Basel IV Solutions

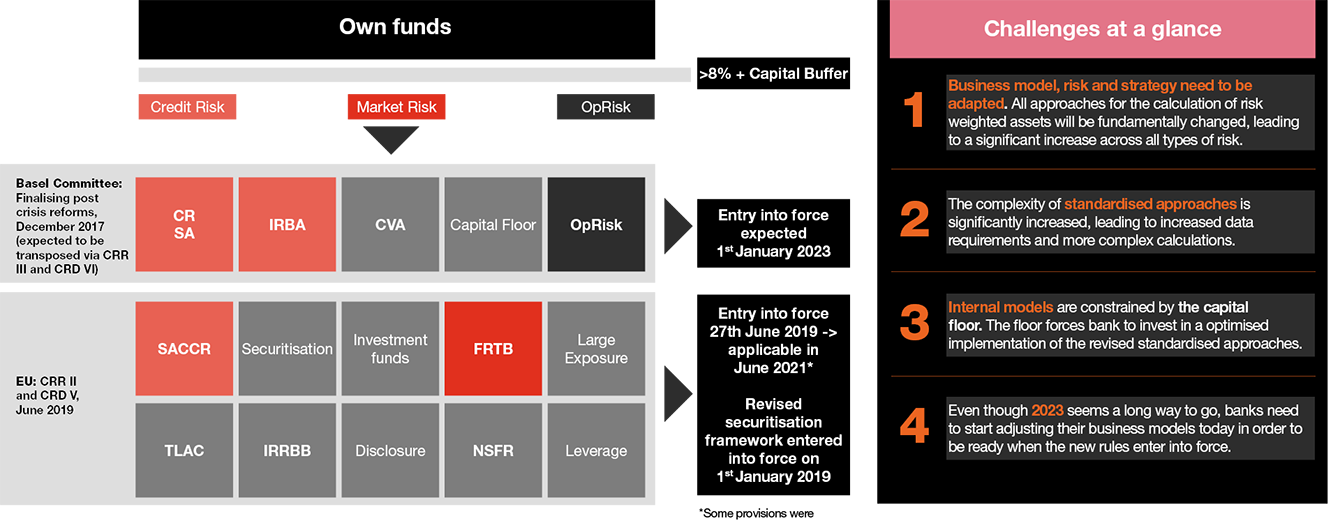

Basel IV encompasses more than just finalising Basel III – The implementation of CRR II/CRR III (Basel IV) in the EU represents one of the biggest challenges for financial institutions in the coming years. The introduction of new rules concerning the calculation of risk-weighted assets and thus the capital ratios of all banks will have fundamental impact on the development of banks' strategies and shape their business models of the future.

Areas of focus are:

- minimising the volatility of the capital requirements when applying Internal Ratings-Based approach, through introduction of a standardised floor;

- reduction in standardised risk weights for low risk mortgage loans;

- higher maximum leverage ratios;

- more detailed disclosure of reserves and other financial statistics.

Basel IV will fundamentally change the calculation of risk weighted assets

Quick Fix - Latest CRR amendments due to COVID-19

The European Commission published an amending regulation to address the impact of COVID-19 pandemic on the economy in order to maximise the capacity of credit institutions to lend and to absorb losses related to the pandemic.

Amendment of CRR (EU No. 575/2013)

- Modification of the calculation of the leverage ratio to exclude central bank reserves

- Extension of the provisions of ECL accounting under the IFRS 9 from 2018-2022 to 2020-2024

- Extension of the preferential treatment regarding provisioning requirements to exposures guaranteed counter-guaranteed by the public sector for 7 years. The preferential treatment is usually only available for NPLs guarantees by official export credit agencies.

- Permitted temporary exclusion from the calculation of their Common Equity Tier 1 of unrealised gains and losses measured at fair value through other comprehensive income.

- Temporary preferential treatment of public debt issued in the currency of another Member State.

Amendment of CRR II (EU No. 2019/876)

- Bringing forward the implementation of:

- provisions on the treatment of certain loans granted by credit institutions to pensioners or employees

- adjustments of risk-weighted non-defaulted SME exposures (SME Supporting factor)

- the preferential treatment of exposures to entities that operate or finance physical structures or facilities, systems and networks that provide or support essential public services (Infrastructure supporting factor)

- Delay the implementation of the leverage ratio buffer to 1 January 2023

- Exempt prudently valued software assets from CET1 calculations.

- The final text of the CRR quick fix was published in the Official Journal of the EU on 26 June 2020 and entered into force as of 27 June 2020.

- Exception: Temporary exclusion of certain central bank reserves will apply from 28 June 2021

Service suite

PwC has already developed thematic solutions that will make your bank easier to understand and implement the Basel IV requirements.

Basel IV and its implementation within the EU with CRR II/ CRR III and CRDV will represent one of the biggest challenges for financial institutions over the next few years and will have a fundamental impact on the institutions’ strategy and business models.

Optimised implementation of all changes related to Basel IV at the right time requires a detailed knowledge and an in-depth understanding of the reforms.

Meet PwC’s regulatory professionals at PwC Academy, who will share their broad experience gained in national and international implementation projects at credit institutions and financial service providers to prepare the participants for the upcoming challenges of Basel IV and will answer your questions.

We assess the impact of the relevant regulations, including CRR II, CRD V as well as the guidelines from the European Banking Authority and the Basel Committee EBA and Basel Committee on your regulatory ratios, data, disclosures and liabilities requirements. From quantifying the impact on the prudential ratios to highlight the changes you should expect on your Pillar 3 report, our Basel IV impact assessment helps you:

- quantify the regulatory changes on your prudential ratios,

- identify key risks to business,

- identify potential market opportunities,

- develop impact mitigation opportunities, and

- plan the changes to be implemented to apply the new requirements.

We assist you in implementing the changes to your systems and processes to comply with the Basel IV, CRR II and CRD V requirements. This operational assistance can cover:

- New calculations and methodologies development and implementation

- Governance model development

- Risk management framework alignment

- Regulatory reporting update

- Risk reporting system upgrade

- Project management support

- Subject Matter Expert support