{{item.title}}

{{item.text}}

{{item.title}}

{{item.text}}

PwC's portfolio of Customer Transformation solutions rethinks the way people connect, transact and engage with your company.

We offer a modernised service platform that delivers a connected, customer-centric experience through seamless engagement. Our pre-built technology and innovative assets help you build customer loyalty, drive growth, increase productivity, and inspire and engage your workforce.

Disruption surrounds you. Time to take control with PwC's Customer Transformation solutions.

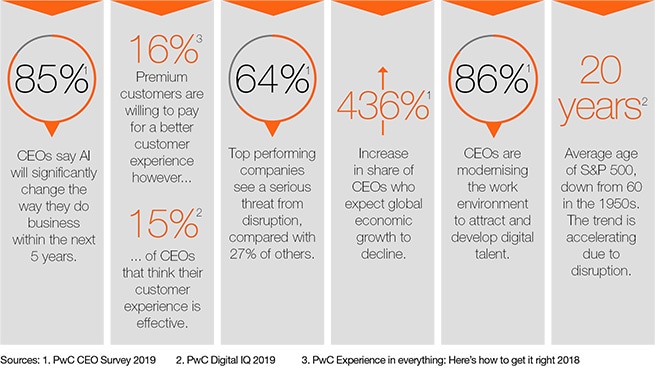

Organisations have little option but to run the gauntlet of change that regulation, pressure to optimise cost and new market entrants are creating. Customer expectations, on top of that, are also changing, with an increasing demand for digital-enabled experiences. This fact is adding even more pressure for businesses to transform. The rapid shift to cloud, and the emergence of Fintech ecosystems, have lowered the barriers that prevented this change. The Salesforce platform in particular is accelerating the pace of innovation with integrated omni-channel, machine learning and analytics capabilities. The opportunities these technologies present to organisations to transform their distribution, marketing and service functions across every customer touchpoint, are significant, but require a customer-led, agile approach to design, implementation and change delivery.

For years, many customers have viewed their financial lives from afar. Digital technology has accentuated this with visions of call centers and automated processing. It's a problem, particularly for an industry that sells trust and relationships as core values.

From a customer's perspective, buying a home involves much more than taking out a mortgage and this logic extends to many life decisions. Whether we’re going to school, starting a family, selecting a vacation spot or just deciding whether to purchase a new phone, we want information on our terms, without boundaries. But to whom do we turn for help? At the same time, digital technology can strengthen relationships and let businesses see what their customers value most. And, by working with others, firms can use this information to make things easier for customers, no matter what they’re buying, from research to payment and beyond.

Key challenges for financial sector clients in Luxembourg centre around modernising technology stacks to take advantage of growth opportunities, and understanding and developing customer relationships - especially in light of COVID-19 severely curtailing opportunities for direct contact. Strengthening the effectiveness of digital channels has therefore gained a huge importance, and it will likely be a strong differentiating factor between those who perform more successfully -or less- in the upcoming years.

Interacting with clients, employees and partners has never been easier thanks to the omnipresence of digital technologies. But in today's fast-paced digital world, investing in technology isn't enough. Putting people at the centre of digital transformation initiatives is critical so that companies can create excitement for new ways of working and ultimately meet their unique customer needs, business processes and governance mandates to foster a competitive advantage.

PwC's Sales & Marketing Excellence, a certified Salesforce FullForce, end-to-end solution from initial inquiry-to-order. All on one single platform, this accelerator provides real-time access to data at any stage of the inquiry-to-order process to improve customer satisfaction and share of wallet.

A holistic solution with digital enablement, Service Excellence helps clients transform how they deliver services to their customers. It enables them to build customer loyalty, leveraging consistent communication and interaction throughout the customer lifecycle and across all channels, while increasing revenue and reducing cost to serve.

A certified Salesforce Fullforce Solution, PwC’s OneBank Solution helps relationship managers and consumer bankers understand their clients and book of business in a way they could not before. At its core is Customer 360, which uses proactive alerts, analytics and tailored insight into the needs of their clients and relationships.

Our Trust Creation & Security solution provides a suite of security and automated control solutions that improve customer satisfaction, build trust and support compliance to consumer protection and financial regulations. Interactive dashboards help users identify risk threats, pinpoint where to take action and give peace of mind to stakeholders.

Amplifier, part of PwC Adoption Central, is an intelligent adoption solution that impacts your whole organisation, making sure that you get the most out of your digital transformations. Why? Because enterprise technologies such as CRM, ERP and HCM are only as good as the people using them.

PwC Change Navigator, part of PwC Adoption Central, is a digital workbench that enables change teams to collaboratively analyse your organisation’s change environment, identify the impact, create a best-fit change plan and track progress against key rollout metrics.

Learn what matters most to your customers and anticipate their needs using PwC’s Customer Link Platform. Identify high-value targets, grow wall share and serve your customers on their preferred channel. From data to insight, CLP builds the facts that create results.

Customer experience - the biggest banking innovation category in Luxembourg (source: Banking in Luxembourg: Trends & Figures 2020) - is the primary differentiator in the industry. Adding or improving mobile apps, chatbots and the overall omnichannel customer experience are the top priorities of banks in Luxembourg. In line with the latter, there is a particular focus on customer experience through employee experience and broader digital transformation. Furthermore, there are several use cases that show how traditional front office tools boost an organisations' data (management/usage/analysis).

