investment funds and real estate investment funds. Those exclusions are subject to conditions, including the requirement that the fund or the fund management must be subject to regulatory supervision and the fund should be the ultimate parent entity of a group. To constitute a group, entities and other legal arrangements would need to be financially consolidated on a line-by-line basis. In case there is an exemption from consolidation under an acceptable accounting standard, the current expectation is that the Pillar Two rules should not apply. This is subject to certain exceptions foreseen in the Pillar Two rules, and subject to how those rules may be transposed and interpreted by different jurisdictions.

If there is financial consolidation, investment entities and their related entities could still qualify as Excluded Entities under certain conditions. For Excluded Entities, no effective tax rate shall be calculated, although their revenue should still be considered to assess the 750 million euros threshold for the potential application of the rules to non-Excluded Entities. If there is a financial consolidation at the level of the portfolio companies in which a fund holds an investment, then those entities could constitute a separate group for the minimum taxation rules provided that such group meets the required revenue threshold. Entities which do not qualify as Excluded Entities would in principle need to perform an effective tax rate calculation per jurisdiction based on a Pillar Two basis and verify if the effective tax rate falls below the minimum 15%, which could then lead to the application of Pillar Two top-up taxes.

Key takeaways for funds and related entities

- Review whether the fund consolidates with other entities or is being consolidated and assess the annual revenue to determine the potential application of the Pillar Two rules.

- In case of financial consolidation or Pillar Two deemed consolidation, review whether certain entities could be treated as Excluded Entities and monitor specific situations such as joint ventures or management incentive plans which could lead entities to fall within the scope of the rules.

- If entities cannot be treated as Excluded Entities, review whether some of the tax neutrality regimes foreseen in the rules for investment entities could potentially provide relief from the application of top-up taxes.

- In case of deals or a group restructuring, review the potential Pillar Two consequences including differences between asset and share deals, update tax rate modelling for groups subject to the Pillar Two rules, monitor the application of the Pillar Two transition rules and review any potential pre-deal transactions undertaken by the counterparty which could impact the Pillar Two calculations.

- Prepare data gathering for reporting obligations under Pillar Two or prepare supportive documentation on entities falling outside the scope of the rules or entities which could be treated as Excluded Entities under the rules.

- Review whether the fund documentation and joint venture agreements are sufficiently broad to cover potential Pillar Two consequences.

- Review the impact of the Pillar Two rules on the portfolio companies which meet the 750 million euros revenue threshold. Consider impact of potential acquisitions and add-ons in a determined investment perimeter in order to monitor the reach of the 750 million euros thresholds where relevant, including as from due diligence phase for acquisitions and add-ons.

- For investment managers, review the location of management companies, general partnerships, co-investment entities and others to determine whether they could be subject to the Pillar Two rules. Review the income streams of in-scope entities and future GAAP/ Pillar Two treatment.

Have a look at the below flowchart and our self-assessment test to review whether your fund or corporate structure could be subject to the Pillar Two rules.

If no line-by-line consolidation, structures in principle fall outside of the Pillar 2 rules except in specific cases such as deemed consolidation rules, a main entity constituting a Pillar 2 group with a permanent establishment or specific joint venture situations. Contact your PwC tax advisor for further details!

