Historically, risk management practices in the financial sector tended to focus mostly on credit, market, operational, liquidity and regulatory risk.

But the world in which financial institutions operate today is becoming increasingly uncertain, and traditional risk categories, while crucial, are becoming insufficient by themselves. From recent geopolitical confrontations and interstate wars, to fracturing trade ties between the world’s leading economies, the gamut of risks is expanding and becoming more complex.

Indeed, the global economy stands at a critical juncture whereby a combination of unprecedented and interconnected systemic risks can create ripple effects that could rapidly spread and exacerbate the pressures financial institutions face. If not properly addressed and mitigated, these risks could strike suddenly and without any warning. Traditional risk management models might not be capable of accounting for their scale and speed.

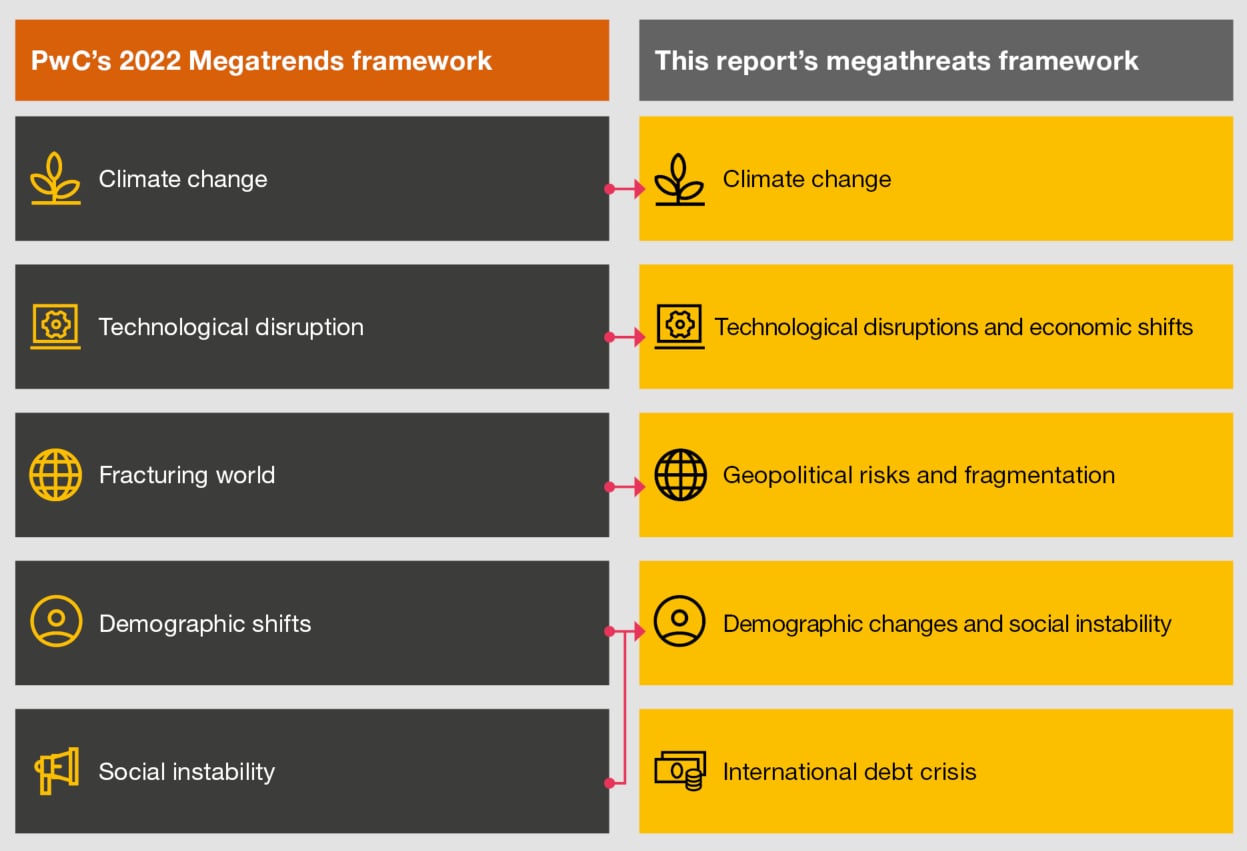

Drawing inspiration from PwC’s 'Megatrends: Five global shifts reshaping the world we live in', this report develops a 'Megathreats' framework which financial institutions can adopt to keep track of and mitigate their exposure to the systemic risks looming on the horizon:

The five megathreats outlined are the following:

Climate change: Climate change is altering global weather and temperature patterns. Alongside ever-increasing extreme weather events, this is having far reaching and unpredictable economic consequences which can have devastating knock-on effects on financial institutions.

Technological disruptions and economic shifts: As the global economy becomes increasingly dependent on sophisticated technologies for growth, it becomes increasingly vulnerable to failures in those systems.

Geopolitical risks and fragmentation: The structure of the global political order is rapidly moving away from the largely stable and predictable model that came to being following the end of the Cold War, and towards a fragmented system characterised by geopolitical tensions and trade wars.

Demographic changes and social instability: Demographics are evolving in unexpected ways across the world, from accelerated declines in birthrates to ever-evolving migration patterns. Increased immigration in advanced economies to strengthen a relatively smaller working age population is often associated with the rise of populism and societal tensions. In turn, this could lead to novel and erratic policy and regulatory landscapes which can harm financial institutions.

International debt crisis: Over the last several years, sovereign debt has been increasing at a rapid pace across the world, but especially in developing countries. Concerns over the sustainability of this debt are growing, with sovereign defaults looming on the horizon.

As shocks stemming from these five systemic megathreats intensify and become more common in the years to come, risk management methods need to be reassessed. Risk managers must be wary of these threats, understand their potential consequences, expand their horizons and adopt new and creative approaches to pre-empt the fallout.

Through a series of illustrative scenarios for each of the five megathreats outlined, this report seeks to encourage financial institutions to challenge assumptions and deeply reflect and rethink how they prepare for the increasingly complex world of today, all-the-while building resilience through forward-looking practical strategies and reverse stress-testing.

Read on to learn more why the unorthodox challenges we face today demand unorthodox methods.

Managing systemic risks in the 21st century

Contact us

Benjamin Gauthier

Advisory Partner, Risk & Compliance Leader, PwC Luxembourg

Tel: +352 49 48 48 4137

Björn Ebert

Financial Services and Managed Services Leader, PwC Luxembourg

Tel: +325 621 332 256

Partner, Global AWM Market Research Centre Leader, PwC Luxembourg

Tel: +352 49 48 48 2191