Elevating the compliance function to drive value to your business

Compliance Function

Your digital compliance transformation journey starts now

Leave behind the land of manual control execution and set sails to a modern and digital Compliance Management System world that will elevate your compliance maturity level.

With the development of our digital PwC Compliance Control Hub, the digitalisation of your Compliance Monitoring Plan will play a pivotal role in helping your senior management to sustainably strengthen the confidence of their company towards external stakeholders.

For many financial service providers, the compliance role is not anymore only reduced to controls, but also entails a fully-fledged and growing advisory role within companies. Our experts are therefore hands-on to advise you and your business on strategic aspects relating to your compliance transformation journey. Indeed, compliance management can make a significant contribution in defining and shaping your company's strategy as well as the values and standards for employees and other stakeholders.

Besides, the digital compliance transformation will help you to identify new business opportunities and shape new products.

Book a demo to know more about our PwC Compliance Control Hub solution

Your challenges

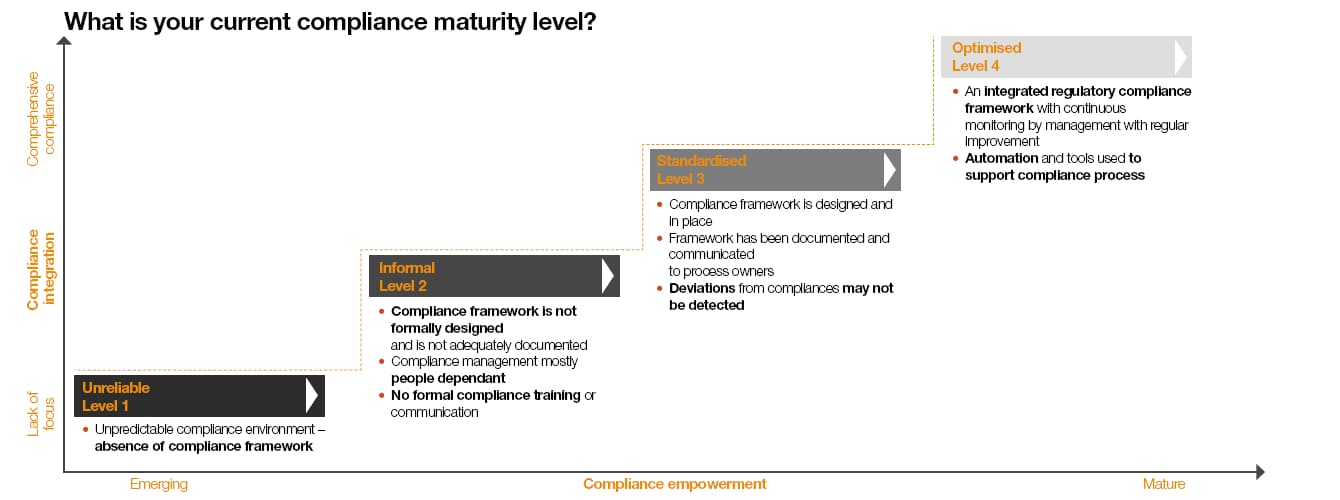

In light of the Compliance Functions' challenges and your actual organizational setup, where do you situate your compliance maturity level?

As a Compliance Officer, you contribute in increasing the value and digitalisation of the company, taking into account that the future of compliance will move from being a mere standard setter and controller to a supporting advisor and active risk manager in the company along with the business division.

Our services

- Compliance Management System

- Regulatory Inventory

- Compliance Managed Services

- Compliance workforce staffing and upskilling

Compliance Management System

Establishing an effective Compliance Management System proves challenging due to the intricate task of aligning it with an ever-evolving regulatory landscape, often resulting in a delicate balance between comprehensive coverage and operational efficiency.

Supporting the Implementation and Performance of the Compliance Risk Assessment

Navigate the Compliance Risk Assessment phase with our assistance, ensuring a comprehensive understanding of risks and vulnerabilities applicable to your scope of activities. We facilitate the integration of risk assessment results into your Compliance Management System (CMS).

Supporting the Implementation of the Compliance Management System (CMS)

We provide practical support in implementing your Compliance Management System, addressing the challenges of aligning it with evolving regulatory requirements. Our approach focuses on a strategic integration to enhance the CMS's effectiveness within your organizational structure.