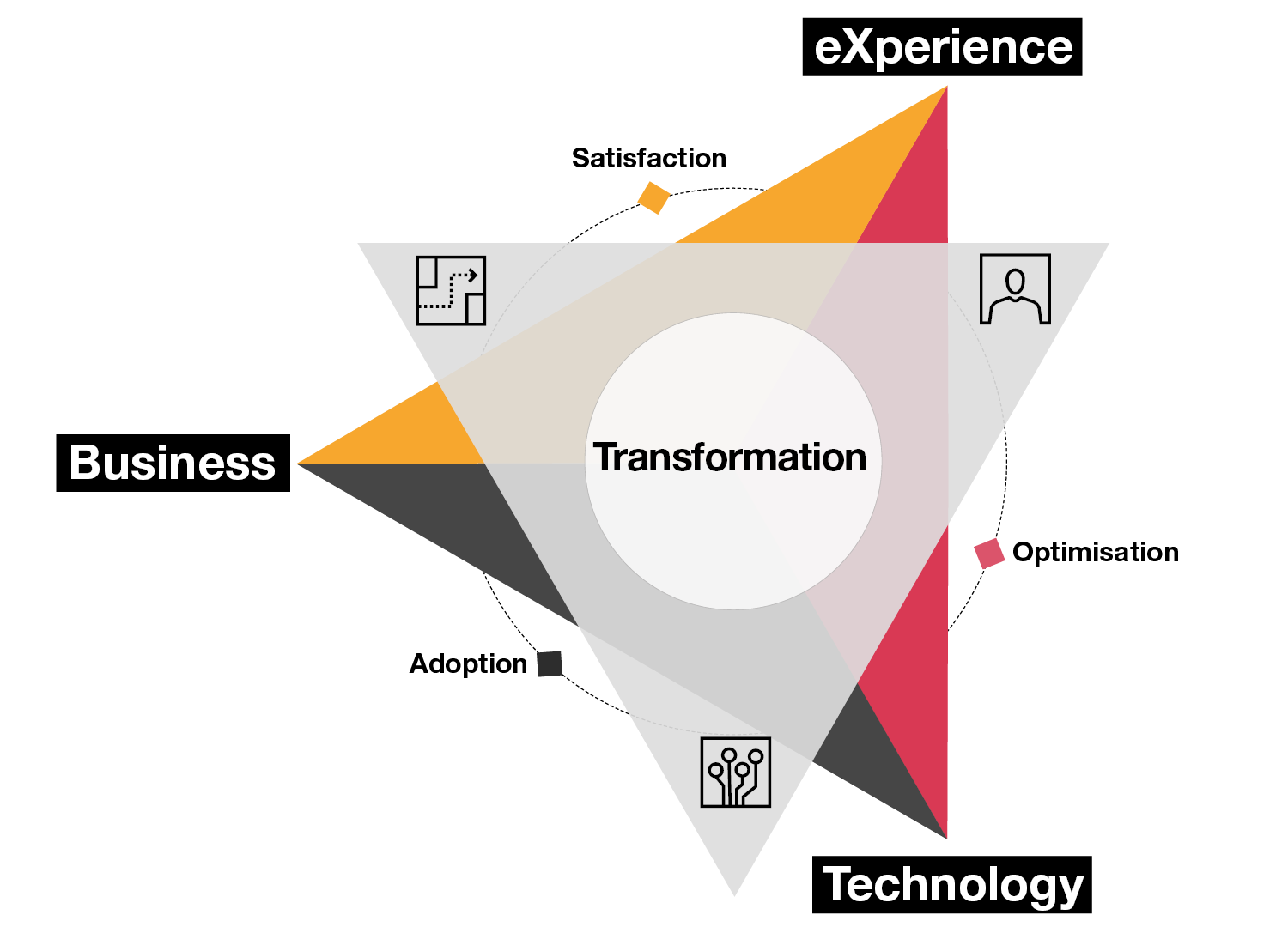

We use PwC's BXT philosophy to ensure diverse perspectives -covering Business, eXperience, and Technology- are considered throughout our work, in recognition of the fact that technology deployments often fail to achieve their business objectives without sufficient focus on the experience of the end user. In our specially designed Experience Centre in Luxembourg, companies and organisations can explore the impacts that digital transformation can have for their customers and employees.

Based on your strategic agenda we bring together experts from various angles/disciplines. Whether they are strategy or transformational specialists, customer experience designers, data analysts, cyber security experts or tech consultants. They work seamlessly together with you, from strategy to execution.

That's what we call our BXT approach: a combination of Business, eXperience and Technology.

Growing your business in today's disrupted and ever-changing world can be though. Customers are demanding faster, more personalised user experiences. Business processes that once were cumbersome can now be automated. Operational efficiency has become paramount.

Your business transformation needs are why we've developed strong alliances with a number of technology firms. By combining PwC's expertise and our Alliance partners' technology, we can help you solve your most critical business issues. Whatever your focus - moving to the Cloud, greater innovation, or business transformation- PwC and our Alliance partners are here to help.