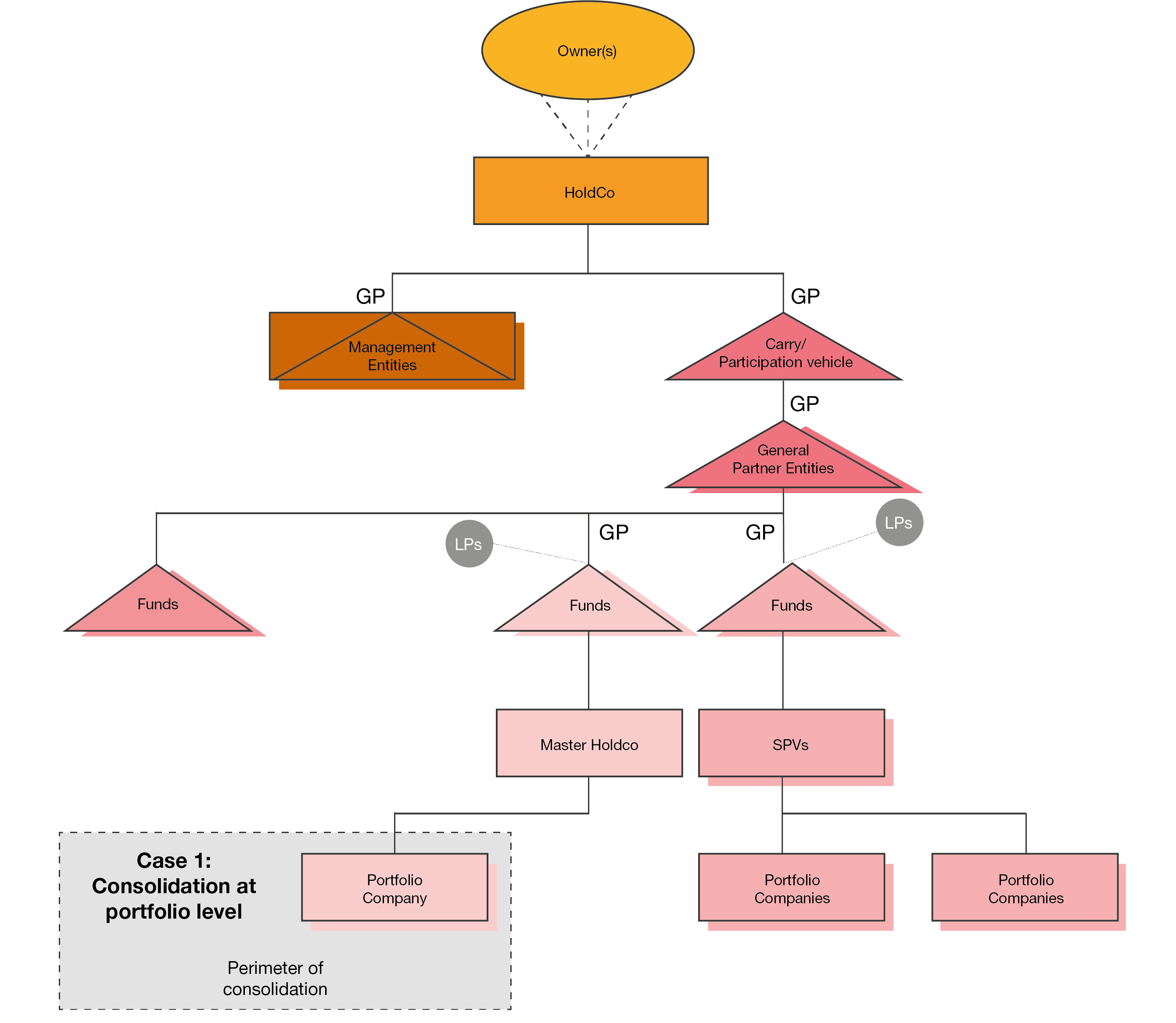

Action points

- Review and document that there is no need for consolidation at a higher level (e.g., document levels of control, consolidation exemptions despite control, etc.) or a potential deemed consolidation under the Pillar 2 rules.

- Confirm that the consolidated group meets the EUR 750 millions revenue threshold to fall within the Pillar 2 rules.

- Review and document whether any entities of the group could qualify as Excluded Entities for Pillar 2 purposes, e.g., due to being held by a investment entity (even if not consolidated with the investment entity).

- Review the impact of the Pillar 2 rules for any non-Excluded Entities and communicate with stakeholders.

- Determine whether certain oversight on the application of the rules would be maintained at Fund management level.