Effectiveness and Efficiency Assessment of the CMS

Our specialists conduct thorough assessments of your CMS, identifying potential areas of improvement to enhance its overall effectiveness and efficiency. We provide practical recommendations for optimization, empowering your organization to maintain a robust compliance framework.

Regulatory Inventory

Drafting Policies and Procedures

We support you in drafting policies and procedures in line with the regulatory landscape applicable to your activities. Our approach ensures your organization is equipped with comprehensive documentation to navigate the relevant compliance requirements.

Advise on the operational implementation of the regulatory change

We provide advice for the operational implementation of regulatory changes, gaining insights to facilitate a smooth transition and achieve regulatory compliance within your entity.

Identify the applicable regulatory requirements and define the regulatory inventory

We help you to identify applicable regulatory requirements and define a robust regulatory inventory applicable to it. Our approach enables your organization to stay ahead by understanding and addressing the regulatory requirements.

Compliance Managed Services

The digital transformation of compliance faces resistance from legacy systems or manual work performance and a struggle to bridge the gap between traditional processes and innovative solutions, hindering the seamless adoption of automation and data analytics.

- Compliance Control Hub

Our Compliance Control Hub is a digital solution that offers the Compliance Function to set up and perform a tailor-made Compliance Monitoring Plan in line with your organisation's applicable regulatory environment.

Do you want to know more? Reach out to us to schedule a demo now (link to contact)

- AML/CFT Support Projects

Our local team includes forensic investigators, tax fraud specialists, forensic and investigative analytics specialists, AML/CTF experts, OFAC/EU Sanction specialists, KYC remediation specialists, regulatory experts and internal controls specialists.

We are closely integrated into PwC’s global network of financial crime specialists, with over 3,000 partners and professional staff across 83 countries working to combat financial crime. We’re organized to reflect the multidisciplinary financial crime task forces established by major financial institutions and government agencies, with market leading specialists in cybersecurity, anti-money laundering, sanctions, fraud and anti-bribery/anti-corruption.

- Whistleblowing Directive Implementation Projects

An effective whistleblowing system is not only about the creation of a mailbox or hotline. It needs to be properly communicated to ensure responsible reporting. Procedures need to detail the handling of reports, clearly outline the protection for reporting persons, but also the consequences for any misuse.

- Policies and Procedures: We review your existing policies and procedures and/or support you in elaborating all relevant communications to make your whistleblowing system as accessible and understandable as possible.

- Training: We support you in the design of your training - for all employees regarding the use of the whistleblowing system, but also for the dedicated staff handling the reports or to brief the Board and Management.

- System: We advise you on the setup of an internal solution for your whistleblowing system or the choice of an external provider that fits your needs.

- Alert handling and Managed Services: Our experts can assist in the running of your alert intake by assessing whether an alert is substantiated, meaning if it needs further investigation.

- Investigation support: In case a report needs further investigation, we can accompany you during the entire investigation life-cycle.

Compliance workforce staffing and upskilling

A shortage of skilled compliance professionals coupled with the rapid evolution of regulatory requirements creates a dual challenge, making it difficult to find talent proficient in both traditional compliance expertise and emerging technologies.

Compliance Training

We support you in the design of your training for all employees with regards to the upskilling towards compliance related topics

Support of the Compliance Teams (Secondments)

Our compliance experts are hands-on to advise you and to support your organization’s day to day business to assist the compliance function’s operations

How we can help

Our team of compliance experts is here to help you navigate the widths of regulatory requirements and transform your business with a holistic approach relating to your Compliance Function.

Join us in shaping a future where the Compliance Function operates as a strategic asset, supporting your organisation's growth and sustainability.

We are committed to providing organisations across industries with tailored solutions, expert guidance, and digital technology to accompany market players throughout their compliance transformation journey.

Compliance Control Hub

A digital solution that rethinks the way you perform Compliance duties

Contact us

Olivier Carré

Deputy Managing Partner, Technology & Transformation Leader, PwC Luxembourg

Tel: +352 49 48 48 4174

Benjamin Gauthier

Advisory Partner, Risk & Compliance Leader, PwC Luxembourg

Tel: +352 49 48 48 4137

Nicole Schadeck

Advisory Director, Regulatory & Compliance, PwC Luxembourg

Tel: +352 62133 21 64