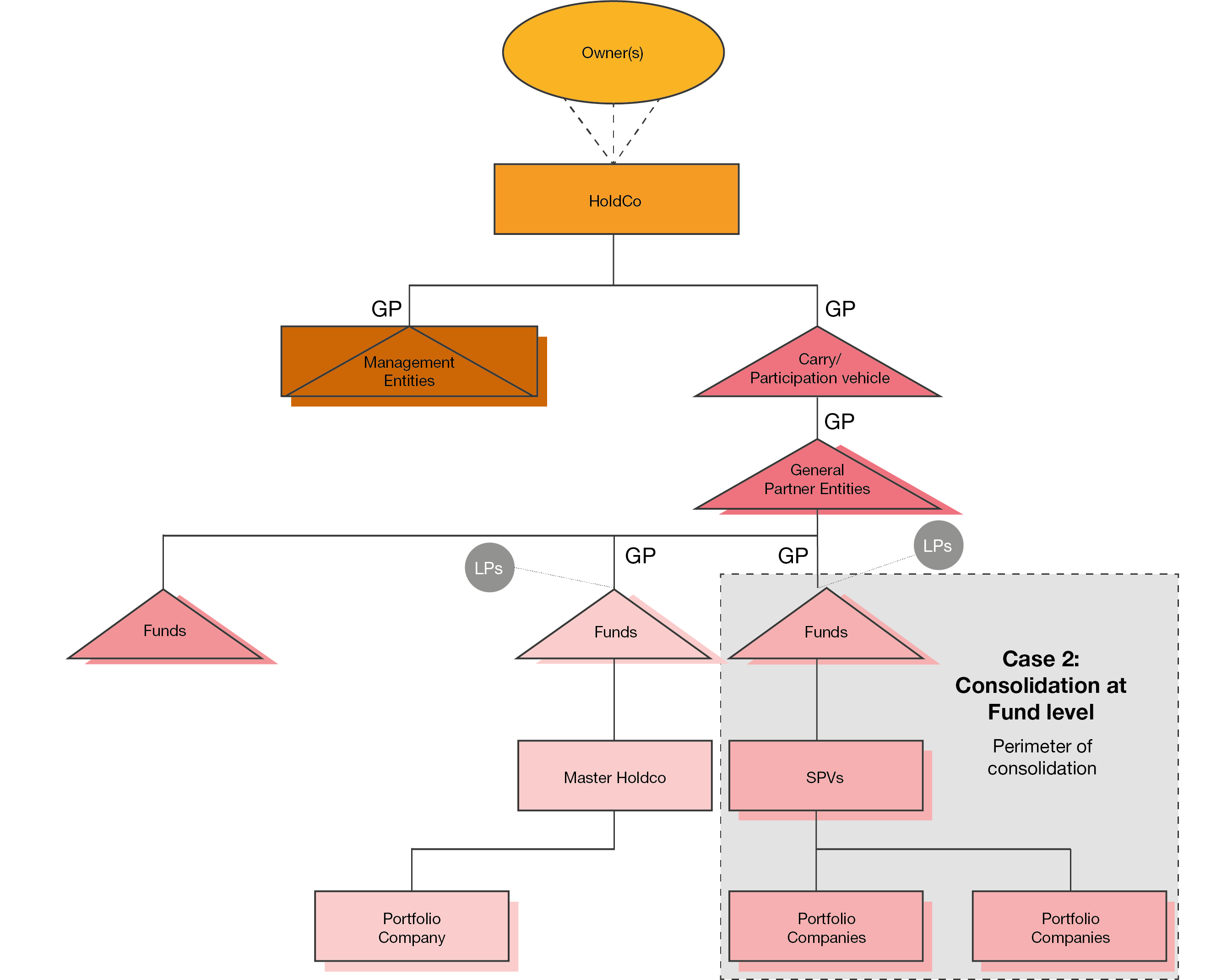

Action points

- Confirm whether the consolidation is a legal requirement (within Pillar 2 scope) or solely done for operational or management purposes (arguments that this should not be covered by Pillar 2).

- Confirm that the consolidated group meets the EUR 750 millions revenue threshold to fall within the Pillar 2 rules – see how revenue is determined if you consider the threshold not to be met.

- Review and document whether any entities could qualify as Excluded Entities for Pillar 2 purposes, i.e. as an investment entity or a real estate investment vehicle which is the ultimate parent entity, or as an entity which has been set up by one of those entities.

- If not Excluded Entities, assess the impact of the Pillar 2 rules, including some of the tax neutrality regimes foreseen by the rules.

- Communicate with stakeholders on the expected impact of the Pillar 2 rules.

Action points

- Confirm whether the consolidation is a legal requirement (within Pillar 2 scope) or solely done for operational or management purposes (arguments that this should not be covered by Pillar 2).

- Confirm that the consolidated group meets the EUR 750 millions revenue threshold to fall within the Pillar 2 rules - see how revenue is determined if you consider the threshold not to be met.

- Analyse whether any entities could be treated as Excluded Entities under the Pillar 2 rules, specifically analyse the status of the consolidating parent entity.

- If not Excluded Entities, assess the impact of the Pillar 2 rules, including some of the tax neutrality regimes foreseen by the rules.

- Communicate with stakeholders on the expected impact of the Pillar 2 rules.

Action points

- Confirm that the consolidated group meets the EUR 750 millions revenue threshold to fall within the Pillar 2 rules.

- Review and document whether any entities could qualify as Excluded Entities for Pillar 2 purposes.

- If not Excluded Entities, assess the impact of the Pillar 2 rules, including some of the tax neutrality regimes foreseen by the rules.

- Communicate with stakeholders on the expected impact of the Pillar 2 rules.

As the EU and other countries move toward enacting the Pillar Two rules, businesses will need to navigate intensive data collection, analysis, and compliance.

Have a look at PwC's Pillar 2 Training Program, a customised training course to upskill your teams, adapted to the needs of your organisation and business industry.